Bitcoin (BTC), the biggest cryptocurrency in the marketplace, just lately hit the essential $70,000 stage, which has confirmed to be a big impediment to its worth consolidation in latest months.

Regardless of breaking above earlier highs and setting new all-time highs all time excessive The value of BTC in March was US$73,700. In early Could, the worth of BTC skilled a 20% adjustment to round US$56,500. Nevertheless, this correction marks the start of latest bullish momentum, with Bitcoin at the moment buying and selling round $69,300.

Regardless of some worth volatility and an absence of sustained bullish motion in Bitcoin, enterprise capitalist and market professional Chamath Palihapitiya has made optimistic predictions about the way forward for the cryptocurrency.

Bitcoin worth and halving evaluation

On a latest episode of the All In PodcastPalihapitiya analyzed BTC’s historic patterns relating to halving occasions, which happen roughly each 4 years and scale back the block rewards given to miners.

The enterprise capitalist identified that after a interval of halvedBuyers sometimes spend the primary three months reassessing costs and total market circumstances. Nevertheless, traditionally, vital worth will increase have sometimes occurred inside 6 to 18 months.

Associated Studying

To help his evaluation, Palihapitiya talked about earlier halving occasions. To study extra, the primary halving occurred on November 28, 2012, lowering the block reward from 50 BTC to 25 BTC. On the time of the halving, Bitcoin was priced at $13 and peaked at $1,152 inside a yr.

The second halving occurred on July 16, 2016, lowering block reward to 12.5 Bitcoin. The value of Bitcoin was $664 on the time and peaked at $17,760 inside a yr.

The latest halving occurred on Could 11, 2020, lowering the block reward to six.25 BTC. Throughout the halving, Bitcoin was priced at $9,734, reaching an all-time excessive of $69,000 inside a yr.

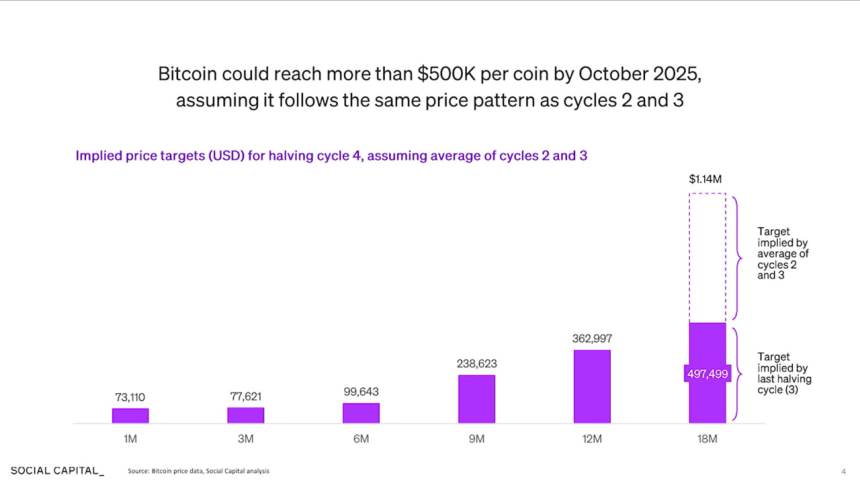

Based mostly on these historic patterns and making use of the common positive factors from earlier halvings, Palihapitiya mentioned that if Bitcoin continues to comply with the efficiency of the earlier market cycle, its worth may surge to round $500,000 by October 2025, as proven within the chart above.

Notably, consultants imagine that with Bitcoin’s worth appreciating to such ranges, it’s attainable different to gold and as a buying and selling utility for onerous belongings. This case, coupled with issues concerning the devaluation of fiat currencies, presents an attractive alternative for Bitcoin’s future.

Bitcoin demand rising?

Palihapitiya additional identified within the interview that as an increasing number of international locations undertake a dual-currency method and Bitcoin is thought to be a invaluable asset just like the nationwide foreign money, the demand for Bitcoin will enhance.

This shift will solely occur when folks acknowledge the necessity for Bitcoin in on a regular basis transactions of products and companies and as a retailer of worth in everlasting belongings.

Associated Studying

General, Palihapitiya’s evaluation of Bitcoin historic sample The post-halving occasion offers an optimistic outlook for cryptocurrency costs.

With Bitcoin anticipated to succeed in $500,000 by October 2025, its rising recognition as a dual-currency asset alongside fiat currencies provides new prospects for buyers and the broader cryptocurrency market.

Featured pictures from DALL-E, charts from TradingView.com