Dying, taxes, and 21 million Bitcoins. That is what we could be positive of. The remaining is theory. In the present day I need to share my large wager on the following halving. I am positive 4 years from now I will be cringing at a few of these “prophecies,” however a few of them will come true. I haven’t got loads of knowledge to again up these predictions, some are instinct and a few are random. All I do know is that the long run is bizarre.

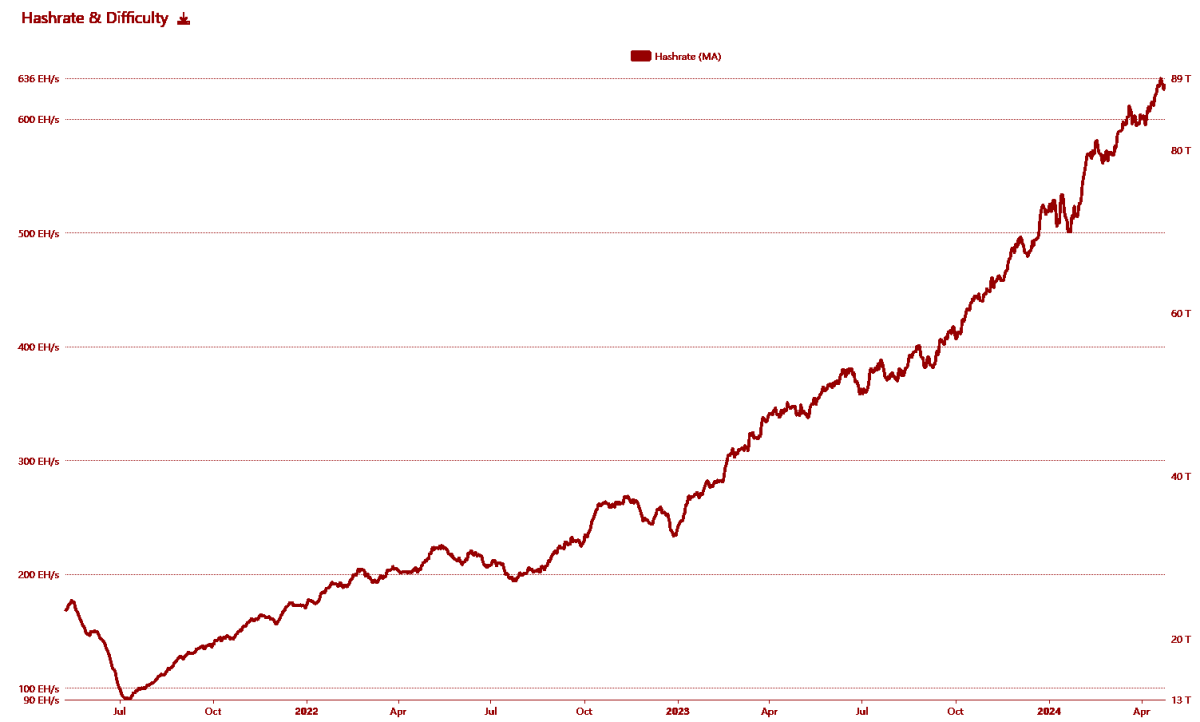

3 Zeta Hash Mining

Primarily based on my mining expertise within the final cycle, I realized a precious lesson in attempting to estimate hashrate, that the log just isn’t linear. The present computing energy far exceeds my expectations, so I’ll redouble my efforts within the subsequent cycle. We will see extra nation-states undertake it, and it will be torn aside. That is how we conquer the celebs.

5 nations within the Western Hemisphere declare USDT as authorized tender

Nations with excessive inflation and unstable currencies are following El Salvador’s instance and exploring cryptocurrencies as authorized tender. Political actions in nations reminiscent of Argentina and Venezuela reveal rising public and legislative curiosity in digital currencies. Financial experiences point out that the adoption of digital currencies can cut back transaction prices and improve monetary inclusion.

Apple integrates stablecoin into pockets

Apple has a historical past of (slowly) adopting new monetary applied sciences, however customers are very considering accessing conventional banking and secure companies by way of cell pockets apps. Apple’s current hiring and patents within the cryptocurrency and blockchain area counsel that future merchandise embrace digital currencies.

