The CEO of on-chain analytics agency CryptoQuant defined that Bitcoin’s worth just isn’t at present overvalued primarily based on its community fundamentals.

Bitcoin worth is probably not overvalued primarily based on sizzling cap ratio

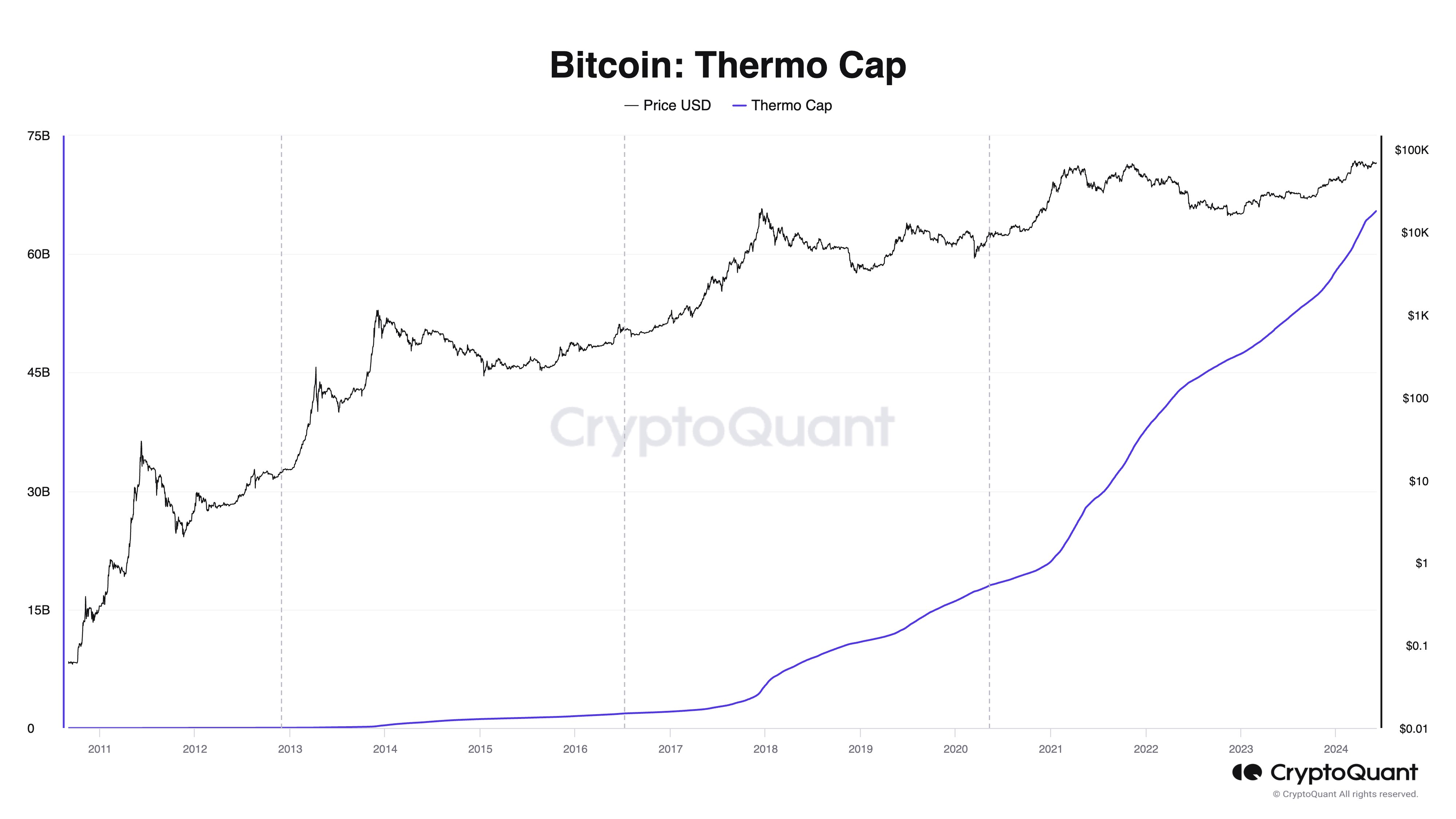

In a brand new article on X, CryptoQuant CEO and founder Ki Younger Ju discusses the newest pattern in Bitcoin’s sizzling cap ratio. “Thermo Cap” is a capitalization mannequin for BTC that calculates the whole worth of the asset by equating the worth of every token with the spot worth on the time of mining on the community.

Associated Studying

In different phrases, the mannequin calculates the cumulative worth of cash mined by miners because the inception of the blockchain. That is very totally different from the same old market cap and so forth. Within the case of market capitalization, the present spot worth is taken into account the worth of all circulating tokens.

Since cash mined by miners are the one approach to enhance the availability of a cryptocurrency, Thermo Cap may be thought-about a measure of “actual” capital inflows into the community.

The chart under reveals how Bitcoin’s sizzling hat has modified over its historical past:

As proven within the determine above, Thermo Cap has skilled an accelerated development curve. This naturally displays the growing quantity of capital flowing into the asset over time.

