Joseph Lubin, co-founder of Ethereum and CEO of blockchain expertise firm Consensys, mentioned that the U.S. Securities and Trade Fee (SEC) could approve a spot Ethereum ETF, which can result in extreme restrictions on the availability of Ethereum. This growth is anticipated to be a “watershed” second for Ethereum.

In an unique interview with DL Information, Lubin predicted that the approval of a spot Ethereum ETF would unleash lots of institutional demand. On condition that many establishments have begun investing in cryptocurrencies by spot Bitcoin ETFs, Ethereum is of course the following necessary asset to diversify.

Lubin commented that “there will likely be appreciable pure, pent-up stress to purchase Ethereum by these ETFs.” Nonetheless, he additionally identified that Ethereum’s state of affairs could be very completely different from Bitcoin attributable to underlying provide dynamics.

Within the context of ETF creation, the principle distinction between Ethereum and Bitcoin is the provision of the asset. On-chain information exhibits that greater than 27% of Ethereum is pledged by numerous protocols on the Ethereum community. These funds are locked in contracts and contribute to the safety and operation of the community, so they don’t seem to be simply accessible for market transactions.

“Most Ethereum performs a job in core protocols, DeFi techniques or DAOs,” Lubin defined. This structural distinction implies that ETF suppliers have much less ether to buy and allocate to new ETF shares.

Associated Studying

In August 2021, EIP 1559 of the Ethereum community launched a burning mechanism, wherein a portion of the Ether used for transaction charges will likely be completely faraway from circulation. This deflationary mechanism is designed to stability Ethereum provide progress and probably improve its shortage over time.

As community exercise will increase (presumably additional stimulated by new institutional curiosity in Ethereum through ETFs), this burning mechanism will progressively cut back the accessible provide, additional exacerbating a possible provide crunch. “This may very well be a really profound watershed second,” Lubin mentioned.

Ethereum worth targets and issues

An authorised Ethereum spot ETF might have a major influence in the marketplace. Cryptocurrency analyst Miles Deutscher has predicted a attainable state of affairs wherein Ethereum might see a worth spike just like what Bitcoin skilled following the approval of its personal ETF.

In accordance with Deutscher’s evaluation, “BTC rose by 75% within the 63 days after the spot ETF was authorised. If ETH follows the identical pattern (if authorised), its worth will attain $6,446 by July 23.

Bitcoin USD The spot ETF rose 75% inside 63 days after approval.

if $ETH Following the identical pattern (if authorised), this could convey it to $6,446 by July 23. pic.twitter.com/FfWg9VGUMx

— Miles Deutscher (@milesdeutscher) May 21, 2024

Views range amongst analysts, nonetheless. K33 Analysis’s Vetle Lunde famous the challenges of replicating Bitcoin’s success, noting that earlier than spot ETFs have been authorised, futures-based Ethereum ETFs captured solely a fraction of the property in comparison with their Bitcoin counterparts. “Since its launch, the Fut-based ETH ETF has amassed internet inflows of $126 million, roughly equal to the inflows into Bitx over the previous 3 days. The Fut-based ETH ETF’s whole AUM is simply pre-spot approval Fut-based BTC ETF AUM 7.4% of the dimensions.

Associated Studying

On the similar time, cryptocurrency analyst Vijay Boyapati expressed issues in regards to the structural variations of ETFs, particularly the lack of ETF constructions to include staking. “It must be famous that if the ETH ETF is authorised, its underlying asset will carry out a lot worse than the BTC ETF, as it’s nonetheless extremely unlikely that the SEC will enable ETF candidates to pledge,” he mentioned.

This might end result within the ETF not absolutely reflecting the underlying worth progress of Ethereum’s worth, as Alex Thorn, head of analysis at cryptocurrency-focused monetary providers agency Galaxy, highlighted: “The shortage of collateral for ETH ETPs can have a major influence on returns. If you happen to Bought $10,000 of ETH on the merge day in September ’22 and held it to this present day with out staking, then you might be right here in comparison with somebody who bought and staked to gather issuance, suggestions and MEV Efficiency through the interval was 8% worse.

