Studio J

Goldman Sachs stated administration feedback throughout earnings season pointed to a robust AI spending cycle, however there have been issues about what that might imply for margins.

“Whereas traders reward firms investing in synthetic intelligence, prospects are involved about potential return on funding “Suggesting traders will proceed to scrutinize firms’ AI methods and stay targeted on profitability,” strategist David Kostin wrote. Cross-sectional returns for the Russell 3000 (NYSE:IWV) shares present that traders are actually paying extra for earnings than for gross sales development.

“Following a quarterly low of $14 billion in Q1, (AMZN) plans to considerably improve capital expenditures in 2024 to assist synthetic intelligence workloads and capabilities in AWS. (META) Will increase capital expenditure funds to assist synthetic intelligence plan ($35-40 billion in comparison with $35-40 billion in 2024) to advertise synthetic intelligence innovation within the promoting subject.

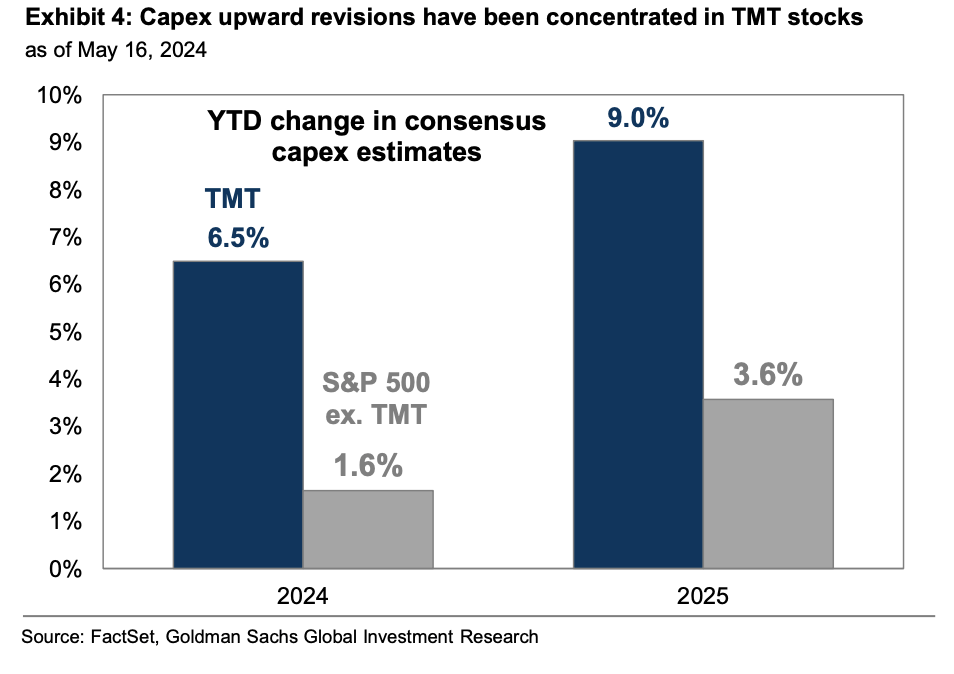

“Consensus forecasts for 2024 and 2025 capital expenditures for TMT shares have elevated 6.5% and 9%, respectively, year-to-date. In distinction, analysts’ capital expenditure forecasts for non-TMT shares have been revised up just one.6% and three.6%.”

“Opposite to what has been the case over the previous two years, firms in our industry-neutral basket with the best capital expenditures and R&D spending have outperformed the basket of shares with the best whole money returns by 5 share factors year-to-date (10% vs. 5%) ,” Costin identified.