audioundwerbung/iStock through Getty Pictures

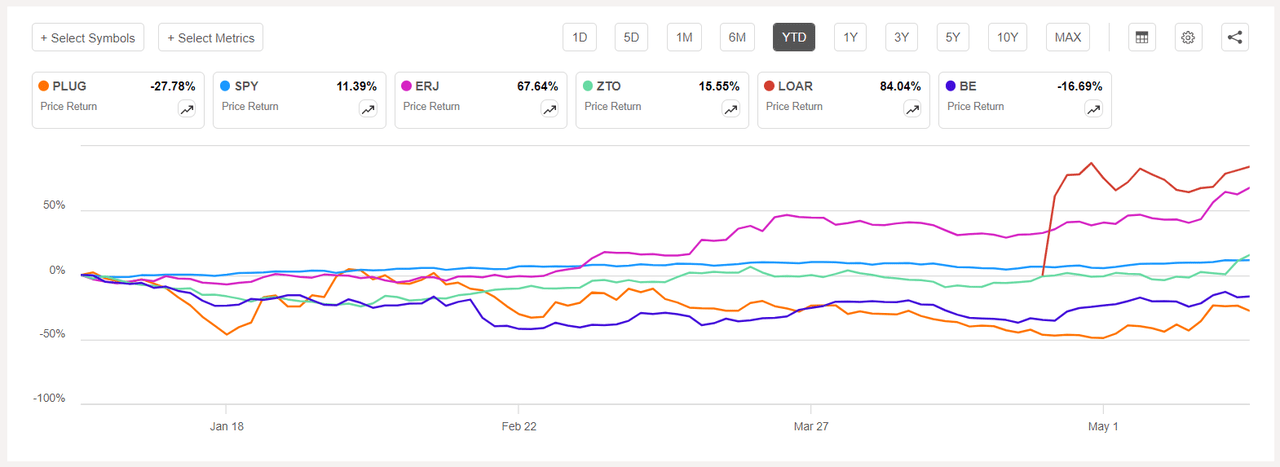

Industrial Choose Sector (XLI) Falls (-0.28%After three consecutive weeks of good points, the SPDR S&P 500 Belief ETF (SPY) rose (+1.65%) trotted and crawled for 4 weeks.

Yr-to-date (YTD) XLI has risen +9.95% SPY surges +11.39%.

The highest 5 gainers within the industrial sector (shares with a market capitalization of greater than $2B) all rose by greater than +10% Every this week. Yr to this point, 3 of those 5 shares are within the inexperienced.

Plug energy (NASDAQ: Plug) +26.95%. The corporate, which develops hydrogen and gasoline cell product options, noticed its shares rise essentially the most on Tuesday (+19.03%) beforehand, the corporate stated it had obtained a conditional dedication of as much as $1.66B in mortgage ensures from the U.S. Division of Power. Plug was one of many shares that surged the day earlier than ( PLUG +12.89%) after the Biden administration introduced plans to impose tariffs on Chinese language photo voltaic firms.Nonetheless, the inventory is within the crimson 12 months to this point -27.78%.

PLUG has a SA Quantitative Score of Sturdy Promote, which takes under consideration elements similar to momentum, profitability, and valuation. The inventory has a profitability issue grade of F and a development issue grade of C+. The common Wall Avenue analyst score disagrees with a maintain score, with 18 out of 29 analysts score the inventory a maintain.

Embraer (ERJ) +19.33%. Shares of the Brazilian plane producer had been among the many largest gainers on Tuesday (+9.11%). YTD, +67.64%.

ERJ’s SA Quantitative Score is Sturdy Purchase, with a Momentum Rating of A+ and Valuation Rating of C+. The common score from Wall Avenue analysts can be optimistic, with a Purchase score, with 5 out of 13 analysts calling the inventory a Sturdy Purchase.

The chart beneath exhibits the highest 5 gainers and SPY’s year-to-date value return efficiency:

ZTO Categorical (ZTO) +17.94%.Shares of the Chinese language logistics providers supplier rise +10.24% On Thursday, first-quarter outcomes beat expectations. YTD, +15.55%.

ZTO has a SA Quantitative Score of Maintain, a Profitability Rating of A, and a Valuation Rating of B-. The common score from Wall Avenue analysts varies with a Sturdy Purchase score, with 15 out of 21 analysts having a Sturdy Purchase score on the inventory.

Loar Holdings (LOAR) +12.02%. Loar held its IPO in April, and its inventory value rose all through the week. The maker of elements for plane and protection programs additionally reported first-quarter outcomes this week. YTD, +5.59%.

