Funding Community – Incestek Pivot Ltd (ASX:) has introduced its first half 2024 outcomes. Total EBIT reached $249 million, exceeding RBC’s forecast of $207 million and the market consensus of $206 million. Nonetheless, straight evaluating these numbers to market estimates is difficult as a result of impression of restructuring, one-time and discontinued operations. The corporate declared an peculiar dividend of 4.3 cents per share, supplemented by a particular dividend of 10.2 cents per share.

Get vital insights with InvestingPro! Unlock entry to AI-powered ProPicks, ProTips, and extra! Use coupon code INVPRODEAL for an extra 10% off!

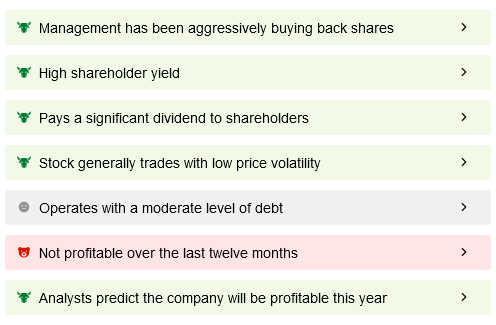

InvestingPro ProTips information at a look! Use coupon code INVPRODEAL for an extra 10% off!

Key insights:

• Future Outlook: The corporate maintains a optimistic outlook for fiscal 2024, with Dyno Nobel’s revenue outlook unchanged. Dyno Nobel Asia Pacific (DNA) expects earnings earlier than curiosity and tax to develop by mid- to high-single digits, whereas Dyno Nobel Americas (DNAP) expects earnings to beat its earlier document because the re-contracting course of nears completion.

• Fertilizer gross sales replace: Superior negotiations with PT Pupuk Kalimantan Timur for money consideration are ongoing. Nonetheless, there isn’t a assure that an settlement will probably be reached or a sale will probably be accomplished. Consequently, anticipated buybacks of as much as $900 million stay on maintain.

• Fertilizers: Fertilizer business EBIT was $10 million, down 91% year-over-year, with revenue margins down 9%. Regardless of margin and market development in its distribution enterprise, and a decline in pure fuel prices from fiscal 2023, dangers stay. Impairment prices of $408 million after tax had been additionally included as a separate vital merchandise (IMI (LON:)).

Take away adverts

.

• Dyno Nobel Asia Pacific: The business’s EBIT was US$108 million, an annual development price of 36%, and a revenue margin enhance of 4%. EBIT development was pushed by profitable subcontracting, BMA growth, know-how development and alternatives in EMEA by the Titonobel enterprise.

• Dyno Nobel Americas: EBIT for the Americas enterprise was $154 million, down 61% year-on-year, with revenue margins down 14%. Nonetheless, development in metals and Chile, improved pricing and value upkeep contributed to margin enchancment. This outcome can be because of improved manufacturing reliability and the WALA offtake settlement.