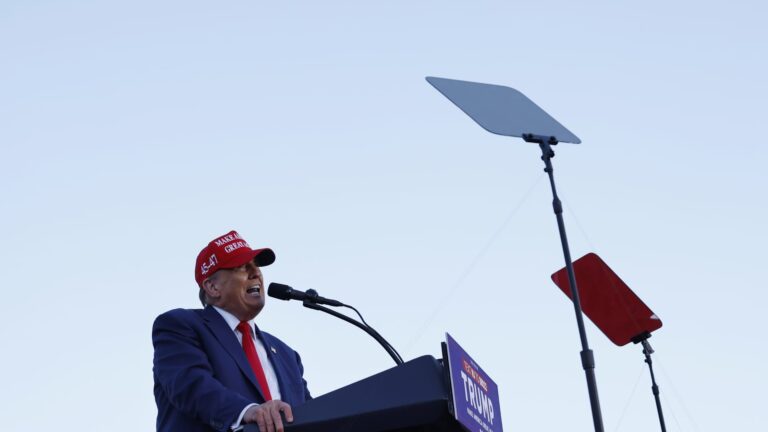

Former President Donald Trump speaks throughout a Wildwood Seashore marketing campaign rally on Could 11, 2024 in Wildwood, New Jersey.

Michael M. Santiago | Michael M. Santiago Getty Pictures Information | Getty Pictures

private charge

“The largest tax cuts expiring are decrease charges and expanded protection,” mentioned Erica York, senior economist and analysis director on the Tax Basis’s Federal Tax Coverage Heart.

TCJA reduces federal earnings tax charges throughout the board, decreasing the highest charge from 39.6% to 37%.

With out an replace from Congress, private tax charges will return to pre-TCJA ranges after 2025.

The usual deduction could drop

Whenever you file your taxes, you possibly can declare the usual deduction or itemized deductions, whichever is larger. Each choices will cut back your taxable earnings.

Some itemized deductions embody charitable presents, a share of medical bills, and state and native taxes (SALT), that are capped at $10,000 beneath the TCJA.

The TCJA almost doubled the usual deduction, making it much less probably for filers to itemize tax deductions. Specialists say that would change after 2025 if the usual deduction returns to 2017 ranges.

Earlier than 2018, about 70% of taxpayers claimed the usual deduction, in contrast with 90% for the 2020 tax 12 months, in accordance with the Tax Coverage Heart.

The $10,000 restrict on the SALT deduction was created to assist pay for adjustments within the TCJA, which has been a key concern for some lawmakers in high-tax states like California, New Jersey and New York.

The SALT cap is scheduled to run out in 2025.

Little one tax credit score may fall

TCJA will increase the kid tax credit score by doubling the utmost tax deduction to $2,000, growing the refundable portion to $1,400, and increasing eligibility. That might return to 2017 ranges with out adjustments from Congress.

Home lawmakers handed a bipartisan tax bundle in January that included an enhancement to the kid tax credit score. Though the invoice has stalled within the Senate, the controversy may affect negotiations because the 2025 deadline approaches.

The “greatest downside” for U.S. high-net-worth people

Federal present and property tax exemptions may even be larger by way of 2025, permitting extra of the ultra-wealthy to switch their belongings to the subsequent technology tax-free.

In 2024, the tax-free restrict for presents throughout lifetime or loss of life rises to $13.61 million per particular person or $27.22 million for a partner. However with out new legal guidelines from Congress, these restrictions will probably be lowered by about half by 2026.

[It’s] That is the most important query we focus on with our clients proper now.

Robert Dietz

Director of Nationwide Tax Analysis, Bernstein Non-public Wealth Administration

“[It’s] That is the most important concern we’re discussing with shoppers proper now,” Robert Dietz, director of nationwide tax analysis at Bernstein Non-public Wealth Administration in Minneapolis, beforehand instructed CNBC.

Specialists say looming adjustments to larger exemptions are prompting some ultra-wealthy People to make lifetime presents to take away belongings from their estates.

Nonetheless, the decrease federal present and property tax exemptions won’t have an effect on most filers. Lower than 0.2% of people that die in 2023 are anticipated to have a taxable property, in accordance with estimates from the Tax Coverage Heart.