WASHINGTON DC, Might 17 (IPS) – The pandemic, geoeconomic fragmentation and chaos attributable to Russia’s warfare in Ukraine have modified world commerce dynamics. Whereas this creates challenges, the realignment of commerce additionally brings new alternatives, significantly for the Caucasus and Central Asia.

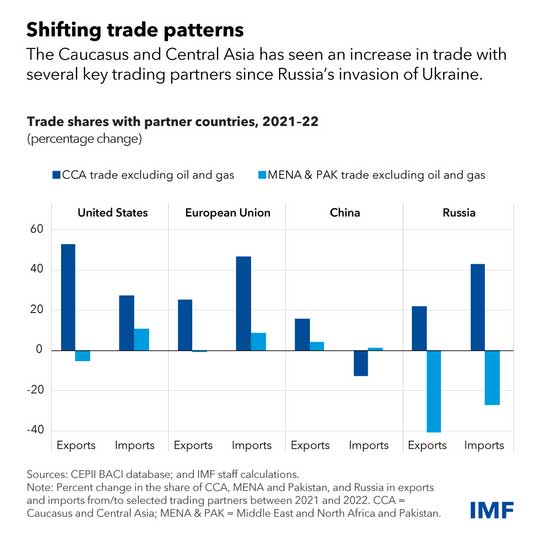

Because the warfare started, the area’s economies have proven continued resilience, with many international locations experiencing a surge in commerce exercise, pushed partially by a push for various commerce routes. In 2022, Armenia, Georgia and the Kyrgyz Republic will enhance their share of commerce excluding oil and gasoline with main companions similar to China, the European Union, Russia and the USA by as much as 60%.

Consequently, regardless of the slowdown, Caucasus and Central Asia’s GDP development is anticipated to stay robust at 3.9% in 2024 earlier than recovering to 4.8% in 2025.

Commerce volumes between China and Europe via Central Asia have greater than quadrupled. Though this route, often known as the “Center Hall”, accounts for under a small portion of general commerce between China and Europe, it holds vital promise for the financial growth of the Caucasus and Central Asia and their integration into international provide chains.

Shifting commerce patterns additionally create alternatives elsewhere. For instance, MENA international locations similar to Algeria, Kuwait, Oman and Qatar will roughly double their vitality exports to the EU in 2022-23 to satisfy rising demand for non-Russian oil and gasoline.

Latest Pink Sea transport assaults triggered by conflicts between Gaza and Israel haven’t solely disrupted maritime commerce, affected surrounding economies, but additionally elevated uncertainty.

Because the battle between Gaza and Israel broke out, Suez Canal transit site visitors has dropped by greater than 60% as ships have been rerouted across the Cape of Good Hope. Cargo volumes have additionally shrunk considerably at Pink Sea ports similar to Aqaba, Jordan and Jeddah, Saudi Arabia. Nonetheless, some commerce has been diverted inside the area, together with to Dammam, Saudi Arabia, on the Persian Gulf.

Continued disruption within the Pink Sea may have appreciable financial penalties for probably the most affected economies. An illustrative state of affairs in our newest Regional Financial Outlook means that if disruptions persist, the Pink Sea international locations (Egypt, Jordan, Saudi Arabia, Sudan, Yemen) may lose round 10% of their exports, with a mean of near 1% GDP on the finish of this yr.

Within the present scenario of uncertainty in worldwide commerce, strategic foresight and proactive coverage reforms can be key elements for international locations to attain commerce and revenue development. To deal with the challenges posed by these shocks and seize future alternatives, international locations want to handle long-standing commerce boundaries arising from growing non-tariff restrictions, insufficient infrastructure and regulatory inefficiencies.

Focused coverage reforms will help do that, however preparation is essential. Our analysis exhibits that decreasing non-tariff commerce boundaries, growing infrastructure funding and bettering regulatory high quality may assist enhance commerce volumes by a mean of 17% over the medium time period, whereas financial output may enhance by 3%. This might additionally enhance resilience to future commerce shocks.

Previous reforms present that efficient motion is feasible. Uzbekistan has elevated its attractiveness to overseas traders, deepened its integration with the worldwide economic system, eradicated forex controls, and improved its enterprise surroundings. Saudi Arabia is creating its non-oil economic system and attracting worldwide companies via its Imaginative and prescient 2030 reform program, which incorporates easing regulatory restrictions on commerce and funding.

Azerbaijan’s funding within the Baku-Tbilisi-Kars railway highlights the potential for infrastructure funding to extend freight capability between Asia and Europe. These measures underscore the transformative energy of focused coverage reforms to adapt to and thrive within the international commerce panorama.

MENA international locations can mitigate ongoing transportation disruptions by bettering provide chain administration, figuring out new suppliers in probably the most affected industries, pursuing various transportation routes, and assessing air cargo capability wants.

Within the medium time period, international locations can construct larger resilience in opposition to commerce disruptions by strengthening and increasing regional ties and connectivity. In flip, investing in transport infrastructure, together with the event of modern sea and land routes, can be essential.

Making a extra numerous commerce panorama – spanning companions, merchandise and routes – will considerably enhance the area’s resilience to disruption. Shifting commerce patterns present distinctive alternatives for international locations to redefine their place within the international financial framework.

This IMF weblog displays the contributions of Bronwen Brown and different employees within the Center East and Central Asia Division. It’s based mostly on Chapter 3 of the April 2024 Regional Financial Outlook for the Center East and Central Asia, “Shocks and Commerce Patterns in a Altering Geoeconomic Panorama.” The authors of this chapter are Apostles Apostles, Hasan Dudu, Philip Gori, Alexander Hajdenberg, Thomas Kroen, Fei Lui, and Salem Mohamed Nechi.

IPS ONE Workplace

Follow @IPSNewsUNBureau

Comply with IPS Information United Nations Bureau on Instagram

© Inter Press Service (2024) — All rights reservedUnique supply: Inter Press Service