One analyst explains how Bitcoin’s buying and selling availability has quietly declined through the asset’s latest consolidation section.

Bitcoin could also be well-positioned to succeed in new all-time highs

In a brand new article on X, analyst Willy Woo discusses the newest developments in Bitcoin shares on centralized exchanges.

Associated Studying

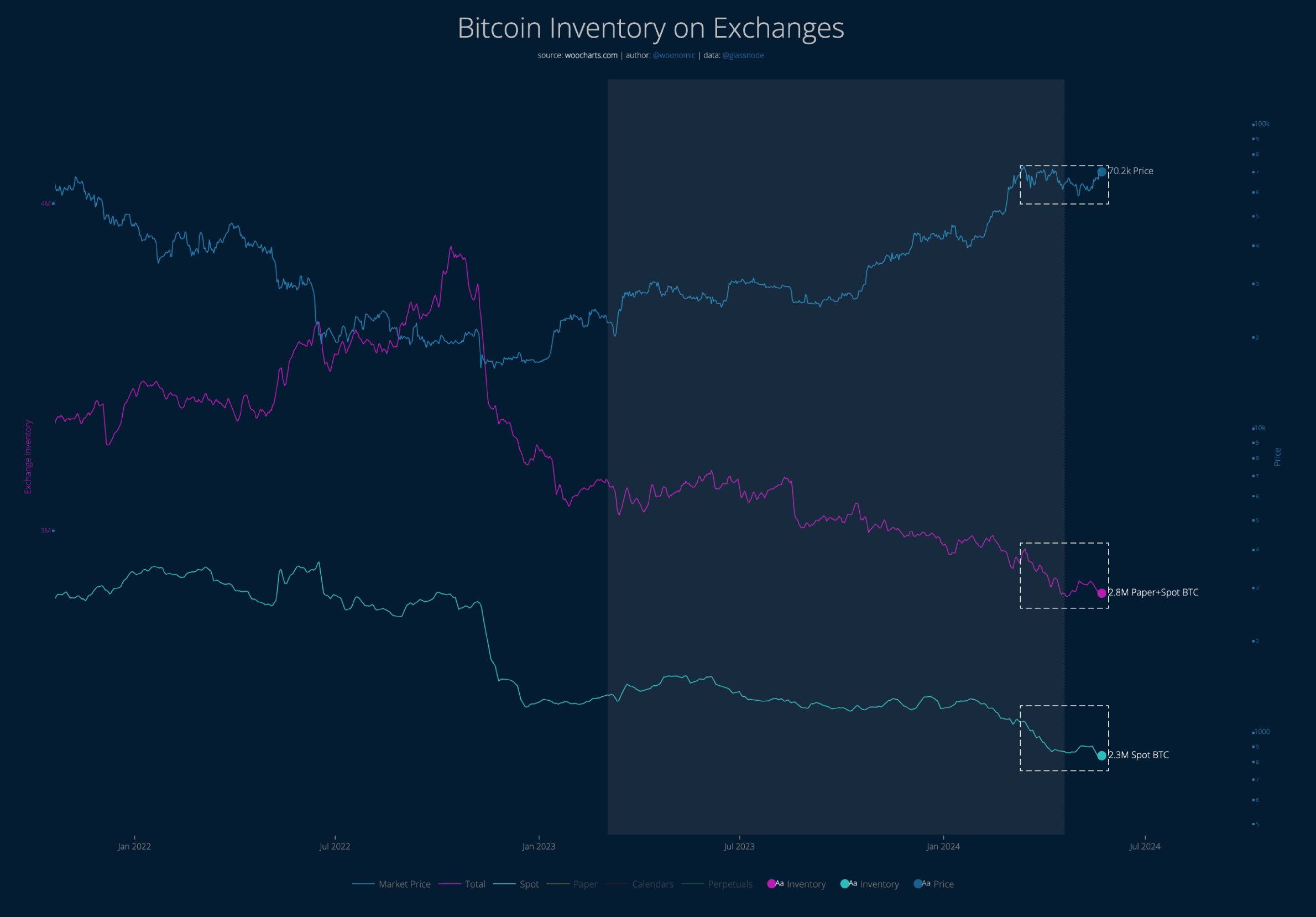

The chart beneath exhibits the evolution of spot and paper Bitcoin reserves over the previous few years.

Because the chart exhibits, Bitcoin in spot wallets has been declining over the previous few months. At the moment, the overall quantity of such BTC held by central entities has dropped to 2.3 million.

It’s additionally clear that the sum of spot and “paper” BTC (highlighted in purple) dropped concurrently. The paper forex BTC right here refers to derivatives associated to cryptocurrencies, which don’t really require traders to personal the asset.

Due to this fact, contemplating that the overall change stock of cryptocurrencies has declined, it doesn’t seem that the lower in spot BTC is because of paper BTC changing it.

Usually talking, the change’s provide is taken into account a portion of the Bitcoin provide that may be “used” for buying and selling. Due to this fact, as a result of approach provide and demand dynamics work, a lower in obtainable provide could possibly be a constructive signal for cryptocurrencies.

