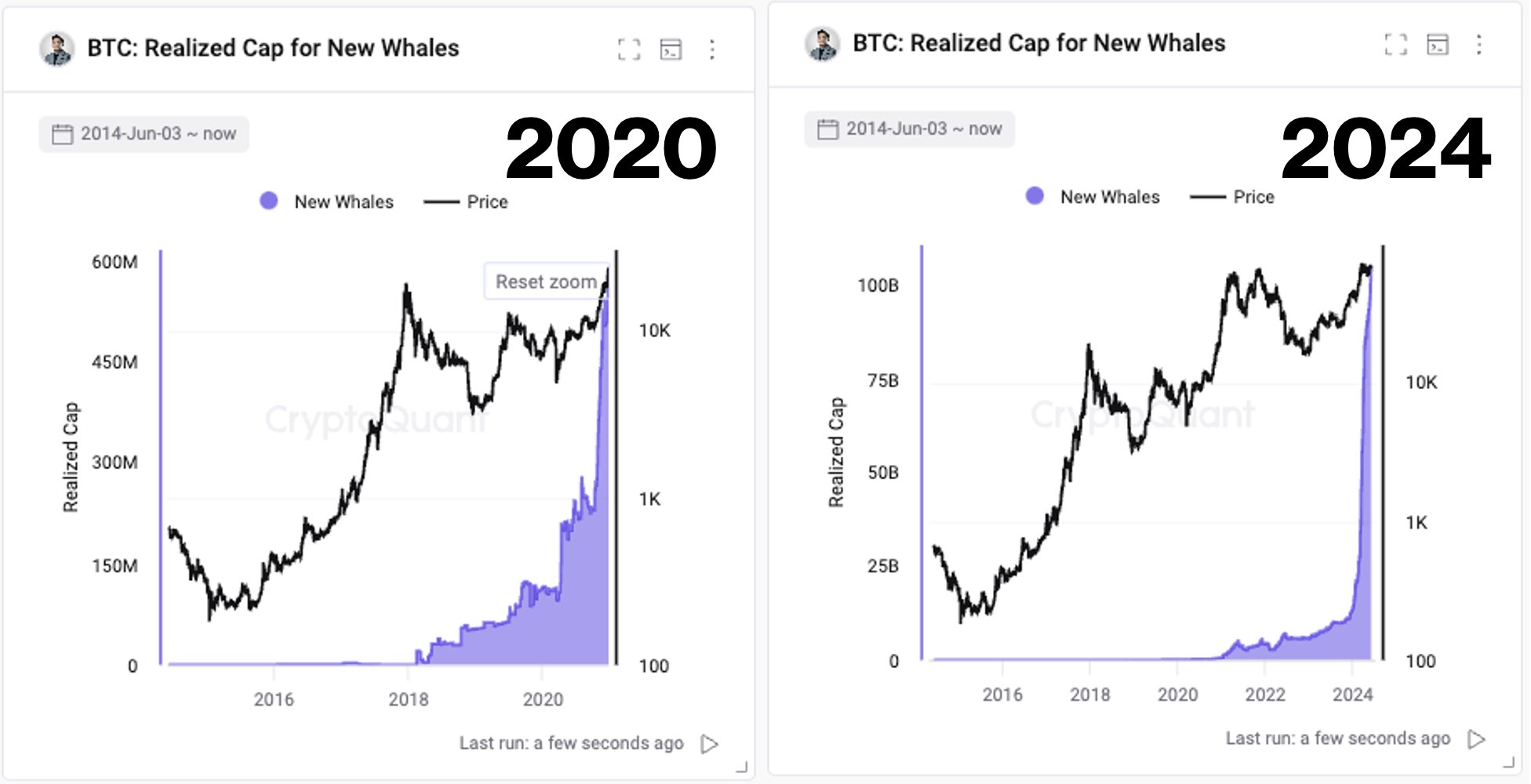

CryptoQuant CEO Ki Younger-Ju famous right this moment that Bitcoin’s present state bears vital similarities to market habits in mid-2020, a interval characterised by stagnant costs however brisk on-chain exercise. Younger-Ju’s insights are illustrated by way of two key charts and shared by way of a put up on

The primary chart represents knowledge by way of 2020 and reveals the value of Bitcoin in addition to the Realized Cap of New Whales – a metric that tracks the full worth of the final transfer in newly acquired Bitcoin by massive traders. It is a totally different type of market cap, assessed by the value at which every UTXO final modified palms relatively than the present market worth. This metric displays the precise realized worth of all tokens within the community, not their present market worth.

Associated Studying

This worth skilled a pointy rise across the center of 2020, which coincided with Bitcoin worth falling into boredom because it has in latest months, buying and selling across the $10,000 mark. Younger-Ju mentioned this era was characterised by excessive ranges of on-chain exercise, which later evaluation revealed concerned over-the-counter (OTC) transactions between institutional gamers.

Within the second chart, extending into 2024, an analogous sample emerges, with much more pronounced cap progress from new whales, despite the fact that Bitcoin’s worth has proven nearly 100 days of sideways motion. The chart reveals that about $1 billion is being poured into new whale wallets day-after-day, a time period that typically refers to addresses holding massive quantities of Bitcoin and is often related to institutional traders or well-capitalized particular person traders.

What this implies for Bitcoin worth

Ki Younger-Ju elaborated on these observations: “The temper in Bitcoin is identical because it was in mid-2020. At the moment, BTC was hovering round $10,000 for six months, with excessive on-chain exercise and later disclosures within the type of over-the-counter transactions. . Now, regardless of much less worth volatility, on-chain exercise stays excessive, with $1 billion being added to new whale wallets day-after-day, presumably in escrow.

Associated Studying

He additional cited a tweet from September 2020, confirming his evaluation, noting that “the variety of BTC transferred has reached a brand new yearly excessive, and these TXs don’t come from exchanges. The proportion of fund flows on every change has hit a brand new low through the 12 months. One thing occurred Occurred. In all probability OTC.

This comparability, together with the continued excessive degree of realized caps for brand spanking new whales, suggests that enormous traders are in an accumulation part, paying homage to the exercise noticed in mid-2020. This sort of transfer is usually not seen on conventional cryptocurrency exchanges and signifies sturdy institutional curiosity, which is usually a harbinger of main market strikes. Following Younger-Ju’s tweet, Bitcoin costs elevated by 480% from September 2020 to November 2021.

Whether or not an analogous transfer is brewing in Bitcoin costs stays to be seen, however the continued progress in Bitcoin holdings by new whales, coupled with sustained worth ranges, suggests strain could also be constructing beneath the floor of an apparently calm market. As has been noticed prior to now, as soon as accrued Bitcoin begins to impression the broader market by way of elevated liquidity or renewed buying and selling curiosity, this example can result in vital worth swings.

At press time, BTC was buying and selling at $68,271.

Featured picture created with DALL·E, chart from TradingView.com