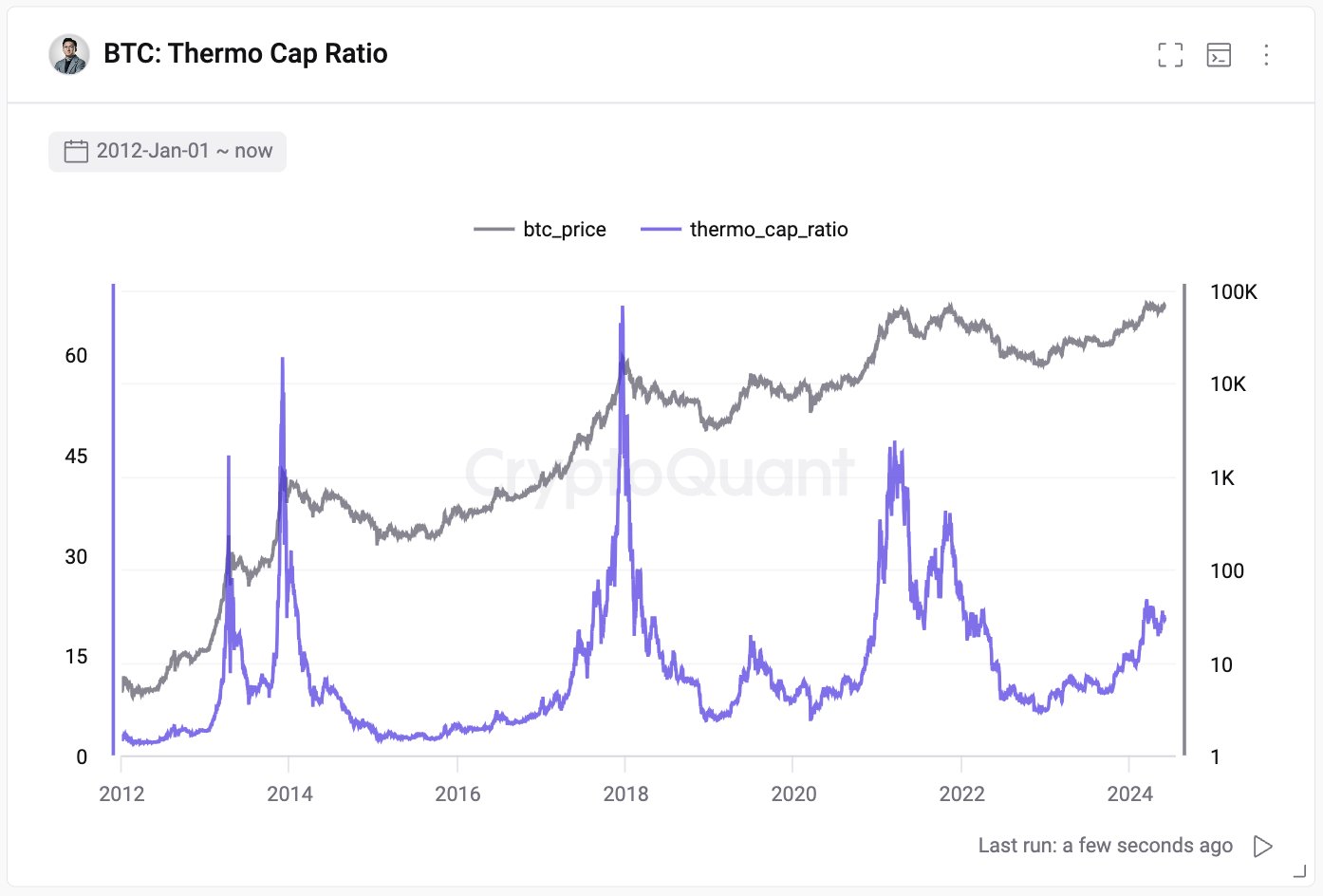

Nonetheless, within the context of the present matter, the metric of curiosity just isn’t the warmth cap itself, however the warmth cap ratio. This indicator tracks the ratio between Bitcoin market capitalization and Thermo Cap.

The chart under reveals the pattern of the asset’s sizzling cap ratio traditionally.

An attention-grabbing sample may be seen within the graph. Evidently very excessive values of the recent hat ratio coincide with highs in cryptocurrency costs.

Associated Studying

At excessive worth, Bitcoin’s market cap is kind of massive in comparison with Thermo Cap, which signifies that Bitcoin’s transaction velocity is way increased than when mined.

Additionally it is clear that Bitcoin bottoms when the ratio displays decrease values. The indicator has been trending upward not too long ago, however its worth has but to achieve ranges seen at previous bull market tops. The founding father of CryptoQuant identified: “Bitcoin just isn’t at present overvalued primarily based on community fundamentals.”

bitcoin worth

Bitcoin has failed to interrupt out of the vary not too long ago, and the worth has maintained a sideways pattern. At the moment, BTC is buying and selling at round $68,900.

Featured photos from Dall-E, CryptoQuant.com, charts from TradingView.com