After taking a two-month breather close to all-time highs, Bitcoin (BTC) seems able to journey one other wave, in line with cryptocurrency analyst Axel Adler. Adler predicted a 300-day bull market, pushed by wholesome short-term holder earnings and a aggressive market.

Associated Studying

Worthwhile punches and extra room

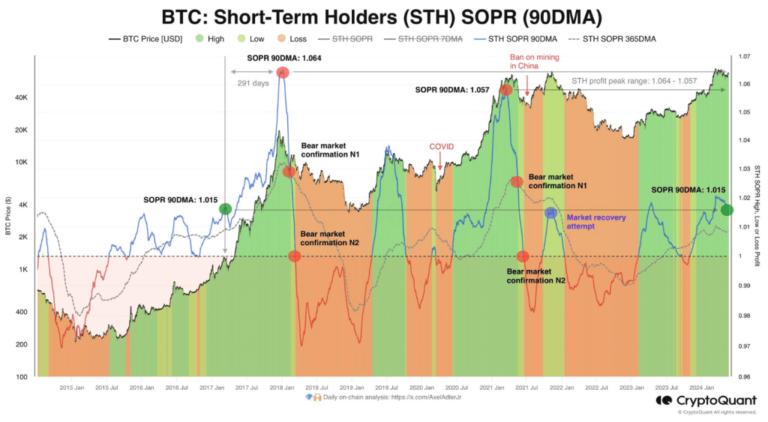

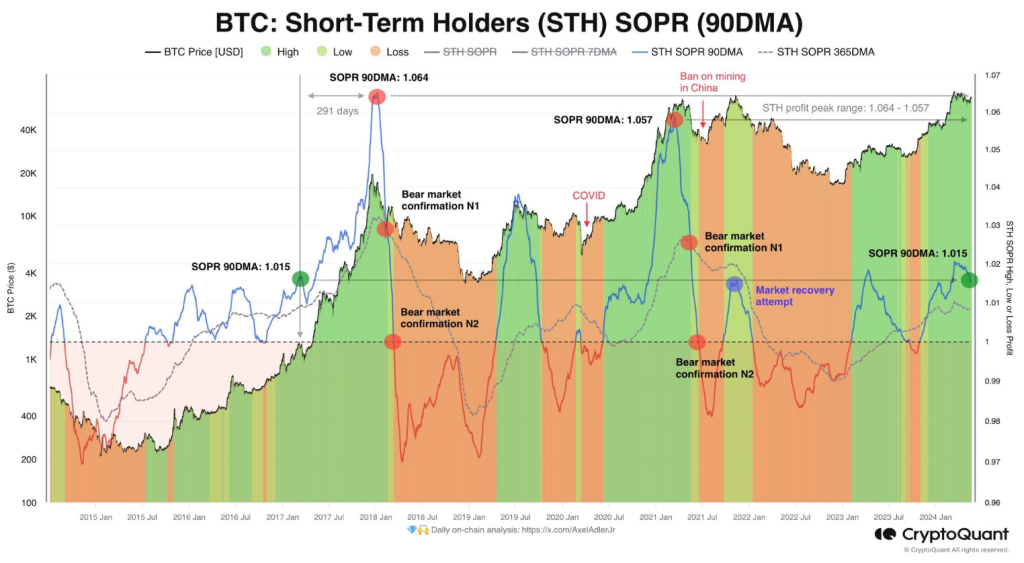

Adler raised the problem with information on the short-term holder spending output margin (STH SOPR). This indicator reveals whether or not short-term holders are cashing out earnings.

At the moment, STH SOPR’s 90-day transferring common sits at 1.015, exhibiting short-term holders within the inexperienced, however has not but reached the deadly strike ranges seen in earlier bull markets (round 1.06). This implies there may be room for extra profit-taking earlier than bulls tire.

I already talked about that the bull market is in full swing. Barring any unexpected black swan occasions, it can doubtless final about +/- 300 days.

That is primarily based on revenue and loss evaluation for short-term holders utilizing a 90-day transferring common. pic.twitter.com/30OgsruvOi

— Axel 💎🙌 Little Adler (@AxelAdlerJr) May 21, 2024

Open Curiosity: Untapped Reserves of Energy

One other weapon within the bulls’ arsenal is Open Curiosity (OI), an indicator that displays the overall quantity of open curiosity in derivatives contracts (futures and choices) held by merchants.

Whereas the latest value surge has been spectacular, OI’s 7-day transferring common hasn’t seen the identical huge bounce seen in earlier bull markets. Adler believes that which means there are reserves of energy hidden out there, and there may be extra firepower ready to be launched.

Technical benefit: Bulls have momentum

However technical evaluation is greater than fancy ratios and arcane charts. Adler recognized a number of technical indicators that paint a bullish outlook. The relative power index (RSI), which measures momentum, has but to interrupt above 70, a stage usually related to overbought circumstances.

This implies the present rally is wholesome and sustainable. Moreover, Chaikin Fund Circulate (CMF) has surged into the plus 0.05 zone, indicating heavy capital inflows and rising investor curiosity in Bitcoin.

Associated Studying

Can the Bulls break via resistance?

Whereas bulls seem to have the higher hand, there are nonetheless hurdles to beat. Key resistance ranges recognized utilizing Fibonacci extension ranges are at $79,000, $88,000, and $97,000. These value factors may act as a barrier to Bitcoin’s value surge.

Nonetheless, if the present momentum continues, these resistance ranges could possibly be damaged, paving the way in which for a potential retest of the all-time excessive of $73,700 and a potential upward transfer.

Featured picture from Display screen Rant, chart from TradingView