Throughout this bull cycle, the cryptocurrency market has been breaking Bitcoin’s high and having fun with bullish momentum. Nonetheless, traders are hoping for a seismic explosion to push the altcoin to new highs.

Associated Studying

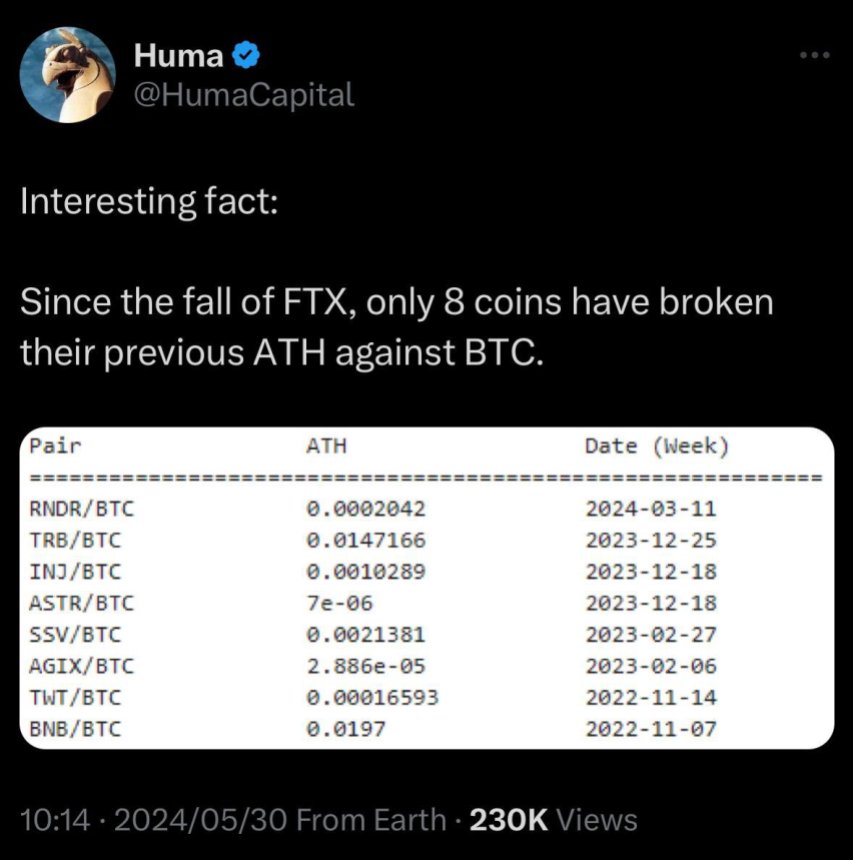

Because the crypto business awaits, on-line reviews point out that solely eight altcoins have hit all-time highs (ATH) in opposition to Bitcoin since FTX fell. A cryptocurrency analyst shared his ideas on the matter.

Altcoins underperform Bitcoin this cycle

On Friday, cryptocurrency analyst Miles Deutscher shared an fascinating reality in regards to the cryptocurrency market. Since November 2022, solely 8 altcoins have surpassed the earlier ATH relative to the flagship cryptocurrency.

To attain this feat, tokens embrace Render (RNDR), Tellor (TRB), Injective (INJ), Astar (ASTR), SSV Community (SSV), SingularityNET (AGIX), True Pockets Token (TWT), and Binance Coin ( BNB)).

Notably, RNDR was the most recent to attain this on March 11, and the checklist solely included altcoins launched earlier than the FTX crash.

Deutscher defined that though he was initially shocked, the information made sense to him and highlighted some key factors based mostly on the singularity of this run.

First, analysts imagine asset choice dynamics have modified in comparison with earlier cycles. Traders are “punished” for overinvesting in sure industries equivalent to L2 and gaming, however are “rewarded” for taking part in different industries equivalent to Memecoins and synthetic intelligence.

In distinction, through the earlier cycle, “you might mainly guess on something and beat BTC.” The analyst mentioned that regardless of retail liquidity injections, the market will possible proceed to expertise outperformance in particular sectors.

He additionally defined that “cryptocurrency is an consideration economic system” and cash will move the place the eye is. Due to this fact, even a mission with one of the best expertise can’t be realized with out an thrilling cause to purchase it.

Deutscher’s second takeaway highlights the market’s present ATH dilution. As he factors out, there are millions of new merchandise being launched day-after-day, and “billions of low-volume/high-FDV VC cash are being launched.” These launches look like outpacing new liquidity, resulting in altcoin efficiency In bother.

Extra room to catch up

The analyst’s third level explains that the bull run is led by Bitcoin and spot Bitcoin exchange-traded funds (ETH). Primarily based on this, he doesn’t suppose it’s stunning that altcoins have “barely moved increased” up to now.

Many cryptocurrency analysts and consultants agree. Alex Krüger has beforehand said that this cycle is “virtually totally” pushed by the momentum of Bitcoin ETFs.

Deutscher sees the underperformance of altcoins as a bullish signal, as Bitcoin’s dominance performed a significant position in earlier cycles. For him, this efficiency leaves “extra room to catch up” and will push the altcoin to unprecedented highs.

Associated Studying

The analyst believes that the market wants one other catalyst to gas a real altcoin season. Nonetheless, he burdened that first-quarter outcomes for a lot of traders had been file highs “even amid a mildly bullish outlook for many alternate options.”

In the end, Deutscher believes there’s room for enormous income on this cycle “even with out the heartbreaking copycat season all of us crave.”

Featured picture from Unsplash.com, chart from TradingView.com