Based on the newest evaluation from main asset administration agency VanEck, Ethereum, the world’s second largest cryptocurrency, is about to rise quickly. The report predicts that Ethereum could possibly be valued at $2.2 trillion by 2030, equal to a worth per coin of about $22,000. The bold forecast hinges on Ethereum’s dominance of the sensible contract house and its potential to generate a staggering $66 billion in free money circulation by the tip of the last decade.

Associated Studying

Conventional finance embraces Ethereum and will get ETF approval

A key driver behind VanEck’s bullish outlook is the current approval of a spot ether ETF by the American Inventory Alternate. These ETFs permit conventional monetary establishments and traders to achieve publicity to Ethereum with out the complexity of holding the cryptocurrency instantly.

This elevated accessibility has broadened Ethereum’s enchantment, attracting monetary advisors, institutional traders, and even massive tech firms. The inflow of those new gamers bolsters Ethereum’s legitimacy and instills confidence in its long-term potential.

Web large with room for development

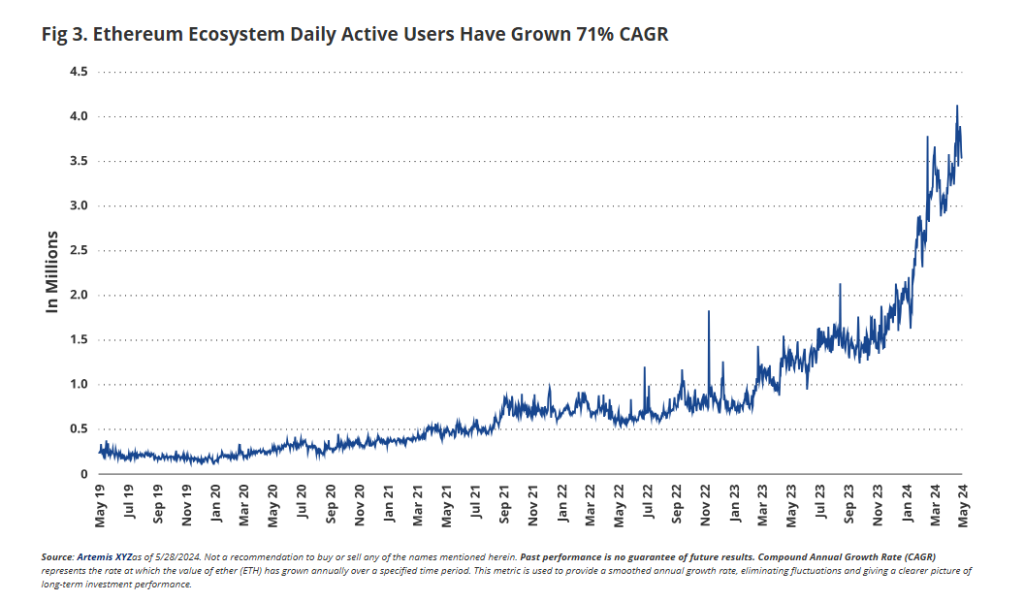

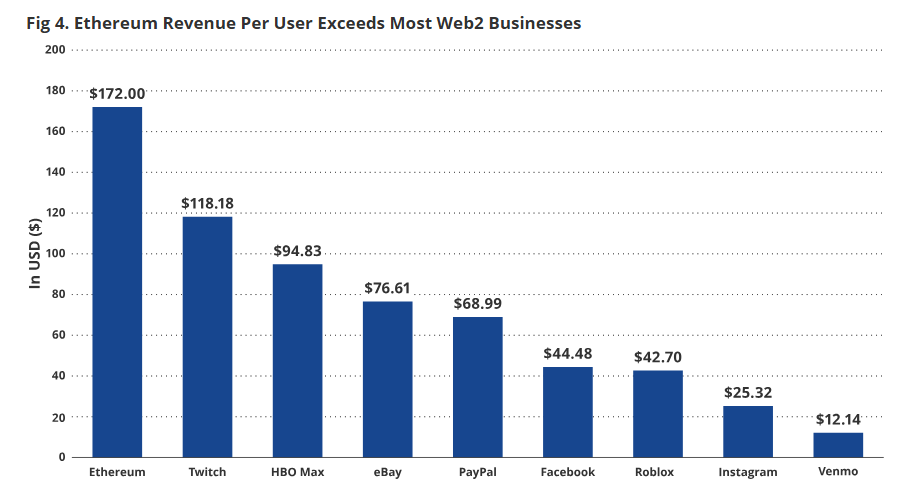

The Ethereum community has a powerful person base, processing roughly $4 trillion price of transactions final 12 months and facilitating $5.5 trillion in stablecoin transfers. This spectacular exercise highlights Ethereum’s place as an essential cog within the decentralized finance (DeFi) machine.

VanEck’s evaluation elements in Ethereum’s continued development, together with continued adoption of purposes constructed on its platform, the rising shortage of ETH tokens as a result of its burn mechanism, and its potential to seize a bigger share of the rising blockchain market . The report estimates that the full addressable market (TAM) for blockchain purposes will attain a staggering $15 trillion, indicating that Ethereum has big room for development.

Will Ethereum turn out to be the Silicon Valley of blockchain?

VanEck’s evaluation paints Ethereum as a possible “Blockchain Silicon Valley,” a platform that fosters innovation and disrupts conventional industries. The power to construct and deploy sensible contracts on Ethereum permits builders to create new purposes and monetary devices that would revolutionize areas comparable to provide chain administration, id verification, and even voting methods. Because the Ethereum ecosystem thrives, the worth proposition of holding ETH tokens strengthens, probably driving the anticipated worth surge.

Associated Studying

Ethereum worth prediction

In the meantime, Ethereum is predicted to rise by 2.13% to succeed in $3,861 by July 6, 2024, in response to the newest forecast. The general market sentiment for Ethereum is optimistic, with the Worry and Greed Index studying at 78, indicating “excessive greed.” The index measures market sentiment and sentiment from quite a lot of sources, and such excessive ranges typically point out traders have gotten overconfident, which may typically precede a market correction.

By way of current efficiency, Ethereum has skilled 17 inexperienced buying and selling days over the previous 30 buying and selling days, which interprets to a optimistic day by day efficiency fee of 57%. This means an general upward development that continues to rise. Nonetheless, over the previous 30 days, Ethereum’s volatility reached 11.30%. This stage of volatility is comparatively excessive, which implies that whereas costs are anticipated to rise, they will fluctuate considerably.

Featured picture from InvestorsObserver, chart from TradingView