On-chain knowledge exhibits that 90% of Ethereum traders have now made a revenue after the asset’s value surged considerably above $3,800.

Ethereum traders unstoppable after ETF rally

In accordance with knowledge from market intelligence platform IntoTheBlock, ETH’s newest rebound alerts a shift in profitability for traders on-line.

To trace holder profitability, analytics companies use on-chain knowledge to search out the common acquisition value or value foundation for every tackle on the blockchain.

If that value is decrease than the present spot worth of the cryptocurrency for any tackle, that individual investor is taken into account worthwhile, or “within the cash” as outlined by IntoTheBlock.

Then again, a value foundation decrease than the asset value signifies that the tackle holds some internet loss, so its holder will “lose cash.”

In fact, if the common buy value of the pockets equals the spot value of the token, then the investor can be thought of to have simply damaged even (“at-the-money”).

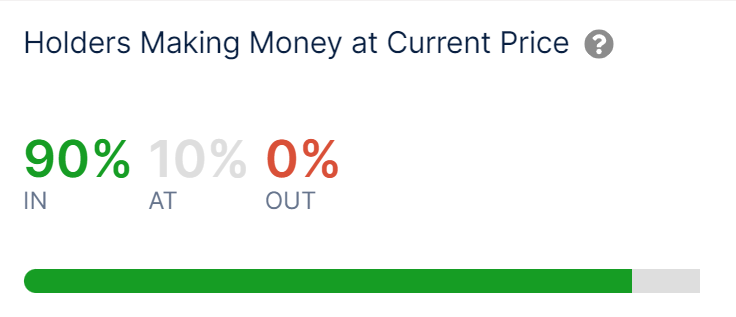

Now, following the asset’s huge surge, the profitability of the Ethereum consumer base breaks down as follows:

Seems like a considerable amount of traders are within the inexperienced in the intervening time | Supply: IntoTheBlock on X

As proven above, 90% of the addresses on the Ethereum community are holding tokens with a internet unrealized acquire after the asset’s value surged.

Apparently, 0% of wallets are additionally out of cash, which means nobody on the blockchain is dropping cash anymore. Nonetheless, 10% of traders are nonetheless breaking even.

Traditionally, holders of income usually tend to promote than holders of losses. Subsequently, every time there’s a important imbalance available in the market towards inexperienced traders, the chance of a sell-off is excessive.

Subsequently, it’s extra doubtless that cryptocurrency costs will peak at excessive profitability ranges. With the big variety of ETH traders at present holding positive aspects, there could possibly be an enormous profit-taking occasion that would hinder the present rally.

Nevertheless it’s value noting that in bull markets, the asset is commonly capable of maintain excessive income for traders for a time period, as excessive demand retains pouring in to soak up any profit-taking earlier than a high is lastly seen.

That mentioned, if profitability stays excessive for an prolonged interval, the chance of a minimum of a brief cooling could enhance. Now, it stays to be seen how Ethereum costs will develop going ahead, and whether or not the hype surrounding spot ETFs will have the ability to offset the sell-off available in the market.

Ethereum value

Ethereum has gained greater than 22% up to now 24 hours and has reached its highest degree in additional than two months, at present buying and selling round $3,800.

The value of the coin appears to have noticed some sharp bullish momentum up to now day | Supply: ETHUSD on TradingView

Featured photographs by Bastian Riccardi on Unsplash.com, IntoTheBlock.com, chart by TradingView.com