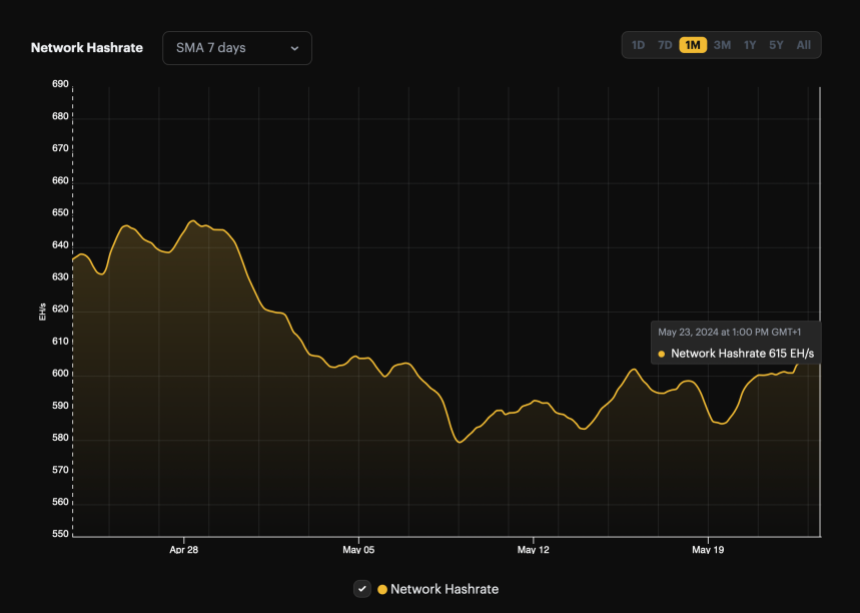

As the typical community computing energy soared to 600 EH/s, Bitcoin mining problem adjusted upward by almost 2%, reaching over 84.4 trillion.

The expansion comes in opposition to the backdrop of rising optimism within the cryptocurrency market, significantly as a result of hypothesis concerning the potential approval of a U.S. spot Ethereum ETF. It’s price noting that Bitcoin mining problem measures the problem of discovering a hash under a given goal.

The Bitcoin community has a worldwide block problem that’s adjusted each 2,016 blocks (roughly each two weeks) to make sure that the time between mined blocks stays round 10 minutes, regardless of the rising variety of miners and computing energy.

Associated Studying

This problem adjustment helps preserve the conventional block manufacturing time of the community and ensures stability and safety.

A serious shift in Bitcoin mining

The adjustment in BTC mining problem marked a significant shift earlier this month, with the metric falling by almost 6%, the most important drop because the December 2022 bear market.

The hash charge rebounded from the 580-590 EH/s vary to over 600 EH/s, in step with a broader crypto market rally pushed by expectations of regulatory developments in Ethereum merchandise.

The idea of mining problem is essential to understanding how Bitcoin self-regulates the manufacturing of recent blocks. As extra miners be part of the community, the problem will increase, making it tougher to mine new blocks.

Quite the opposite, if the variety of miners decreases, the problem will lower and mining will develop into simpler. This mechanism ensures that the entry of recent Bitcoins into the market stays steady and predictable, no matter fluctuations within the variety of miners.

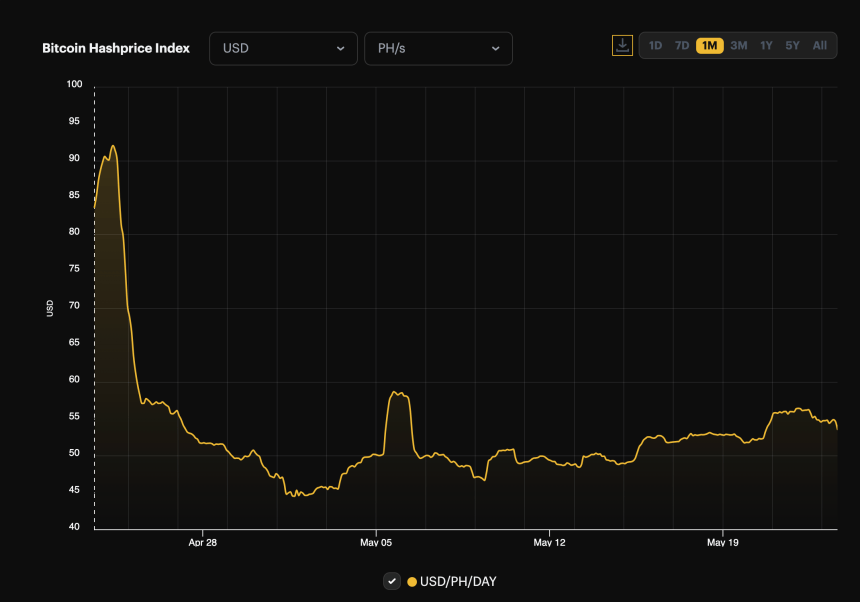

The latest improve in mining problem coincides with a slight restoration in Bitcoin hash worth, which hit an all-time low in late April.

Hash Worth is an indicator developed by Bitcoin mining service Luxor that measures anticipated day by day earnings per unit of hash charge. It has rebounded from lower than $50 per PH/s per day to round $54.6 per PH/s per day, bringing slight aid to miners after the latest market downturn.

Bitcoin Worth Development and Future Expectations

Though the worth of Bitcoin fell barely by 2% previously 24 hours, it nonetheless maintains a weekly upward development of three.9% and is buying and selling at $68,132.

The transfer is being intently watched as traders and merchants await the U.S. Securities and Change Fee’s resolution on the Ethereum ETF spot, which may have a big affect on the general cryptocurrency market.

In response to those developments, a outstanding analyst named BitQuant shared By way of the insights of social media platform X, Bitcoin is predicted to develop considerably. In accordance with BitQuant, Bitcoin is predicted to succeed in $95,000, with a pointy rise to $80,000 anticipated in Could.

Associated Studying

Nevertheless, BitQuant additionally predicts that the worth will fall considerably from the native peak in June, insisting that the general timeline for the height has not modified.

A few updates for these right here who’re constructing generational wealth however do not take part in day buying and selling:

1. Sure, #bitcoin It is going to be $95,000.

2. Sure, $95K will prolong into June, however the huge decline from this native high can even happen in June, so the general timeline for this native high shouldn’t be there but… pic.twitter.com/VFvMweBVbs— BitQuant (@BitQua) May 22, 2024

Featured picture created with DALL·E, chart from TradingView

2 Comments

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.