A quant analyst explains the potential main Bitcoin indicators that would inform the place the cryptocurrency’s value will pattern subsequent.

Bitcoin Coinbase Premium Might Be the Reply to The place BTC Will Go Subsequent

In a CryptoQuant Quicktake put up, an analyst talked in regards to the traits presently occurring with Bitcoin Coinbase Premium. “We are able to use Coinbase Premium’s pattern as a number one indicator of the long run course of BTC costs,” the quant famous.

“Coinbase Premium” is an indicator that tracks the distinction between Bitcoin costs listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

Associated Studying

When the worth of this indicator is constructive, it signifies that the worth on Coinbase is presently larger than the worth on Binance. This pattern exhibits that the shopping for strain on the previous platform is larger than the latter (or the promoting strain is decrease).

Then again, a detrimental premium means Coinbase could also be promoting larger than Binance as a result of the asset is presently buying and selling at a cheaper price on Binance.

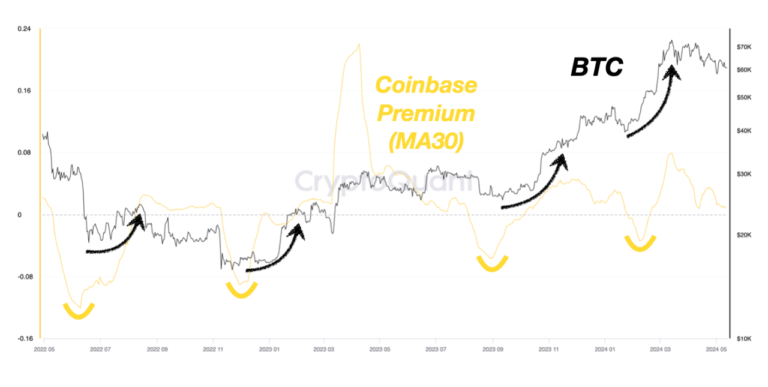

Now, the chart beneath exhibits the pattern of the 30-day transferring common (MA) of Bitcoin Coinbase Premium over the previous few years:

The 30-day MA worth of the metric appears to have been taking place in latest weeks | Supply: CryptoQuant

As proven within the chart above, Bitcoin Coinbase’s 30-day MA Premium has been constructive not too long ago, displaying that Coinbase customers have supported the asset by means of the rally.

Coinbase is broadly thought to be the platform of alternative for US institutional entities, whereas Binance has a extra world person base. Due to this fact, the worth of the premium can trace at how whale conduct in the USA differs from that in different components of the world.

As you’ll be able to see from the chart, the shopping for strain from these institutional merchants peaked on the value prime however has been declining since then. The indicator stays usually constructive, though it’s now very near the impartial zero mark.

Within the chart, the quant highlights an attention-grabbing sample that the cryptocurrency has adopted over the previous two years with regard to Coinbase Premium. Evidently each time the indicator bottoms in detrimental territory and reverses again into an uptrend, the coin’s value rebounds.

Associated Studying

An instance of this pattern additionally emerged earlier this 12 months, when a reversal on this indicator led to Bitcoin observing a rally that may see the asset finally break above its all-time highs.

Coinbase Premium is presently trending downward, however has not fallen into detrimental territory but. The analyst defined that Bitcoin is in a “wait and see” part and a rebound might take longer. This indicator should first decline additional and attain a reversal level, a minimum of if historic patterns should repeat themselves.

bitcoin value

Bitcoin earlier fell beneath $61,000, however the asset rebounded barely over the previous day to maneuver again above $62,700.

Seems like the worth of the coin has shot up over the past 24 hours | Supply: BTCUSD on TradingView

Featured pictures from Shutterstock.com, CryptoQuant.com, charts from TradingView.com