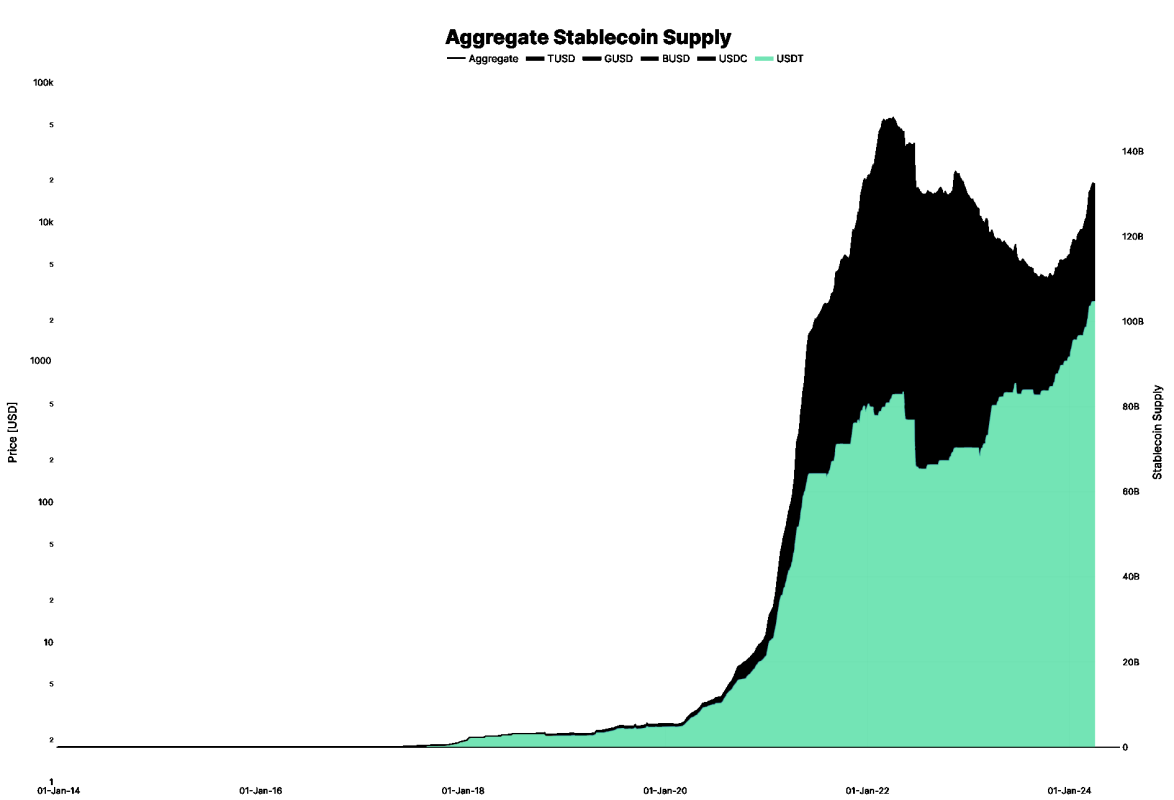

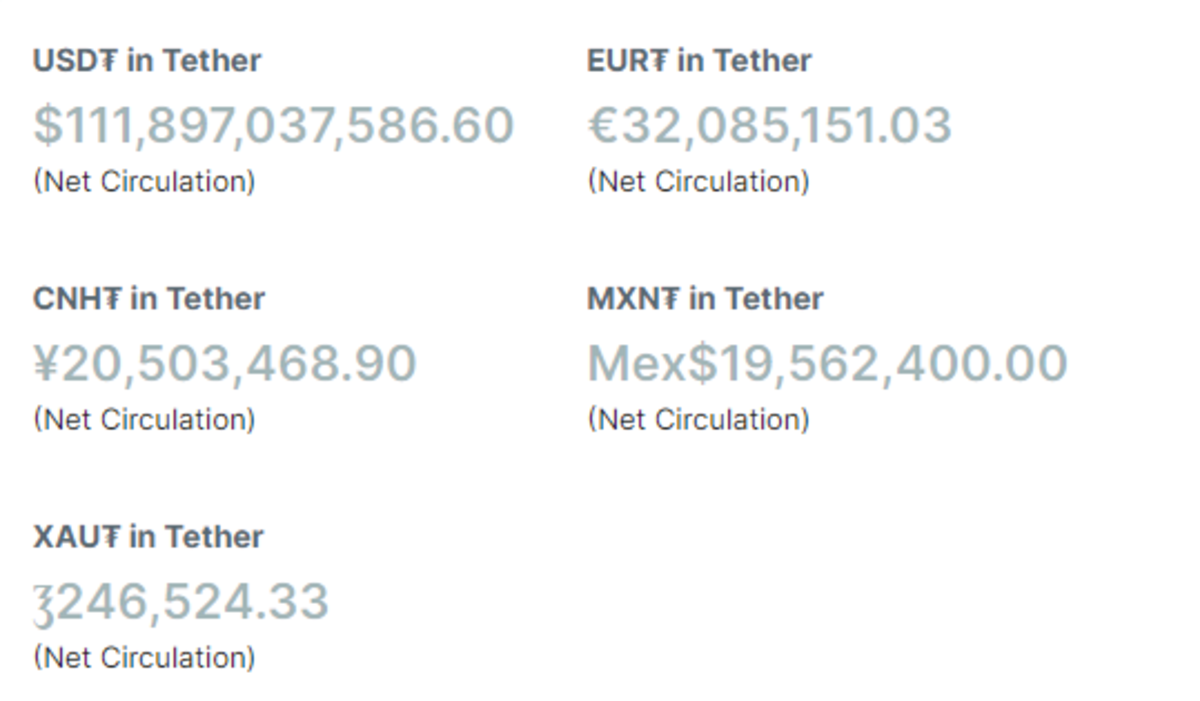

USDt drives Liquid’s progress

The halving of complete day by day transaction quantity on Liquid Community immediately is laughable, however with stablecoin regulation in place we are going to see an insane improve in demand for Tether, which is able to gas Liquids’ progress. As of immediately, USDt liquidity is roughly $36,500,000, accounting for 3.17% of the overall USDt provide. ($111,897,000,000). I predict that by the following halving, Liquid could have issued over $1 billion, or a rise of over 2,600%. That is my