Investing.com – Listed below are the largest strikes by analysts within the synthetic intelligence (AI) area this week.

InvestingPro subscribers at all times get first entry to AI analyst commentary that strikes the markets. Up to date as we speak!

Royal Financial institution of Canada raises Microsoft value goal, synthetic intelligence stays one of many key drivers

Analysts at funding financial institution RBC Capital Markets raised their value goal on Microsoft (NASDAQ: ) inventory to $500 from $450 on Friday, citing constructive suggestions from their current investor assembly with Microsoft’s director of investor relations.

Royal Financial institution of Canada emphasised that synthetic intelligence stays a key development driver for Microsoft and emphasised that the expertise large continues to speculate closely on this fast-growing area.

“Whereas capital expenditures are more likely to proceed to extend and affect margins, Microsoft is monitoring demand alerts whereas specializing in reducing the associated fee curve,” analysts stated within the report.

“Superior applied sciences reminiscent of extra environment friendly GPT-4o and Maia (customized synthetic intelligence chips) will assist decrease the associated fee curve,” they added.

RBC additionally highlighted Microsoft’s experience in cloud companies as a key benefit, offering a unified structure for all AI workloads.

As well as, Royal Financial institution of Canada identified that though Microsoft’s core cloud enterprise continues to be in its early levels, there’s a clear development that the corporate will transfer extra workloads to the cloud.

They famous that Azure’s development, excluding synthetic intelligence, accelerated within the fiscal second quarter.

“Importantly, core Azure is benefiting from the broader AI roadmap, as one-third of the greater than 50,000 Azure AI prospects are new to Azure,” the analysts famous.

MS: Dell nonetheless finest solution to drive momentum in AI servers

Take away adverts

.

This week, Morgan Stanley analysts reiterated Dell Applied sciences (NYSE: ) as their prime choose and raised their 12-month value goal on the expertise inventory to $152 from $128.

“Even when T12M strikes greater than 100%, Dell trades at simply 13 occasions our fiscal 2026 earnings per share of $10.12 (18% above market value) and nonetheless performs 1) constructing AI server energy, 2) affect on storage demand and three) bettering PC market,” analysts stated.

Analysts highlighted within the report that Dell’s momentum has elevated considerably over the previous 4 weeks, which they attribute to secondary cloud service supplier (CSP) AI server contract competitors wins, further enterprise AI server orders, and storage Improve in demand.

In consequence, the tech firm now has its strongest ahead spending intentions in additional than six years.

“We consider the big Tier 2 CSP wins talked about above may equate to $2B in orders for the quarter, implying that the AI backlog on the finish of the April quarter shall be just below $4B, which is more likely to be greater given smaller participant wins. greater, until there are any vital modifications within the April quarter rev report,” they added.

Mizuho analysts say buyers are extra hesitant to personal AMD inventory

Buyers are more and more hesitant to personal AMD (NASDAQ: ) inventory, analysts at Mizuho Financial institution be aware in a brand new report.

“Why add AMD if I’ve NVDA and AVGO right here which might be cheaper and fewer dangerous?” This appears to be the primary headwind for market contributors, the analyst stated.

Take away adverts

.

The corporate’s shares surged to a brand new intraday excessive of $168 earlier this week, however there weren’t any particular company-related occasions that may very well be attributed to the rise. The analyst stated the quick squeeze seems to be affecting a lot of the tech market.

AMD, in the meantime, has turn into one of many AI darlings over the previous 12 months or so with its highly effective AI-focused GPUs, nevertheless it stays a big quick place for a lot of East Coast hedge funds, with many simply Lengthy (LO) buyers shunned Mizuho, which stated the plan could be launched earlier than Nvidia launches Blackwell later this 12 months.

“Shares really feel like aircraft crash survivors trying to find land on a life raft in the midst of an enormous ocean,” the analyst wrote.

“I am nonetheless bullish and I like the danger reward in case you have the endurance and the length (like 6-9 months). However I really feel the priority, the hesitancy and the priority amongst buyers.

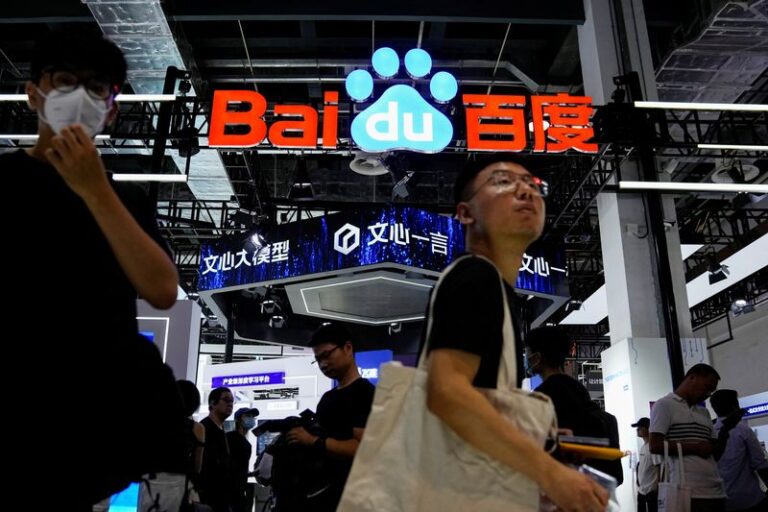

Morgan Stanley downgrades Baidu as synthetic intelligence monetization is slower than anticipated

In the meantime, Morgan Stanley analysts this week downgraded Baidu (NASDAQ: ) inventory as they forecast a difficult outlook for the Chinese language web firm’s advert income and anticipated monetization of its synthetic intelligence enterprise wants time.

In consequence, the Wall Road large downgraded Baidu’s U.S.-listed shares from “chubby” to “equal weight” and lowered its value goal to $125 from $140.

The reduce follows Baidu’s weak first-quarter revenue as weakening financial circumstances in China hit its core promoting income.

The corporate is China’s largest on-line search engine, and its synthetic intelligence initiatives (particularly the Ernie bot like ChatGPT) and demand for AI-driven cloud companies have boosted income. Nevertheless, Morgan Stanley analysts defined that this was offset by a lot greater bills for Baidu’s AI improvement.

Take away adverts

.

They consider that the weak point in Baidu’s promoting unit will proceed, and that the transformation of its conventional enterprise into synthetic intelligence merchandise is “gradual and lags behind consumer retention.”

Deutsche Financial institution downgrades Accenture to carry and doesn’t view GenAI as a development catalyst

Likewise, shares of Eire-based IT companies supplier Accenture (NYSE: ) had been downgraded.

Particularly, Deutsche Financial institution analysts downgraded the inventory to “maintain” from “purchase” and lowered their 12-month value goal to $295 from $409.

The analyst stated that after Accenture’s natural income is anticipated to contract -2.5% cc within the second quarter of 2024, the corporate seems to have transitioned from a constant market share gainer, particularly prior to now two years, to now dropping market share. To friends within the extremely pressured IT companies trade.

“We consider ACN’s outlook stays basically weak and Wall Road’s forecasts are more likely to be revised downwards additional,” the analysts wrote.

“Our channel examination means that Gen AI won’t be a catalyst for vital income development for ACN within the close to/medium time period and shall be disruptive to present pricing buildings,” they added.

The funding financial institution stated the controversy over whether or not Gen AI can have a damaging affect on IT service suppliers is anticipated to proceed to affect the trade’s price-to-earnings ratios and will push Accenture’s valuation towards a decrease, extra regular historic NTM price-to-earnings ratio.