Investor confidence within the cryptocurrency market appears to be on the rise currently, and Bitcoin is the principle beneficiary of this optimistic pattern. So, regardless of Bitcoin’s considerably dismal worth motion, massive buyers proceed to build up Bitcoin.

The worth of the key cryptocurrency is more likely to finish Might under the psychological $70,000 mark, regardless of touching that stage a number of occasions within the final two weeks of the month. The newest on-chain information reveals that confidence in Bitcoin continues to develop.

Is BTC prepared for a worth enhance?

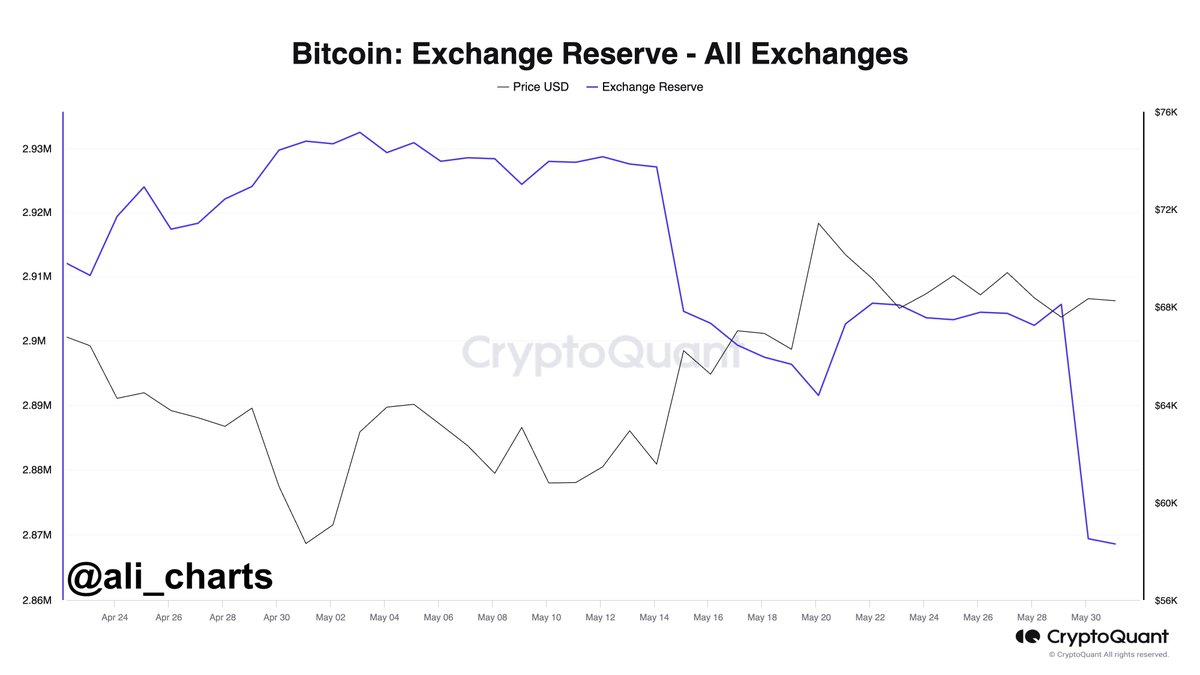

Ali Martinez, a well known cryptocurrency analyst, posted on the X platform that a considerable amount of Bitcoin has flowed out of centralized exchanges. This on-chain statement is predicated on the CryptoQuant trade reserves indicator, which tracks the quantity of a selected cryptocurrency in all centralized trade wallets.

Associated Studying

A rise within the worth of this indicator reveals that buyers are depositing extra crypto belongings (on this case, Bitcoin) to centralized exchanges than are withdrawing them. On the similar time, when the worth of this indicator decreases, it signifies that extra cash are leaving the trade than coming into it.

In line with Martinez’s put up, greater than 37,000 BTC (value roughly $2.53 billion) has been transferred out of cryptocurrency exchanges prior to now three days. The huge outflow indicators a change in Bitcoin investor sentiment and long-term holding methods.

Whereas it’s troublesome to inform the precise causes behind the large outflows from exchanges, the movement of funds throughout buying and selling platforms reveals rising investor confidence. This implies that many buyers could also be persuaded by Bitcoin’s future prospects to decide on to retailer their belongings in self-custodial wallets for the long run.

What’s extra, a downward spiral in Bitcoin provide from centralized exchanges may set off a bullish rally within the worth of main cryptocurrencies. A continued decline in Bitcoin balances on exchanges may result in a provide squeeze.

For context, a provide crunch refers to a scenario or interval wherein the availability of a selected asset falls under demand, inflicting the asset’s worth to surge.

Bitcoin Value at a Look

As of this writing, Bitcoin is buying and selling at round $67,489, down 1.5% prior to now 24 hours. The previous day’s lackluster efficiency highlights the key cryptocurrency’s struggles over the previous week. In line with information from CoinGecko, BTC costs have fallen by practically 2% prior to now seven days.

Associated Studying

Featured picture from iStock, chart from TradingView