Bitcoin (BTC), the world’s largest cryptocurrency, has been consolidating over the previous week, buying and selling between $67,000 and $70,000, after experiencing a short 20% worth correction and falling to $56,400 in early Might.

this Consolidation interval In the meantime, inflows into the U.S. spot Bitcoin ETF market have reignited, and promoting stress within the ETF market and broader Bitcoin buyers seems to have cooled.

Bitcoin promoting stress subsides

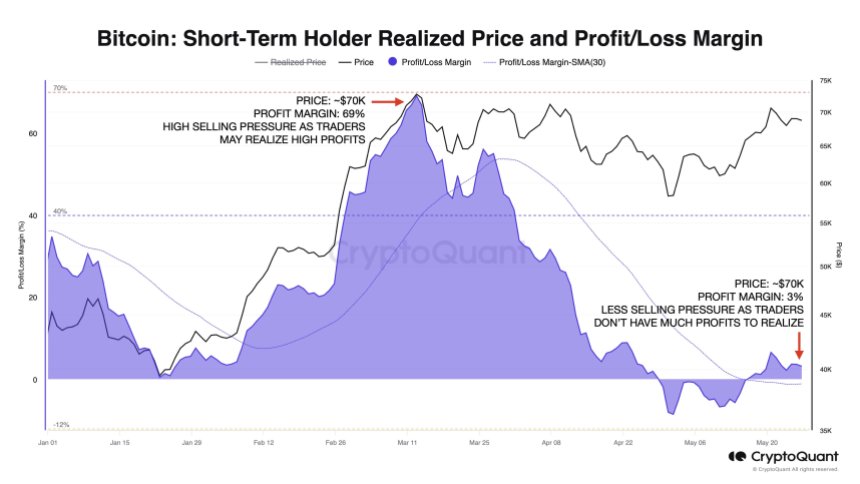

in accordance with Julio Moreno, director of analysis at on-chain market evaluation firm CryptoQuant, stated that the present Bitcoin worth degree is $70,000, which is totally different from the final time it reached this degree in March.

Moreno famous that merchants at the moment are exerting a lot decrease promoting stress, with unrealized income solely round 3%, in contrast with 69% in early March. This means that many of the “heavy promoting” has been exhausted, as proven within the chart beneath.

Associated Studying

saint knowledge It additionally exhibits that regardless of the U.S. inventory market being closed for the Memorial Day vacation, the market worth of Bitcoin as soon as once more exceeded $70,000.

Market intelligence platform Santiment sees this as an encouraging signal because it exhibits BTC’s capacity to carry out positively on days when it isn’t strongly correlated with main currencies. inventory marketThis would be the case for many of 2022.

The ultimate consolidation stage earlier than the breakthrough

Regardless of this constructive momentum, cryptocurrency analyst Rekt Capital believes well-known Bitcoin’s newest weekly candle closed beneath range-high resistance in its ongoing “reaccumulation” section, which ranges round $60,000 to $70,000.

This might result in additional consolidation inside the vary among the many main cryptocurrencies, according to Rekt Capital’s view paper The present bull market cycle nonetheless has two phases: the re-accumulation section after the halving and the “parabolic rebound section.”

Traditionally, Bitcoin has tended to consolidate close to all-time highs earlier than coming into its most illustrative bull cycles. The analyst stated that Bitcoin has certainly been consolidating at these highs for fairly a while, particularly by the requirements of earlier cycles.

Whereas there’s nonetheless room for additional sideways buying and selling at these elevated worth ranges, the rest of this section is slowly ticking away. This leads us to consider that the long-awaited After halving The rebound, coupled with a revival in investor sentiment, is anticipated to push the market’s largest cryptocurrency larger than the $73,700 it reached in mid-March.

Associated Studying

Subsequently, Bitcoin seems to be coming into a important second within the present bull cycle. Combine and reaccumulate If historic patterns maintain true, the development that has dominated the market in current months may quickly give option to the subsequent parabolic rise.

As of now, BTC is up 2% up to now 24 hours and is up 10% up to now month alone. Bitcoin is at present buying and selling at $70,200.

Featured picture from Shutterstock, chart from TradingView.com