Nicely-known commodities dealer Peter Brandt predicts that the value of Bitcoin towards gold could surge by 230% in 12-18 months.

Earlier article: Predictions from legendary dealer Peter Brandt #bitcoin Costs rose 230% relative to gold.

Are you prepared? 🚀 pic.twitter.com/F50fgvm6N1

— Bitcoin Journal (@BitcoinMagazine) May 31, 2024

Brandt, who has over 50 years of buying and selling expertise, appropriately predicted Bitcoin’s parabolic bull run in 2017.

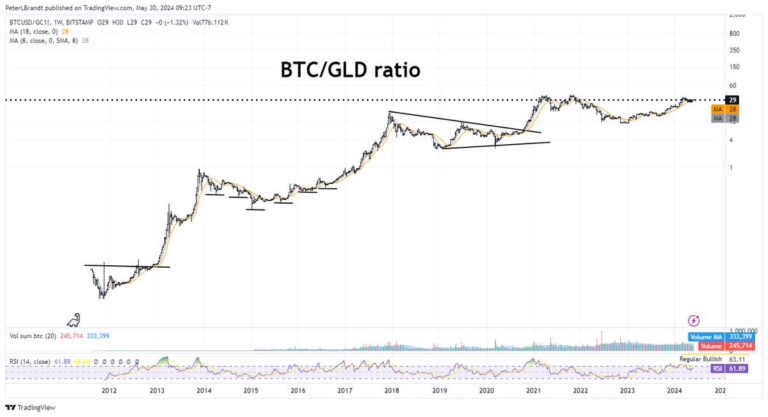

The veteran dealer tweeted: “Bitcoin $BTC has been rising relative to gold since its inception. This chart exhibits the # ounces $GC_F required to buy 1 BTC. The ratio ought to It would final one other 12 to 18 months after which rise to 100 oz GC to purchase BTC.

Peter Brandt on X

At the moment, the BTC/GLD ratio is round 29, which suggests it could take 29 ounces of gold price $68,000 to buy 1 Bitcoin. However Brandt expects this ratio to triple to 100 ounces after Bitcoin’s subsequent consolidation part is over.

At at this time’s gold costs, 100 ounces of Bitcoin are price over $234,000, equal to a worth improve of 230%.

Brandt has lengthy favored Bitcoin over gold. Since its inception in 2009, Bitcoin has far outperformed conventional safe-haven belongings, gaining greater than 375,000% relative to gold throughout that interval.

The dealer believes that regardless of the huge relative positive aspects Bitcoin has seen, there may be nonetheless loads of room to rise relative to gold. The BTC/GLD ratio chart exhibits Bitcoin’s long-term uptrend relative to gold, with room to rise.

Brandt expects Bitcoin to proceed to considerably outperform gold within the coming years. With the approval and profitable launch of the U.S. Bitcoin Spot ETF earlier this yr, its repute as a digital retailer of worth continues to develop amongst establishments.