Accredited by the U.S. Securities and Change Fee (SEC) Regardless of elevated regulatory uncertainty surrounding cryptocurrencies, traders have develop into extra optimistic in regards to the potential for ETH costs to achieve new highs.

Ethereum ETF approval sparks bullish sentiment

Arthur Cheong, Founder and CIO of DeFiance Capital predict Earlier than the newly accredited index fund begins buying and selling, ETH may attain a yearly excessive of $4,500, eclipsing its mid-March excessive of $4,096. This prediction is simply shy of ETH’s all-time excessive of $4,878 throughout the 2021 bull run.

As well as, there’s a ballot A survey performed by WuBlockchain within the Chinese language group confirmed that 58% of respondents believed that ETH has the potential to rise to $10,000 and even larger on this market cycle.

Associated Studying

The U.S. Securities and Change Fee’s latest regulatory shift towards approving an Ethereum ETF has elevated bets on additional worth positive factors. Seven days after the information was introduced, ETH surged 26%, the most important weekly enhance since 2021 Crypto Bull Market.

The event offers speculators hope given the success of U.S. spot Bitcoin ETFs, which have amassed $59 billion in property since their record-breaking debut in January.

Nonetheless, the spot Ethereum ETF is not going to take part pledge, earn rewards by staking tokens to keep up the Ethereum blockchain. This omission could scale back curiosity in these funds in comparison with holding the tokens straight.

The launch timeline for these merchandise stays unsure, though issuers akin to BlackRock and Constancy Investments will want extra SEC approval earlier than launching their merchandise. As of now, ETH is buying and selling at round $3,900, with additional upside potential anticipated.

Possibility betting alerts may climb to $5,000

Based on Bloomberg ReportAnalysts akin to Chris Weston, head of analysis at Pepperstone Group, see ETH’s retracement as a shopping for alternative as dangers stay tilted to the upside.

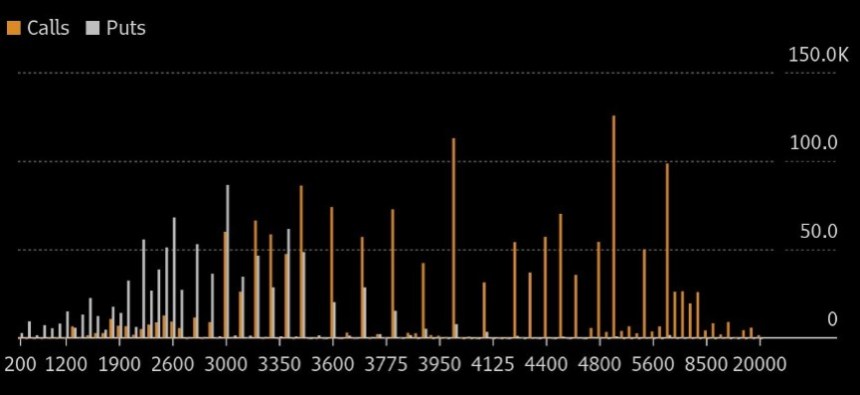

Curiously, as proven within the chart under, some merchants are betting on name choices, with focus suggesting costs may climb to $5,000 or larger.

Moreover, ETH is predicted to be extra unstable than Bitcoin, as proven by the T3 Ethereum Volatility Index, highlighting the potential for better worth volatility for the second-largest digital asset.

Associated Studying

Insights from the futures market, particularly the open curiosity ranges of Chicago Mercantile Change (CME) Ethereum futures, present the next proof: institutional wants For regulated cryptocurrency publicity.

Though open curiosity in CME Ethereum futures is rising, it’s nonetheless considerably decrease than CME Bitcoin futures. This means comparatively little institutional publicity to Ethereum and will impression preliminary inflows into Ethereum ETFs.

Nonetheless, the market is holding a detailed eye on ETH’s actions because the approval of an Ethereum ETF opens up new avenues for funding and hypothesis. Price-effectivenessThere’s typically bullish sentiment and optimistic forecasts amongst traders.

Featured picture from Shutterstock, chart from TradingView.com