Miscellaneous Images/iStock Editorial by way of Getty Photographs

Industrial Choose Sector (XLI) Falls for Second Straight Week -0.69% As of the week ending Could 24.

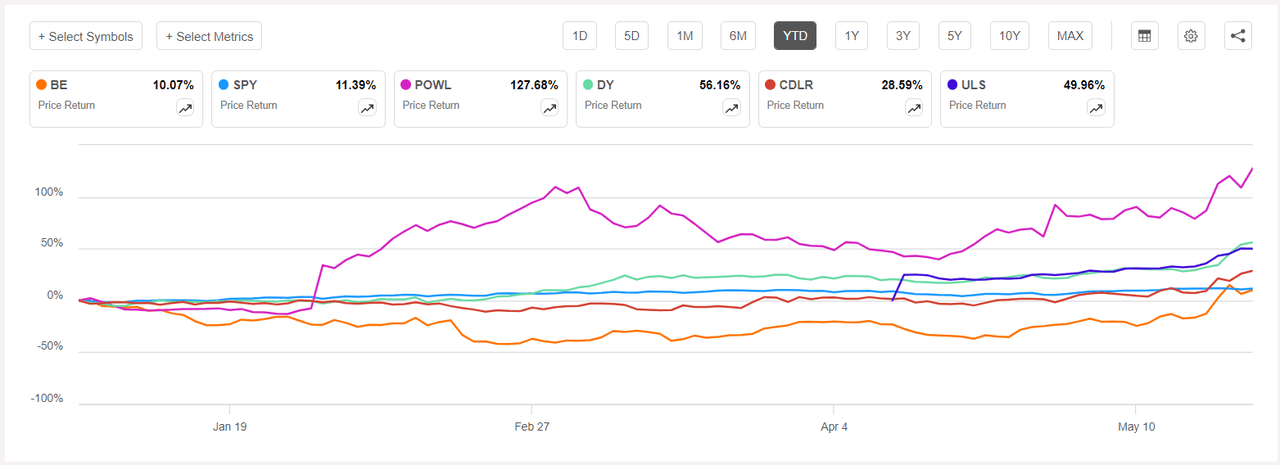

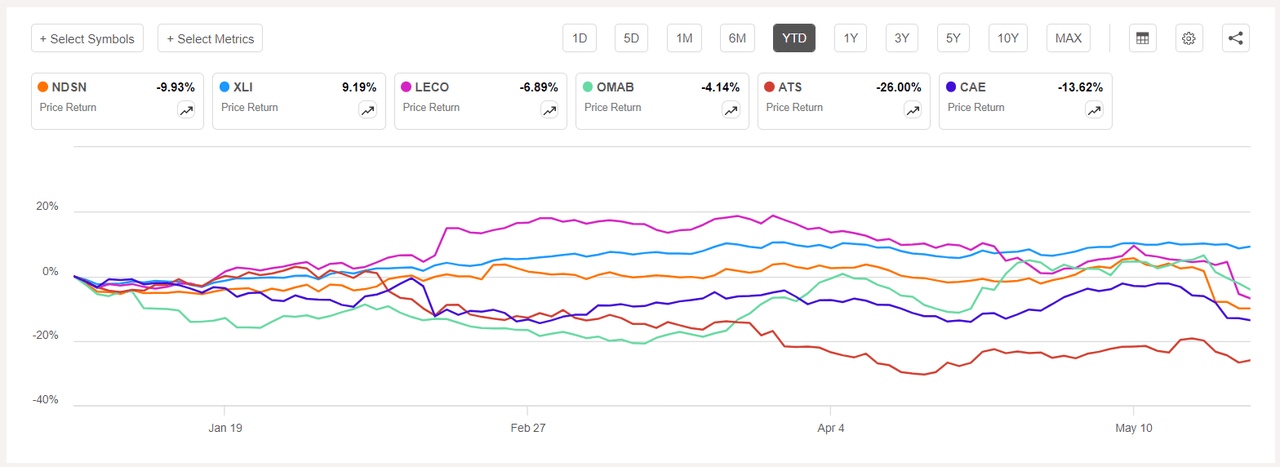

XLI ranks among the many 9 Eleven sectors within the S&P 500 ended the week decrease. Yr thus far (YTD), XLI has risen +9.19%whereas SPY has climbed +11.39%.

The highest 5 gainers within the industrial sector (shares with a market capitalization of greater than $2B) all rose by greater than +12% Every this week. Yr thus far, these 5 shares are all within the inexperienced.

