Bitcoin continues to dominate discussions, with its latest worth motion attracting explicit consideration. Because the asset struggles to regain March’s all-time highs above $73,000, the newest try peaked above $71,000 earlier this week, however the worth has fallen again to round $68,231 as of writing.

The retracement marks a 7.3% decline from the March peak and marks a unstable interval for the cryptocurrency, which is affected by a wide range of underlying market elements.

Associated Studying

Lengthy-term holders promote much less, what this implies for Bitcoin

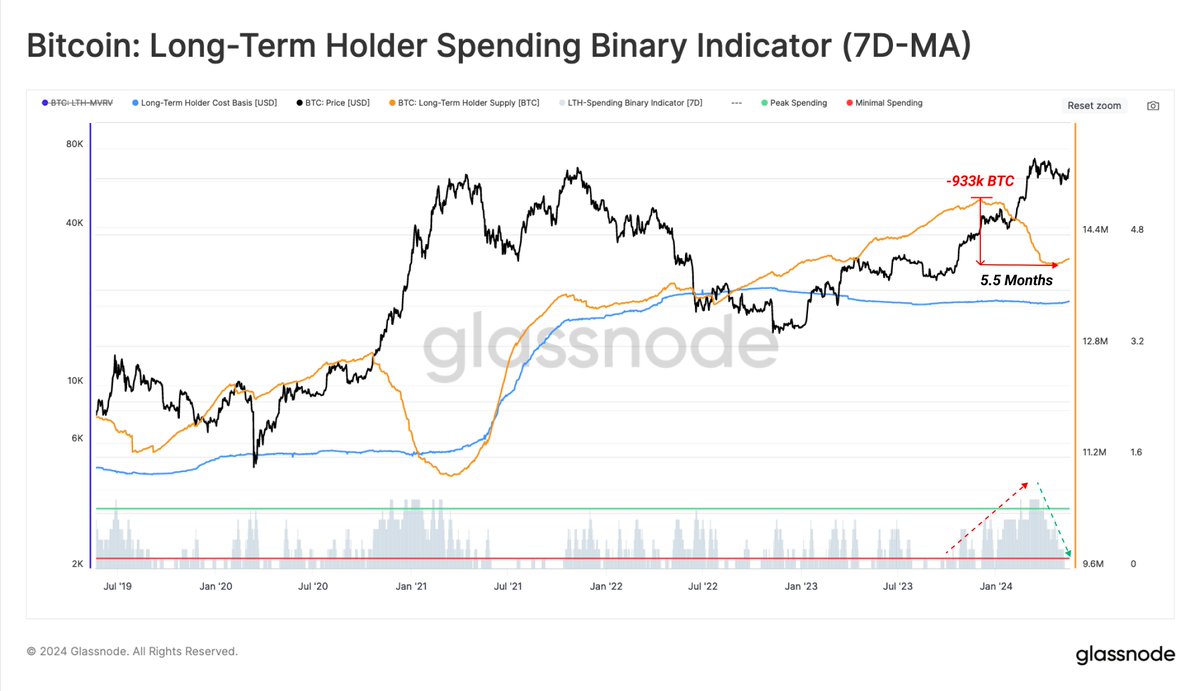

Glassnode is a widely known market intelligence platform that highlights main developments in Bitcoin market habits. Based on the platform’s latest evaluation, distribution stress on long-term Bitcoin holders (LTH) has dropped considerably.

Latest information from Glassnode’s Lengthy-Time period Holder Binary Spending Indicator, which tracks promoting exercise amongst long-term Bitcoin holders, means that promoting stress amongst this group has eased considerably.

Traditionally, when long-term holders cut back promoting, it reduces downward stress on costs, which may set off extra bullish market situations.

Additional insights into Bitcoin worth motion come from famend cryptocurrency analyst RektCapital, who famous On Social Media Platform

With the crypto asset buying and selling just below $69,000, RektCapital revealed that Bitcoin could solely escape of the present re-accumulation vary round 160 days after the halving, with a significant breakout not anticipated till September 2024 on the newest. This evaluation is essential as a result of it units the stage for traders who’re in search of indicators of Bitcoin’s subsequent massive transfer.

Traditionally, Bitcoin has all the time been rejected on its first makes an attempt to interrupt out from the vary highs after the halving.

Moreover, historical past suggests this re-accumulation ought to last more

Bitcoin tends to interrupt out of those re-accumulation ranges after 160 days… https://t.co/Jw7FcQui2Q pic.twitter.com/beLdOPqZOi

— Rekt Capital (@rektcapital) May 24, 2024

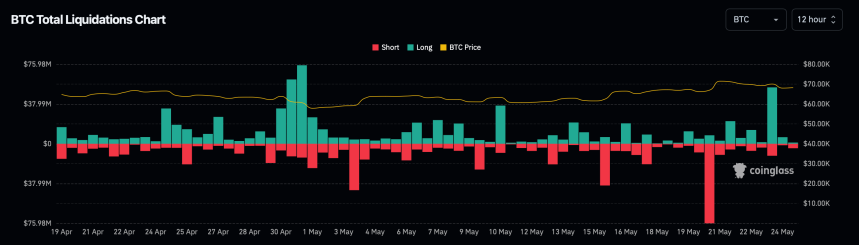

In the meantime, Bitcoin’s latest worth motion has led to some merchants struggling large losses. Coinglass information reveals that previously 24 hours, Bitcoin lengthy merchants have liquidated roughly $41.68 million, and quick merchants have liquidated roughly $14.34 million. .

Total, the cryptocurrency market noticed a complete of $292.07 million in liquidations throughout the identical interval, affecting 78,874 merchants.

Upcoming challenges for the Bitcoin market

in keeping with greek sceneA lot of Bitcoin and Ethereum choices are about to run out, including one other layer of complexity to the market’s close to future. 21,000 BTC choices are expiring quickly, with a put ratio of 0.88, a Maxpain level of $67,000, and a notional worth of $1.4 billion.

Likewise, 350,000 ETH choices are expiring quickly, and since they’ve a notional worth of $1.3 billion and a put ratio of 0.58, their dynamics may impression the broader market.

Rights information as of Could 24

21,000 BTC choices are expiring, with a put ratio of 0.88, a Maxpain level of $67,000, and a notional worth of $1.4 billion.

350,000 ETH choices are expiring quickly, with a put ratio of 0.58, a Maxpain level of $3,200, and a notional worth of $1.3… pic.twitter.com/rftA9kBm4q— Greeks.dwell (@GreeksLive) May 24, 2024

On this case, a put possibility offers the holder the best to promote an asset at a predetermined worth inside a selected time-frame, which is usually used as safety in opposition to a decline within the asset’s worth.

Associated Studying

In distinction, name choices present the best to purchase underneath comparable situations, usually in anticipation of a worth enhance. The put ratio is a instrument that helps gauge market sentiment, with the next ratio indicating a bearish outlook and a decrease ratio indicating a bullish state of affairs.

Featured picture created with DALL·E, chart from TradingView