On-chain information means that Bitcoin indicators are presently reflecting the identical traits that led to the 2021 bull market peak.

Allocation to long-term Bitcoin holders seems to be ending

As CryptoQuant neighborhood supervisor Maartunn defined in an article postal On X, long-term BTC holders are presently displaying a development paying homage to 2021.

“Lengthy-term holders” (LTH) are Bitcoin traders whose Bitcoins have been dormant (i.e., not moved from wallets or bought) for greater than 155 days.

Usually talking, the longer a holder retains a coin stationary, the much less doubtless they’re to maneuver it at any time. Subsequently, LTH, which has been held for an extended time period, is taken into account a steadfast hand available in the market.

These traders do not usually react to occasions within the broader market, equivalent to a rally or a crash, however this yr’s surge in costs to all-time highs (ATH) has even pressured these holders to promote.

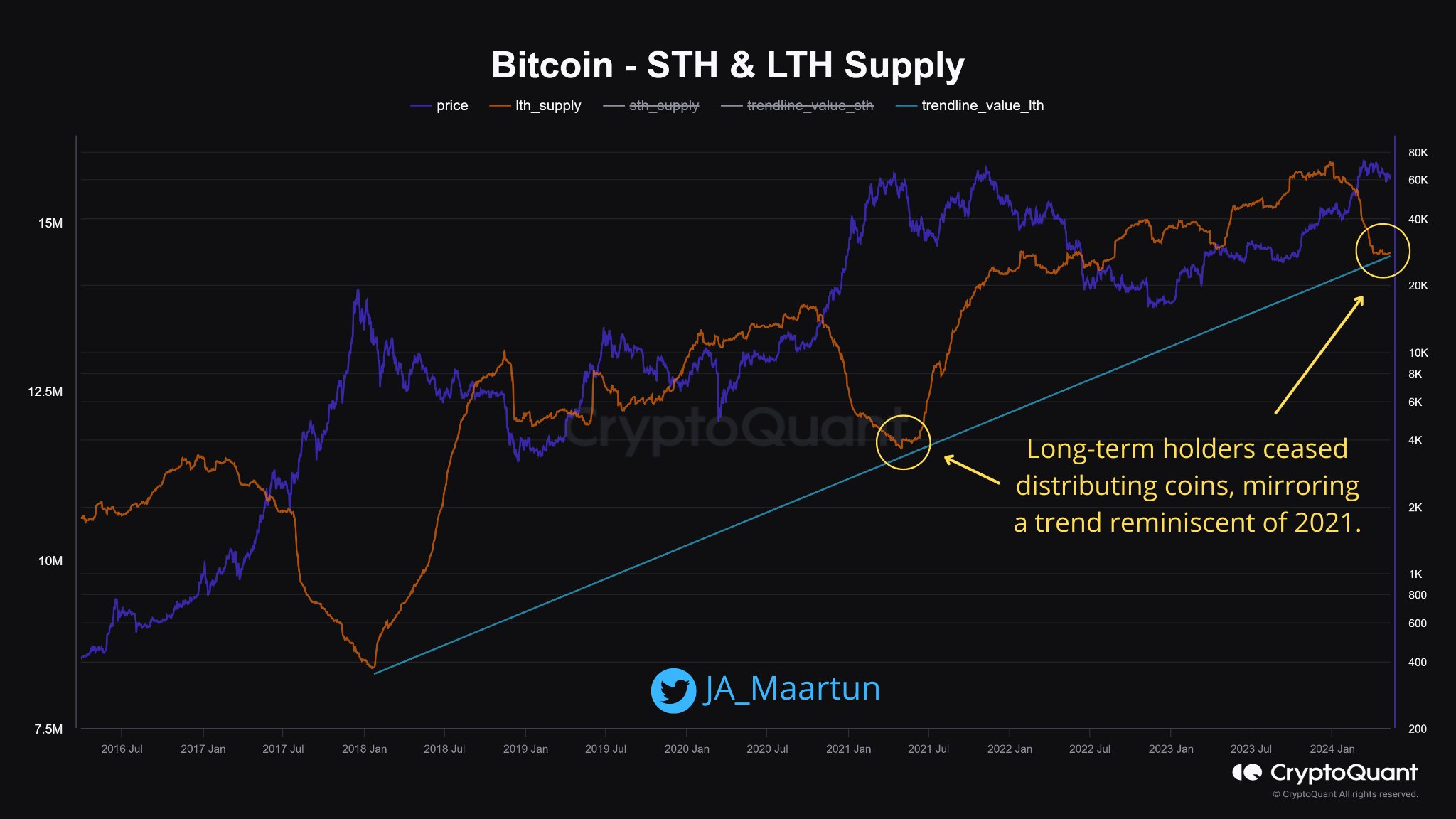

The chart beneath reveals the development within the whole Bitcoin provide held by LTH group addresses over the previous few years:

Seems like the worth of the metric has noticed a drawdown in current months | Supply: @JA_Maartun on X

Because the chart reveals, Bitcoin LTH continued to build up between the Might 2021 crash and this yr’s rebound. Nonetheless, as new ATH rises, the availability to those holders begins to development downward.

One thing to bear in mind is that this indicator has a 155-day lag on purchases, as solely mature provide counts in direction of this indicator.

Subsequently, when the indicator rises, it doesn’t imply that there’s accumulation presently, nevertheless it signifies that some purchases occurred 155 days in the past and these cash have simply aged out and could be counted in direction of LTH.

Nonetheless, for gross sales, there isn’t any such delay because the cash exit the group as quickly as they’re transferred on the community. Subsequently, the current decline will correspond to the sell-off presently happening.

Not too long ago, LTH’s sell-off has slowed as Bitcoin value stalled, with provide transferring roughly sideways. As Maartunn highlights within the chart, this development is just like what was noticed in 2021.

LTH ending distribution means the cryptocurrency has reached a peak. An analogous sample emerged throughout the 2017 bull interval. Subsequently, primarily based on these historic precedents, the most recent flat development in LTH provide may additionally point out a possible peak of the current bull market.

In fact, that is provided that LTH distribution truly ends. The chart reveals that over the previous two bull markets, LTH’s preliminary sharp sell-off was adopted by a slower distribution section.

This slowing downtrend continued for a number of months till the indicator reached a consolidation section and the asset peaked. For now, it stays to be seen whether or not the most recent development change in Bitcoin LTH provide corresponds to a earlier or later section.

bitcoin value

As of this writing, Bitcoin is hovering close to $62,700, down almost 2% from the previous week.

The worth of the asset seems to have shot up over the previous day | Supply: BTCUSD on TradingView

Featured pictures from Shutterstock.com, CryptoQuant.com, charts from TradingView.com