Floki Inu (FLOKI), a Shiba Inu-inspired meme coin, has shortly been thrust into the highlight over the previous week attributable to a surge in buying and selling exercise and a virtually 20% worth enhance. Nonetheless, specialists warn that this “increase” could also be short-lived and pushed extra by hype than stable fundamentals.

Associated Studying

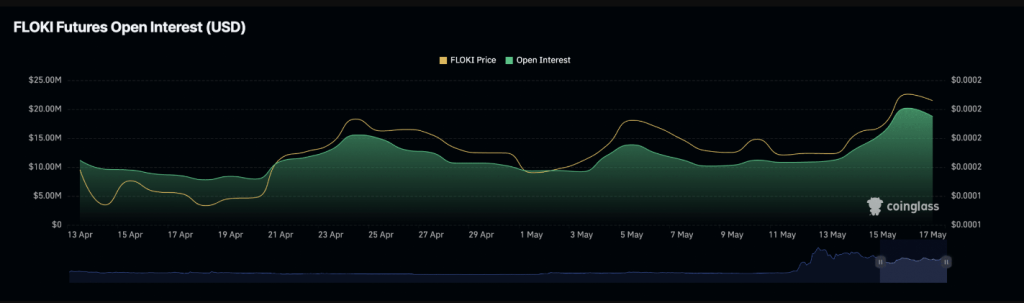

Open curiosity surges: Newcomers flock to FLOKI

A key indicator of pleasure is the spike in FLOKI futures open curiosity. The determine, which displays the variety of open curiosity in futures contracts, has climbed 110% since Could 1, reaching a 30-day excessive of almost $20 million, based on Coinglass. This means a lot of new market individuals coming into FLOKI positions, probably anticipating additional worth will increase.

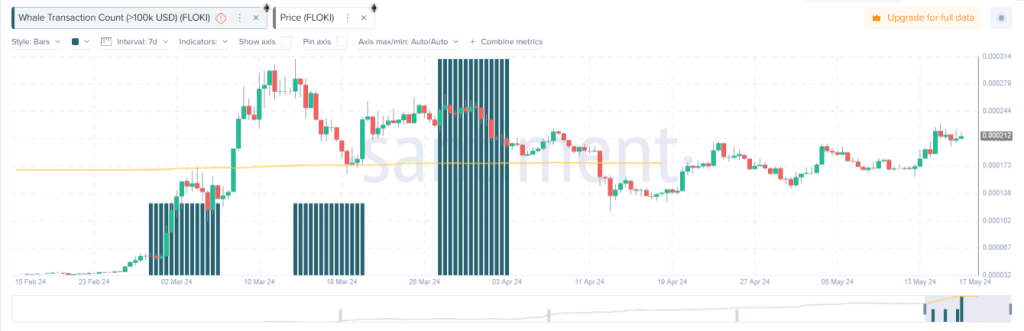

Including gas to the hearth was the sharp rise in FLOKI’s each day buying and selling quantity. On Could 15, Santiment reported each day buying and selling quantity of over $1 billion, which was FLOKI’s highest stage because the finish of March. This intense shopping for exercise reveals a surge in investor curiosity, driving costs increased.

Momentum indicator reveals bullish pattern

The efficiency of key momentum indicators additional helps the bullish case for FLOKI. Each the Relative Power Index (RSI) and the Cash Movement Index (MFI) are at present comfortably above the impartial line at 62.68 and 65.37 respectively. Merely put, these indicators counsel that worth momentum is leaning towards additional upside within the close to time period.

Nonetheless, beneath the glamorous exterior lies an underlying concern. Chaikin Fund Movement (CMF), a measure of shopping for and promoting stress on property, paints a slightly gloomy image.

Nonetheless in damaging territory

Regardless of the worth enhance, FLOKI’s CMF stays firmly in damaging territory, at present hovering round -0.11. This means that regardless of rising costs, shopping for stress could also be waning.

This distinction between worth and shopping for stress is often seen as an indication of a possible reversal, suggesting that the rally is being pushed by short-term hypothesis slightly than long-term investor confidence.

Associated Studying

Whereas FLOKI’s latest efficiency is undeniably spectacular, underlying elements counsel a probably unstable future. A surge in open curiosity and quantity hints at market insanity, however a damaging CMF raises considerations in regards to the sustainability of the rally.

Featured photographs from Floki, charts from TradingView