Rising automobile insurance coverage premiums have been a major driver of inflation over the previous few months. Financial institution of America Securities economist Stephen Juneau identified in a current report that motorized vehicle insurance coverage elevated by 22.6% yearly in April, the biggest improve since 1979.

“This has been a rising driver of inflationary stickiness in core CPI, which remained excessive at 3.6% year-on-year in April,” he wrote. Whereas rising motorized vehicle insurance coverage prices are usually not a current pattern, they’re Performed a bigger position in driving up the Shopper Worth Index (CPI) for core companies, which exclude rents and landlord equal rents (often known as tremendous core companies).

Tremendous core companies CPI elevated by 4.9% year-on-year, with motor insurance coverage contributing 2.3 share factors and all different parts contributing 2.6 share factors.

“Important will increase in motorized vehicle insurance coverage premiums are a response to the business’s underwriting losses,” Junod stated. Elements contributing to those losses embody rising car costs (new and used), elevated know-how and labor restore prices, and modifications in driving patterns The return to regular has resulted in a rise within the variety of accidents.

Recall that at the same time as Individuals drove much less as they labored remotely and halted most leisure journey throughout the worst of the pandemic, provide chain disruptions attributable to COVID-19 triggered automobile costs to soar.

The excellent news is that motorized vehicle insurance coverage price development seems to be slowing. “There are indicators that many insurance coverage firms are returning to profitability,” Junod stated. “Moreover, automobile costs have given again a few of their earlier beneficial properties and business wage development has cooled. That does not imply your premiums will go down, however we predict development ought to sluggish.”

The Fed’s subsequent main measure of inflation is private consumption expenditures in Friday’s private revenue and spending report. Inside this indicator, motorized vehicle insurance coverage grew modestly, partly explaining the hole between CPI and the tremendous core companies inflation information in PCE inflation – CPI was +4.8% in March in comparison with +3.5% for PCE. Nevertheless, each are considerably increased than the pre-pandemic price of two.0%.

“We imagine additional enchancment on this combination is likely one of the keys for the Fed to develop into extra assured within the deflationary course of and start a price chopping cycle. Till then, we count on the Fed to maintain charges on maintain,” Financial institution of America’s Juno wrote.

Excluding the extra unstable meals and vitality classes, core PCE is anticipated to rise 2.8% yearly in April, the identical price as March, in accordance with TD Economics.

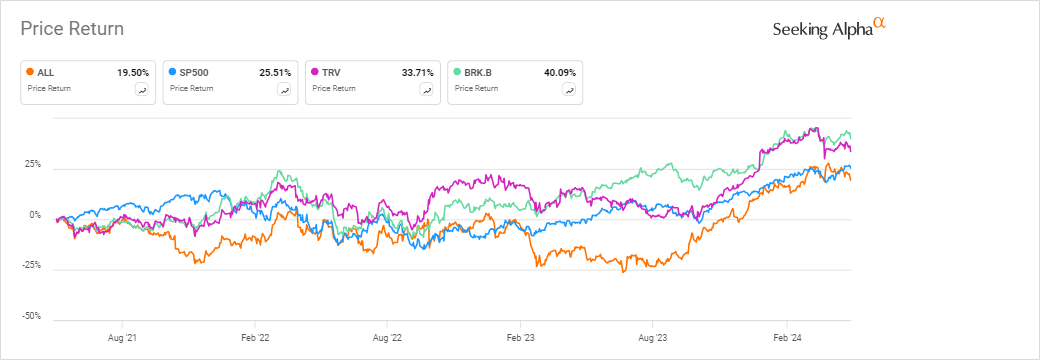

As premiums rise, so do the shares of property and casualty insurance coverage firms. Over the previous 12 months, Allstate (NYSE: All) shares rose 41%, Geico mother or father firm Berkshire Hathaway (NYSE:BRK.B) (NYSE:BRK.A) rose 25%, each exceeding the S&P 500’s 27% achieve throughout the identical interval. Traveler (NYSE:TRV), on the similar time, rose 18%.

Within the property and casualty insurance coverage area, SA Inventory Screener charges 7 shares as Robust Buys, with Allstate (ALL) on the prime of the record.