Bloom Power (BE) +10.48%.Firm share value rises +8.05% On Tuesday, the corporate introduced a partnership with C3.ai to launch an initiative to combine the C3 AI reliability suite to precisely mannequin Bloom gasoline cell efficiency and design.

On Tuesday, the U.S. authorities additionally stated it will enhance tariffs on a spread of Chinese language imports, together with electrical autos and semiconductors. YTD, -16.69%. SA has a quant score of Maintain on Bloom, whereas Wall Avenue analysts’ common score is Purchase.

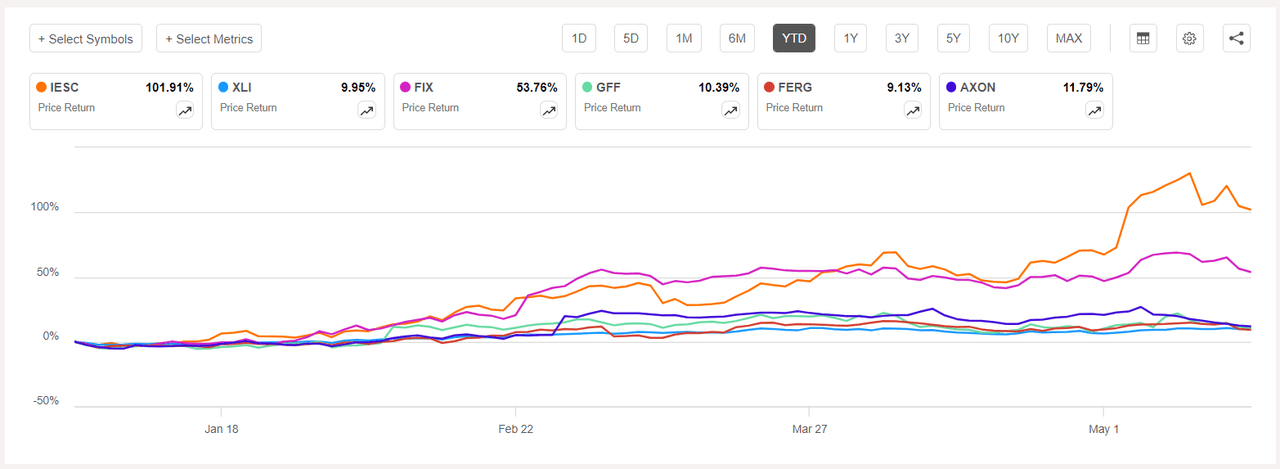

The highest 5 losers this week in industrial shares (market capitalization over $2B) all fell by greater than -4% Every. Nonetheless, these 5 shares are all within the inexperienced 12 months to this point.

IES Holdings (NASDAQ: IESC) -12.26%. Shares of IES, which supplies community infrastructure set up providers, fell essentially the most on Monday (-10.62%). The inventory can be among the many high 5 gainers for the reason that previous two weeks. YTD, +101.91%.

American Consolation System (FIX) -8.29%. Shares of the Houston-based supplier of mechanical and electrical set up providers had been among the many largest decliners on Tuesday (-5.29%). YTD, +53.76%.

FIX has a SA Quantitative Score of Maintain, a Profitability Issue Grade of B+, and a Momentum Issue Grade of A+. The common score amongst Wall Avenue analysts varies from a Purchase score, with three-quarters score the inventory as a Maintain whereas 1 fee it as a Sturdy Purchase.

The chart beneath exhibits the year-to-date value return efficiency of the 5 worst losers and XLI:

Griffin(GFF) -5.36%.Shares of the house and constructing merchandise maker fell this week however are up 12 months to this point +10.39%. SA has a Quantitative Score of “Sturdy Purchase” on GFF, with a Progress Rating of A and a Valuation Rating of C. The common Wall Avenue analyst score is in step with this and in addition has a Sturdy Purchase score, with 4 out of 5 analysts labeling the inventory a Sturdy Purchase.

Ferguson (FERG) -4.89%. Trian Funds trimmed its stake within the plumbing and heating merchandise distributor within the first quarter, billionaire investor Nelson Peltz’s fund disclosed in its newest 13F submitting Wednesday. YTD, +9.13%.

FERG has a SA Quantitative Score of Maintain, a Profitability Issue Score of A, and a Progress Issue Score of D-. The score contrasts with the common Purchase score from Wall Avenue analysts, with 10 out of 19 analysts contemplating the inventory a Sturdy Purchase.

Axon Enterprises (AXON) -4.82%. Shares of the Taser maker fell all week. YTD, +11.79%. SA Quant has a “maintain” score on AXON, whereas Wall Avenue analysts’ common score is a “purchase.”