wild guess based mostly on the belief that the USDt dominoes are falling into place on different predictions.

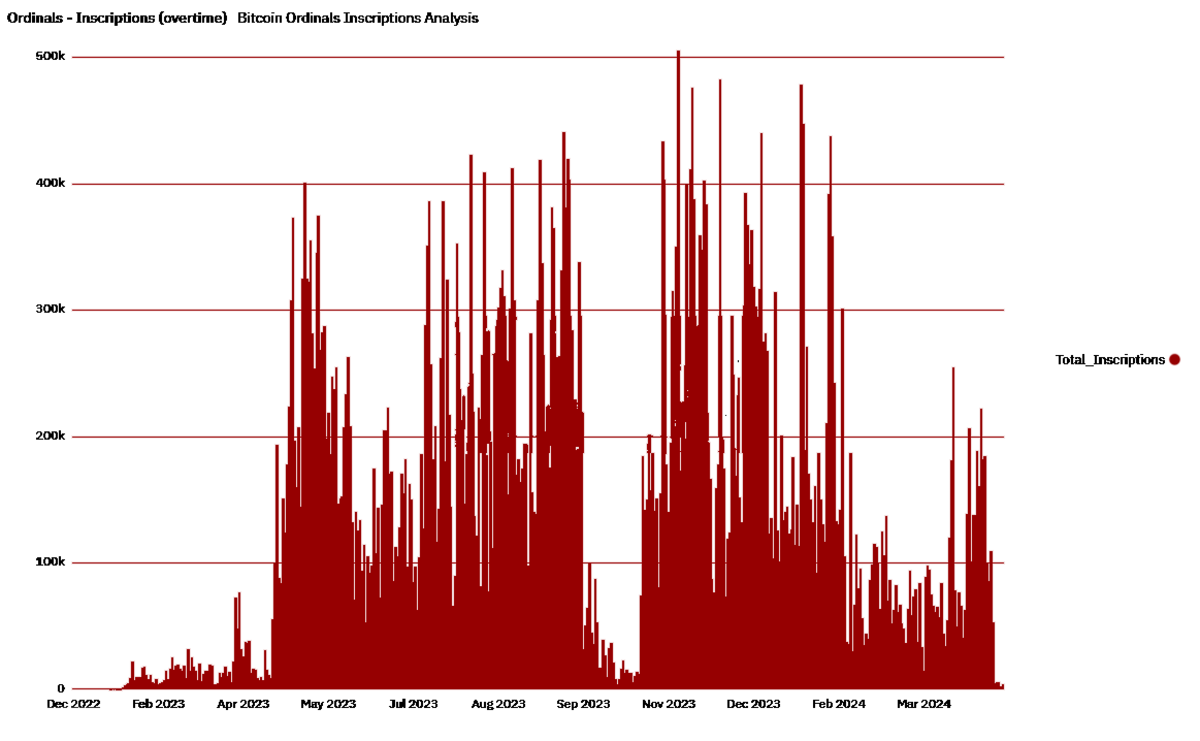

Ordinal numbers nonetheless thrive

The fallen NFT market has proven unanimous curiosity in “blockchain-based verification of possession,” suggesting that initiatives like Ordinals have a vivid future. The preliminary reception by a number of artists and collectors upon Ordinals’ launch hinted at long-term viability. Technical enhancements to blockchain scalability make it possible to handle giant quantities of information like these utilized in Ordinals.