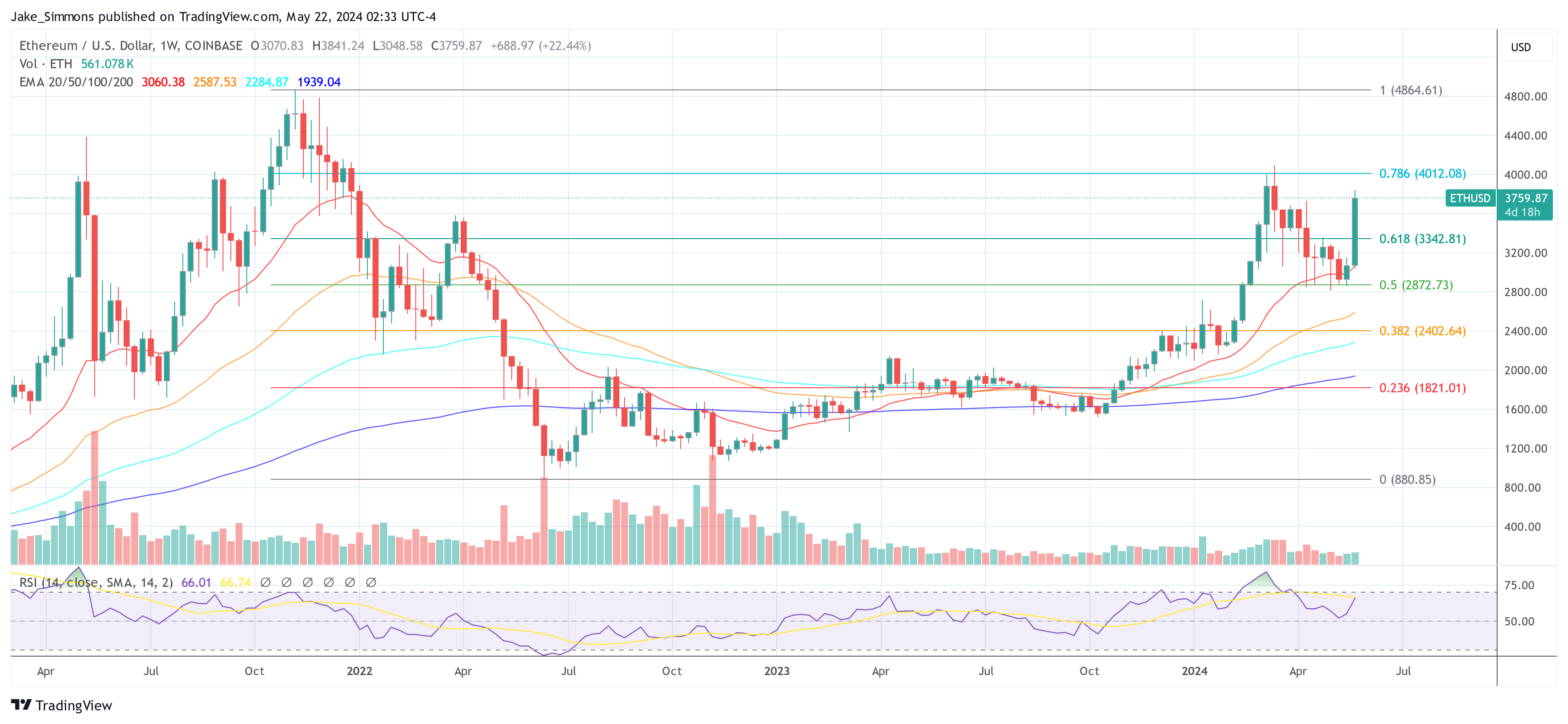

At press time, ETH was buying and selling at $3,759.

Featured picture from Consensys, chart from TradingView.com