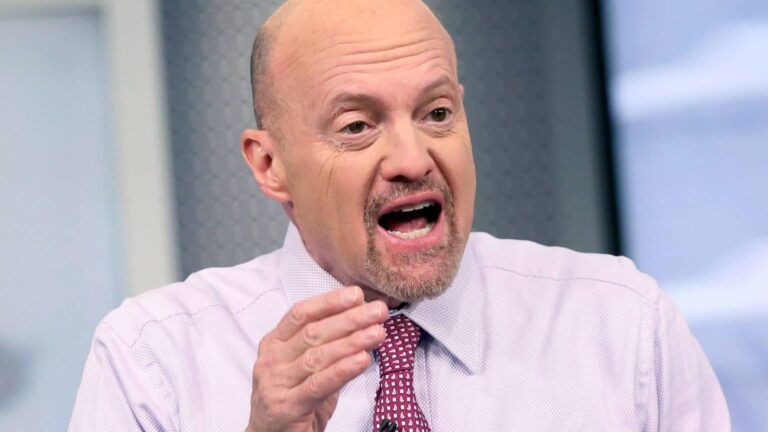

CNBC’s Jim Cramer reminded traders on Monday that the present inventory market relies upon largely on the Federal Reserve’s rate of interest resolution, which is tough to foretell as a consequence of persistent inflation. He stated he hoped new synthetic intelligence know-how would assist minimize prices, however careworn that would not occur anytime quickly.

“We’ve all the time believed that accelerated computing and generative synthetic intelligence will clear up a lot of our issues, and ultimately they may, however the emphasis is on ‘ultimately,'” he stated. “Within the quick time period, it is not going to have any influence on the overarching points that we fear about, not in the timeframe that issues to the Fed.”

For Cramer, synthetic intelligence is a sport changer. It has the potential to spice up productiveness and make items like groceries and medication extra inexpensive, serving to to enhance client steadiness sheets. However he stated the know-how wasn’t sufficient to instantly tackle excessive prices in industries corresponding to insurance coverage, housing and clothes.

This week brings new inflation information: Producer Worth Index on Tuesday and Client Worth Index on Wednesday. However as a result of these indicators are tough to manage they usually function at the next fee than the Fed wish to see, Cramer advises traders to stay to shares that aren’t affected by rates of interest.

“Proper now, at this second, all the things is on the sting,” he stated. “However what comes earlier than the sting? Effectively, the reply is every kind of inflation information that would push rates of interest greater and make us really feel prefer it’s too dangerous to spend money on shares proper now.”