The dealing with charge subsidizes the mining revenue at a ratio of two:1

As block rewards are halved, transaction charges have gotten an more and more necessary a part of miners’ revenue, as seen throughout the previous two halvings. Financial fashions predict that as transactions improve, accrued charges will turn into a significant incentive for miners. Historic knowledge reveals that with every halving occasion, the ratio of charges relative to dam rewards continues to extend. I used to be the one who charged essentially the most.

LN will obtain 90% centralization and compliance

The expansion of the Lightning Community is supported by main monetary establishments in search of scalable options, resulting in potential centralization. Regulatory stress is shaping crypto in favor of centralization for simpler regulation. Analysis on community nodes reveals that community nodes are inclined to turn into centralized as main gamers set up their dominance.

E-Money finds a distinct segment for miner funds

The necessity for environment friendly miner cost strategies is driving the adoption of digital money options to offer on the spot, low-fee funds. Pilot applications have proven promising outcomes for integrating digital money into mining operations. Financial evaluation reveals that digital money can cut back volatility and improve liquidity for miners.

Seed phrase safety challenges posed by Neuralink

Neuralink and comparable initiatives discover direct brain-computer interfaces, complicating conventional encryption practices. All of your seeds belong to the machine. New methods of making seeds with out revealing them to machines turn into essential.

Oil contract on-chain settlement

Using Bitcoin in commodity buying and selling is increasing following the success of an on-chain buying and selling pilot for crude oil. Nations vital of the greenback’s dominance are exploring Bitcoin options to bypass the normal monetary system. Advances in Bitcoin know-how have enhanced its potential to deal with settlement of large-scale, advanced contracts.

Bitcoin ETF market worth exceeds gold ETF

The speedy enlargement of the Bitcoin funding market and the launch of Bitcoin ETFs in a number of nations point out that the market is rising. Bitcoin’s market capitalization generally exceeds that of huge firms (FAANG) and conventional belongings. Bitcoin is more and more considered as a “protected haven” asset, driving ETF funding. Relaxation in peace gold.

Assassination market solved by decentralized oracles

Greater than $100 billion is locked within the “DeFi platform” and participates in “decentralized purposes.” The feasibility of decentralized oracles for betting on real-world occasions. We are going to see an on-chain assassination market. Most likely carried out by a swarm of drones.

Reorganizing Epic Sat

Final halving we needed fireworks however did not get them. The following halving we are going to get the worth of Epic Sat, the following halving will likely be big and the mining swimming pools that don’t take part will likely be laughed at.

SV2 can solely seize 20% of the computing energy

Nobody cares, sadly. Massive mining swimming pools don’t have any incentive to undertake SV2. Huge mining swimming pools will proceed to search out revolutionary methods to monetize blocks, and this doesn’t embrace SV2.

Investing in Bitcoin in a U.S. state

States reminiscent of Wyoming and Texas have already enacted blockchain-friendly legal guidelines, laying the groundwork for such investments. Diversifying treasury treasuries with Bitcoin can function a hedge in opposition to inflation, particularly amid a robust and risky U.S. greenback. Some finance ministers have expressed curiosity in exploring digital belongings as a part of their monetary methods.

Synthetic intelligence turns into sentient and requires Bitcoin

These machines need Bitcoin, not shitcoins.

China lifts Bitcoin mining ban

China’s earlier Bitcoin mining ban had a big influence on the worldwide hashrate and mining panorama. The resumption of Bitcoin mining will economically increase the event of China’s industrial and technological sectors. They’ll now not ignore the significance of hashing.

The Nice Alternative turns into a actuality, resulting in mass evictions

Nationalist actions in Europe have used Nice Alternative principle to affect immigration coverage. Demographic research predict important adjustments within the inhabitants that would underpin radical coverage adjustments. The political pursuits of the events supporting these theories counsel the potential of extra aggressive inhabitants insurance policies.

Bukele stays president

Bukele’s recognition in El Salvador has been fueled by his bullish Bitcoin financial insurance policies, suggesting he has the potential to stay within the management function for the long run. Surveys in El Salvador present Bukele’s approval scores are excessive, particularly amongst tech-savvy individuals. Constitutional or legislative adjustments would facilitate time period extension or re-election.

Bitcoin Greenback is a documentary

Fashions by monetary analysts predict that Bitcoin might be price greater than $1 million per coin inside a decade, given provide and demand dynamics. Traditionally, Bitcoin’s worth has surged following halvings, supporting predictions of future worth will increase. Institutional funding is growing, with main firms allocating funding portfolios to cryptocurrencies, growing its legitimacy and demand.

Zoom BIP activated

CTV, LNhance. OPCAT, some BIPs are activated.