In probably the most anticipated quarter of this earnings season, Nvidia’s income and earnings far exceeded excessive expectations. Even higher was CEO Jen-Hsun Huang’s hefty income steering and broader imaginative and prescient, which strengthened the concept that firms and international locations are working with the AI chip large to shift $1 trillion value of conventional information facilities towards accelerated computing. Knowledge from information supplier LSEG (previously Refinitiv) confirmed that income within the first quarter of fiscal 2025 elevated 262% year-on-year to US$26.04 billion, a lot greater than analysts’ forecast of US$24.65 billion. The corporate had anticipated income of $24 billion, plus or minus 2%, so it is a enormous breakthrough. Adjusted earnings per share grew 461% to $6.12, beating the LSEG consensus estimate of $5.59. Based on market information platform FactSet, the adjusted gross revenue margin was 78.9%, which additionally exceeded Wall Avenue expectations of 77.2%. The corporate estimates gross revenue margin to be 77%. Plus or minus 50 foundation factors. Along with the sturdy outcomes, Nvidia additionally introduced a 10-for-1 inventory cut up. Whereas inventory splits do not technically create worth, they do have a optimistic influence on shares. The corporate stated the cut up was to “make fairness extra accessible to staff and traders.” We commend Nvidia for doing this and can proceed to induce different firms to do the identical. Nvidia just lately performed a 4-for-1 inventory cut up in July 2021. Not surprisingly, Nvidia shares soared in after-hours buying and selling. Nvidia Why we have now it: Nvidia’s high-performance graphics processing models (GPUs) are a key driver behind the unreal intelligence revolution, powering accelerated information facilities being quickly constructed world wide. However this is not only a {hardware} story. By its Nvidia AI Enterprise service, Nvidia is constructing a doubtlessly enormous software program enterprise. Opponents: Superior Micro Units and Intel Final bought: August 31, 2022 Launched: March 2019 Backside line What are air pockets? Heading into the quarter, it appears like the one factor that could be holding Nvidia again is a slowdown associated to product transitions, as prospects delay orders for H100 and H200 GPUs (graphics processing models) in anticipation of the superior Blackwell chip platform. As you’ll be able to see from Nvidia’s huge development and upside steering, that is removed from the case, with demand anticipated to outpace provide for fairly a while. If this narrative resurfaces, this is a superb factor to recollect subsequent time so these issues do not shake your long-term thesis: Clients are nonetheless of their early phases, Jensen defined on the post-earnings name. Preserve shopping for chips to maintain up with the present technological arms race. Know-how management is every part. “There’s going to be a bunch of wafers coming at them, and so they need to maintain making them, averaging efficiency, if you’ll. In order that’s a sensible factor to do,” the CEO stated. Extra broadly, we heard nothing Wednesday night time to vary our long-term view of how Nvidia may very well be the driving drive behind the present synthetic intelligence industrial revolution. Here is how Jensen explains the shift going down: “In the long run, we’re fully redesigning the best way computer systems work. It is a platform shift. After all, it compares to different platform shifts prior to now, however time will inform Inform us, it is a platform shift. Jensen went on to say how the pc not solely interacts with us, “nevertheless it additionally understands what we imply, what our intentions are in asking it to do it, and it has the flexibility to motive, iteratively motive to course of and Plan and return a outcome. Resolution. “We spend billions on accelerated computing, which is why we maintain Nvidia for the long run moderately than attempting to commerce it forwards and backwards on each headline. By the best way, one other pessimistic assertion we frequently hear is that the customized chips that each one the large cloud firms are producing are a risk to Nvidia’s management. Jensen would not assume so as a result of his platform methods ship the very best efficiency on the lowest whole price of possession. That is an unmatched worth proposition. NVDA YTD mountain Nvidia YTD Sturdy outcomes and outlook, upbeat feedback and a inventory cut up despatched Nvidia shares up about 6%, topping $1,000 per share for the primary time. Nonetheless, we expect the advantages do not cease there. We raised our value goal from $1,050 to $1,200 and maintained a 2 score, which means we view this as a Purchase on a pullback. Quarterly development was pushed by all buyer varieties, however enterprise and shopper networking firms led the best way. The large cloud firms accounted for about 40% of information heart income this quarter, so once you see firms like Oracle and membership names Amazon, Microsoft, and Alphabet elevating their capex outlooks, perceive that quite a lot of that cash goes to Nvidia. And, there is a good motive for that. Nvidia Chief Monetary Officer Colette Kress estimated on the convention name that for each $1 spent on Nvidia AI infrastructure, cloud suppliers have the chance to earn $5 in GPU prompt internet hosting income inside 4 years. One buyer this quarter is Tesla, which is scaling its coaching AI cluster to 35,000 H100 GPUs (graphics processing models). Nvidia stated Tesla’s use of Nvidia’s synthetic intelligence infrastructure paves the best way for “breakthrough efficiency” in Full Self-Driving Model 12. (Full Self-Driving, or FSD, is how Tesla markets its high-level driver help software program. methodology. One other spotlight is Meta’s announcement of its large-scale language mannequin Llama 3, which is educated on a cluster of 24,000 H100 GPUs. Kress believes that as extra shopper community prospects use generative synthetic intelligence purposes. , Nvidia will see extra development alternatives. Tesla and Meta clusters are examples of what Nvidia calls “AI factories.” The corporate believes that “these next-generation information facilities have superior full-end accelerated computing platforms, information is available in, and knowledge comes out.” Nvidia additionally famous that sovereign AI has been a giant supply of development. The corporate defines sovereign AI as “a nation’s capability to provide synthetic intelligence utilizing its personal infrastructure, information, workforce, and industrial networks.” Even with the transition to Blackwell, Nvidia expects demand for Hopper to proceed for fairly a while It had a full information heart within the fourth quarter. Software program was talked about greater than two dozen occasions on the decision, and Nvidia stated on the final quarter’s name that total its software program and companies income hit $1 billion. . They’re high-margin, recurring income companies that may proceed to be a spotlight space within the coming quarters. As for China, the corporate stated it has begun including new merchandise produced particularly for the U.S. authorities that don’t require export management licenses. There are restrictions on gross sales of the quickest chips, fearing they are going to be utilized by the Chinese language army. Nonetheless, it isn’t anticipated to be as a lot of a income driver because it has been prior to now, as constraints on Nvidia’s expertise make the surroundings extra aggressive for the corporate. Nvidia’s fiscal second-quarter steering ought to dispel issues that some sort of synthetic intelligence spending “air bag” is forming. For the present second quarter, Nvidia expects income of $28 billion, plus or minus 2%, above consensus expectations. of $26.6 billion. . Capital Returns Nvidia raised its quarterly dividend by 150%, which is nice, however the annual yield is negligible for the funding case. The larger influence is the worth the corporate purchased again in its fiscal first quarter. $7.7 billion in shares. (Jim Cramer’s charitable belief is lengthy NVDA. See right here for a full checklist of shares.) As Jim Cramer’s CNBC Investing Membership As a subscriber, you’ll obtain commerce alerts from Jim Cramer earlier than he sends a commerce alert for 45 minutes earlier than shopping for or promoting shares in his Charitable Belief portfolio. If Jim talked a couple of inventory on CNBC TV, he would wait 72 hours after issuing a commerce alert earlier than executing the commerce. The funding membership data above is topic to our Phrases and Situations and Privateness Coverage and our Disclaimer. No fiduciary responsibility or obligation is created or created by any data you obtain in reference to the Funding Membership. No particular outcomes or earnings are assured.