Bloom Power (NYSE: BE) +32.12%. Bloom, which makes stable oxide gasoline cell techniques, ranked among the many high 5 gainers for the second week in a row. The inventory was the largest gainer on Tuesday (+17.11%), and different clear vitality/synthetic intelligence performs. Yr thus far, 10.07%.

Bloom’s SA Quantitative Ranking is Maintain, which takes under consideration elements resembling momentum, profitability and valuation. The inventory has a Revenue Issue Ranking of D- and a Progress Issue Ranking of A+. The common ranking amongst Wall Road analysts is “Purchase,” with 8 out of 25 analysts labeling the inventory a “Robust Purchase.”

Powell Industries (POWL) +27.29%. Shares of the Houston-based firm have been among the many greatest gainers on Tuesday (+13.81%). Yr-to-date, share value surges +127.68%. POWL has a SA Quantitative Ranking of Maintain, a Momentum Rating of A+, and a Valuation Rating of D-. The common ranking amongst Wall Road analysts (1 analysts in whole right here) agrees, and likewise provides it a Maintain ranking.

The chart beneath exhibits the highest 5 gainers and SPY’s year-to-date value return efficiency:

Dai Kang (UK) +20.80%. Shares of the Florida-based firm, which offers contracting providers to the telecommunications infrastructure and utilities industries, have risen this week, with the largest good points on Wednesday (+8.25%). YTD, +56.16%.

DY has a SA Quantitative Ranking of Purchase, a Progress Rating of B-, and a Momentum Rating of A+. The common Wall Road analyst ranking can be optimistic, with a “Robust Purchase” ranking, with all 8 analysts calling the inventory this manner.

CDLR +20.10%. The wind farm builder is among the many different/clear vitality firms whose shares rose on Tuesday (+11.10%). YTD, +28.59%. The common ranking from Wall Road analysts (2 right here) is Robust Purchase.

UL Options (ULS) +12.88%. Shares of the safety science providers supplier have been among the many greatest gainers on Tuesday (+5.39%). YTD, +20.18%. The common ranking from Wall Road analysts is Purchase.

The 5 greatest losers this week in industrial shares (market caps over $2B) all fell by greater than -8% Every. Yr thus far, these 5 shares have all posted losses.

Nordson (NASDAQ: NDSN) inventory value plummeted -9.41% On Tuesday, the corporate, which makes merchandise to regulate adhesives and different fluids, offered lower-than-expected fiscal 2024 steering in addition to second-quarter outcomes after the bell on Monday. YTD, -9.93%.

NDSN has a SA Quantitative Ranking of Maintain, a Profitability Issue Grade of A-, and a Momentum Issue Grade of C-. The common ranking from Wall Road analysts varies, with a Purchase ranking, with 2 in 10 contemplating the inventory a Robust Purchase.

Lincoln Electrical (LECO) -10.79%. Shares of the Cleveland-based firm have been among the many greatest decliners on Thursday (-9.49%). YTD, -6.89%. LECO has a SA Quantitative Ranking of Maintain, a Progress Rating of B-, and a Valuation Rating of D+. The common ranking from Wall Road analysts is extra optimistic, with a Purchase ranking, with 5 out of 11 labeling the inventory a Robust Purchase.

The chart beneath exhibits the year-to-date value return efficiency of the 5 worst losers and XLI:

North Central Airport Group (OMAB) -8.76%. The Mexican airport operator’s inventory went ex-dividend on Tuesday. YTD, -4.14%.

OMAB has a SA Quantitative Ranking of Maintain, a Profitability Issue Grade of A, and a Progress Issue Grade of D. The ranking contrasts with the typical Purchase ranking from Wall Road analysts, with 4 out of eight analysts calling the inventory a Robust Purchase.

Amphetamine-type stimulants (ATS) -8.34%. Shares of the Canadian automation options supplier have been among the many greatest decliners on Tuesday (-4.29%). Yr thus far, -26%. SA has a promote quantitative ranking on ATS, which differs from the typical purchase ranking from Wall Road analysts.

laptop aided engineering -8.17%. Shares of the Canadian aerospace protection firm fell all week, with Wednesday’s greatest decline (-5.19%). The corporate introduced on Tuesday (after itemizing) that it was rebasing its protection enterprise. -13.62%. SA Quant has a “maintain” ranking on CAE, whereas Wall Road analysts’ common ranking is a “purchase.”