As might be seen from the chart, the decline in change stock occurred throughout a interval of misery after cryptocurrency costs hit all-time highs (ATH). As Wu identified,

When everybody was terrified of Bitcoin Costs haven’t elevated over the previous two months, obtainable BTC is being quietly snapped up, and importantly there isn’t any paper BTC being printed to switch it.

Due to this fact, the truth that the obtainable provide has decreased throughout this era could possibly be a bullish signal for the coin. “It’s solely a matter of time earlier than Bitcoin breaks by all-time highs,” the analyst stated.

Associated Studying

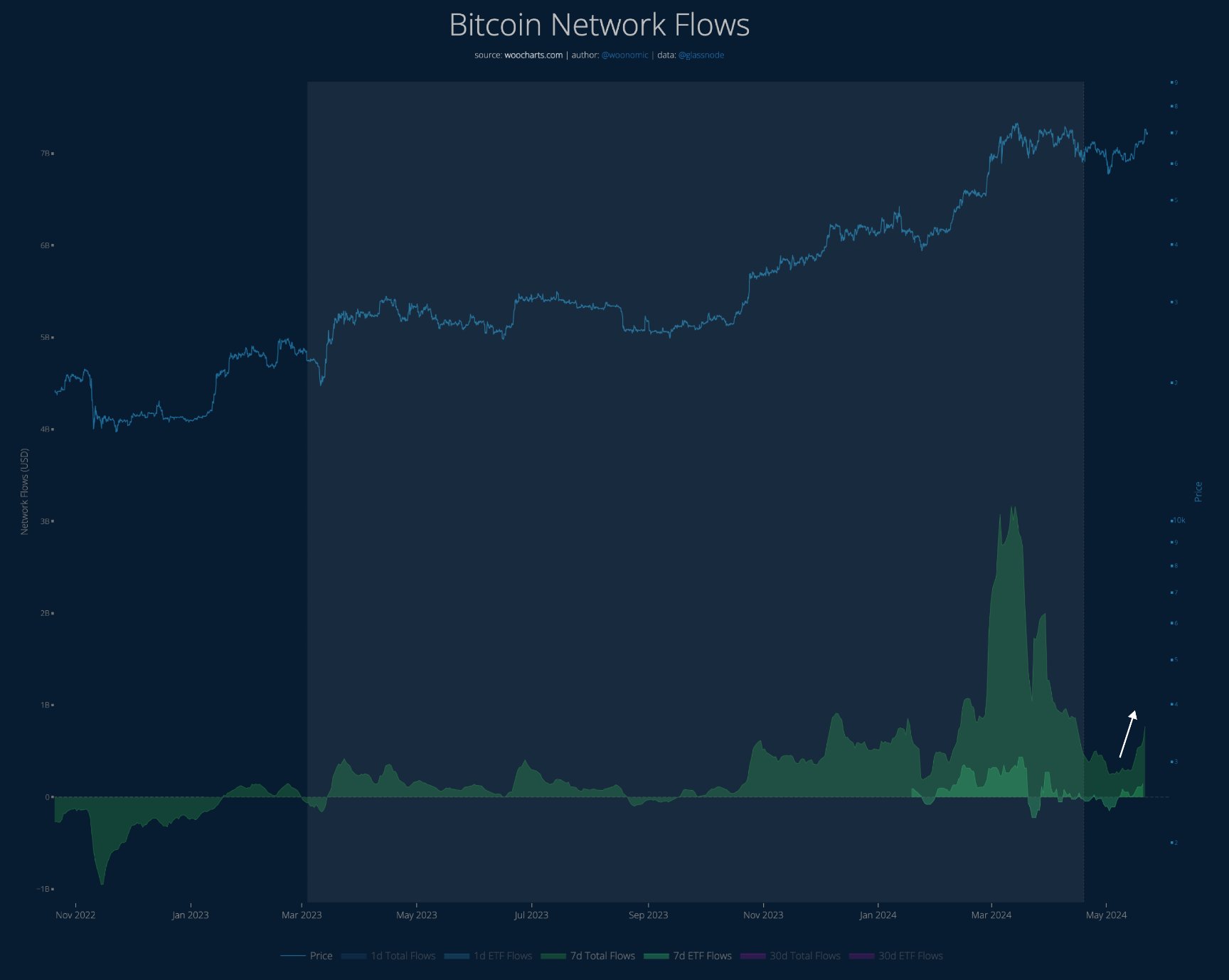

In one other X submit, Woo additionally mentioned how Bitcoin’s capital inflows are simply starting to recuperate after falling sharply earlier.

As proven within the chart, community inflows surged together with all-time highs, however they noticed a pointy slowdown in consolidation subsequently.

Spot exchange-traded fund (ETF) inflows (highlighted in mild inexperienced) additionally disappeared earlier however at the moment are again with a vengeance together with these new capital inflows.

bitcoin value

Bitcoin earlier rose to highs of $71,000 however seems to have declined over the previous few days and is now again beneath $68,000 ranges.

Featured pictures from Shutterstock.com, woocharts.com, charts from TradingView.com

1 Comment

Your article helped me a lot, is there any more related content? Thanks!