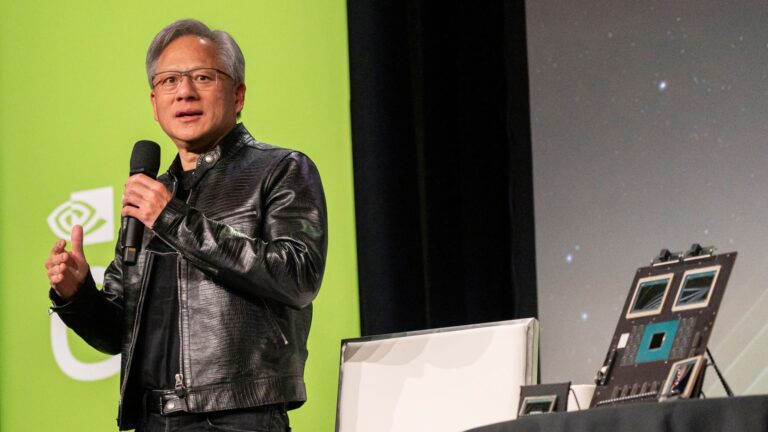

Nvidia Company co-founder and CEO Jensen Huang on the Nvidia GPU Know-how Convention (GTC) in San Jose, California, USA, on Tuesday, March 19, 2024.

David Paul Morris | David Paul Morris Bloomberg | Getty Pictures

In probably the most anticipated quarter of this earnings season, Nvidia’s income and earnings far exceeded excessive expectations. Even higher was CEO Jen-Hsun Huang’s hefty income steering and broader imaginative and prescient, which strengthened the concept that firms and international locations are working with the AI chip large to shift $1 trillion value of conventional information facilities towards accelerated computing.