On-chain information exhibits that historical Bitcoin buyers are waking up sooner than ever to this point within the present cycle.

Bitcoin’s 10-plus-year-old coin has seen important volatility just lately

As Julio Moreno, head of analysis at CryptoQuant, defined in an article on X, the present Bitcoin cycle has made the asset’s OG buyers extra woke up than ever.

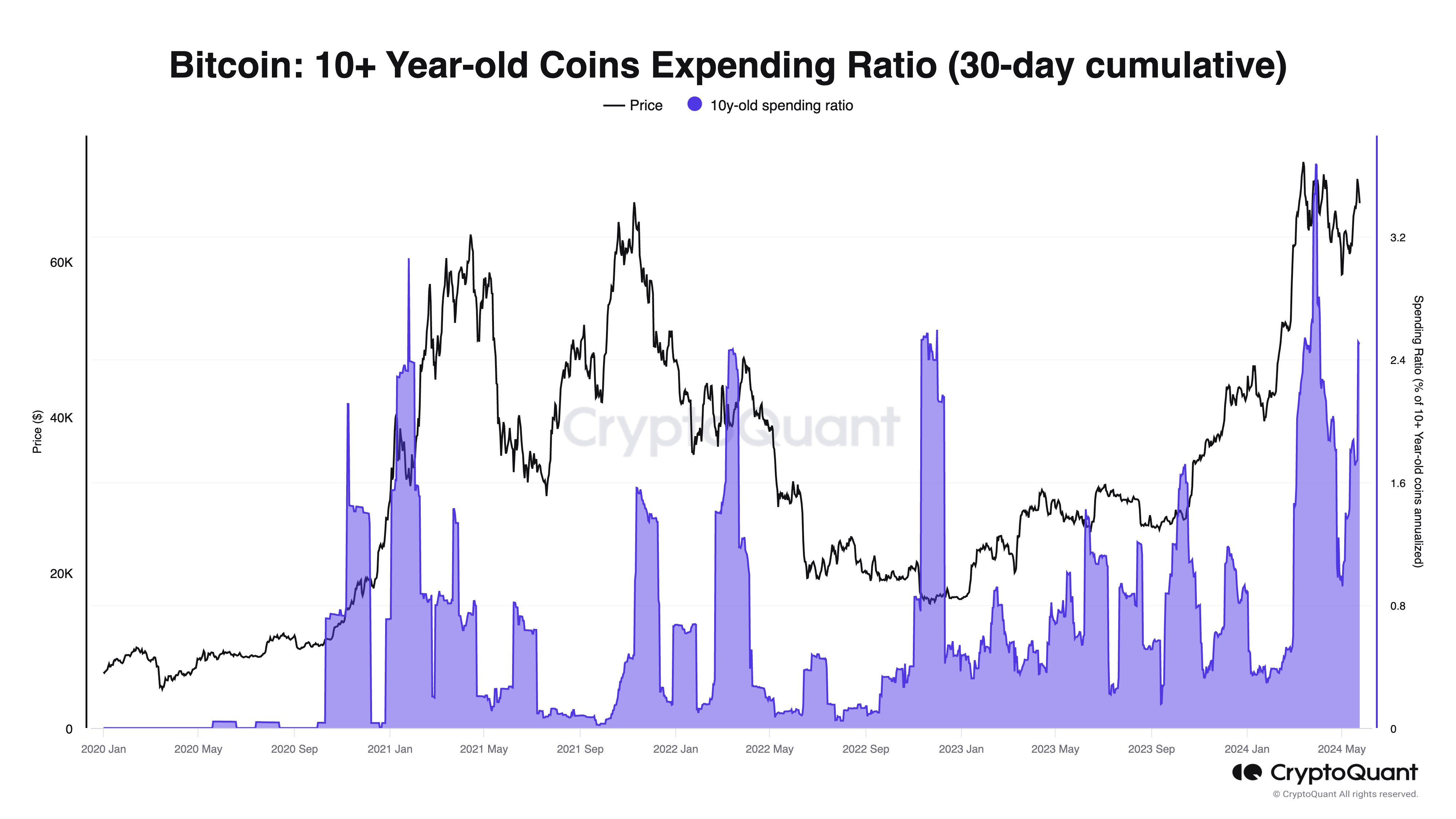

The on-chain metric of curiosity right here is the “10+ Yr Token Spending Ratio,” which principally tells us what share of cash which have been dormant for 10 years or extra have modified over the previous 30 days.

When the worth of this indicator is excessive, it signifies that some outdated buyers on the Web have lastly damaged their silence prior to now month. Motion of cash this outdated is mostly unusual, so this development is value keeping track of because it develops.

Now, right here’s a chart displaying the development in Bitcoin’s 10+ 12 months coin payout ratio over the previous few years:

The worth of the metric seems to have been excessive just lately | Supply: CryptoQuant

As you’ll be able to see from the chart above, this indicator noticed an enormous spike again in March. On the peak of this spike, the metric’s worth reached 3.7%, the very best worth so far within the asset’s historical past.

The huge swings in dormant cash come because the cryptocurrency’s worth hits new all-time highs (ATH). Usually, when these outdated cash are moved, it’s on the market. Particularly with this surge, profit-taking appears to be a probable motive given the ATH breakout.

After this peak, the ratio dropped considerably in worth because the Bitcoin worth itself struggled. Nevertheless, the indicator has additionally rebounded amid the cryptocurrency’s latest restoration.

Presently, the indicator worth is 2.5%, which is decrease than earlier data however nonetheless at a excessive stage in comparison with the previous. So it appears that evidently historical whales have continued to awaken at a outstanding fee over the previous few months.

Who will these buyers be transferring these outdated cash? Typically talking, actions in dormant tokens are associated to holders available in the market. Nevertheless, when the age of a coin reaches greater than 10 years, it turns into extra prone to maintain Bitcoin, which isn’t why they continue to be dormant.

As an alternative, cash of this sort have most probably been “misplaced” as a result of their pockets keys have been misplaced, or their existence was merely forgotten.

It’s certainly attainable that among the holders who offered just lately have been OGs who had been sitting on their fingers all alongside, however it’s possible that many of those buyers have been really individuals who had just lately acquired wallets containing these dormant tokens.

bitcoin worth

As of this writing, Bitcoin is buying and selling round $68,500, up greater than 2% prior to now seven days.

Appears like the value of the asset has been climbing up during the last couple of weeks | Supply: BTCUSD on TradingView

Featured photos from Dall-E, CryptoQuant.com, charts from TradingView.com