The cryptocurrency market continues to navigate a sea of uncertainty, and Avalanche (AVAX) isn’t any exception. Whereas AVAX has proven some resilience in comparison with different altcoin friends, a more in-depth look reveals that the market is dealing with conflicting indicators – a mixture of cautious optimism and underlying unease.

Associated Studying

Bullish whispers or mirage?

AVAX’s future stays shrouded in uncertainty. Whereas there are some optimistic indicators, akin to relative outperformance and a few bullish sentiment, these are offset by worrying indicators of weakening market management and a pointy drop in buying and selling exercise.

Avalanche: Resistance stage looms

Check out the 6-month chart of AVAX and you may see a curler coaster trip, characterised by sharp peaks and troughs. This volatility highlights AVAX’s sensitivity to broader market developments and its reliance on particular developments inside its ecosystem.

Over the previous few months, AVAX has proven the identical sample of sharp corrections following worth spikes. At the moment, the altcoin seems to be consolidating close to the $38 mark after the latest decline from the April highs.

If AVAX can maintain help close to the important thing $35 stage, a northward trajectory is feasible, particularly if a broader bull run emerges within the cryptocurrency market.

Nevertheless, vital resistance ranges lie at $48 and $53 – worth factors that AVAX has examined however failed to interrupt a number of instances in latest months. A sustained break above these ranges would mark a serious shift in momentum, probably pushing AVAX in direction of the $80 and even $100 mark in Q3.

A story of two markets: The place do merchants stand?

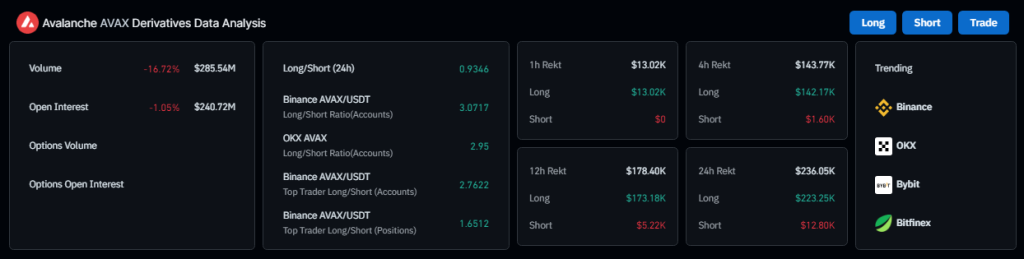

The buying and selling scene surrounding AVAX presents a wierd dichotomy. Coinglass information reveals a staggering 60% drop in buying and selling quantity, implying a big drop in market exercise. That is additional supported by the comparatively balanced lengthy/quick ratios throughout platforms, indicating that merchants are usually hesitant about AVAX’s future.

Nevertheless, there’s a trace of bullish sentiment on distinguished cryptocurrency alternate Binance. Right here, the lengthy/quick ratio skews fairly excessive, suggesting that the outlook for particular person merchants on this explicit platform could also be extra optimistic.

On the similar time, the concern and greed index is 40%, and the present sentiment of the AVAX market is impartial, displaying that buyers’ opinions are balanced.

Associated Studying

Dropping dominance, waning curiosity?

AVAX’s woes lengthen past buying and selling. The altcoin seems to be loosening its grip on market share, with search curiosity additionally declining. This implies a scarcity of market management and probably waning common curiosity — not a recipe for achievement for a token aiming to make enormous beneficial properties.

Featured picture from Summitpost, chart from TradingView