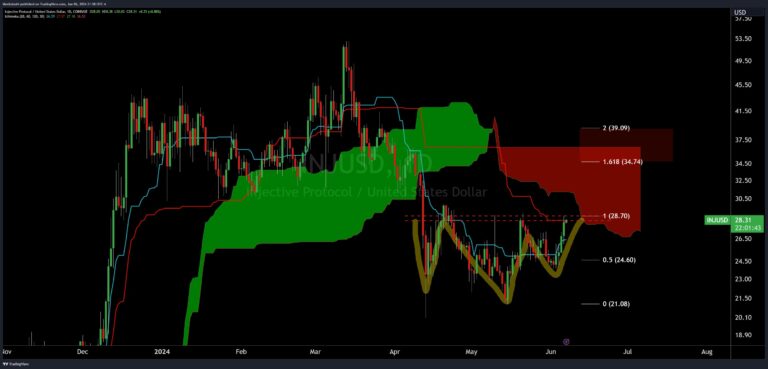

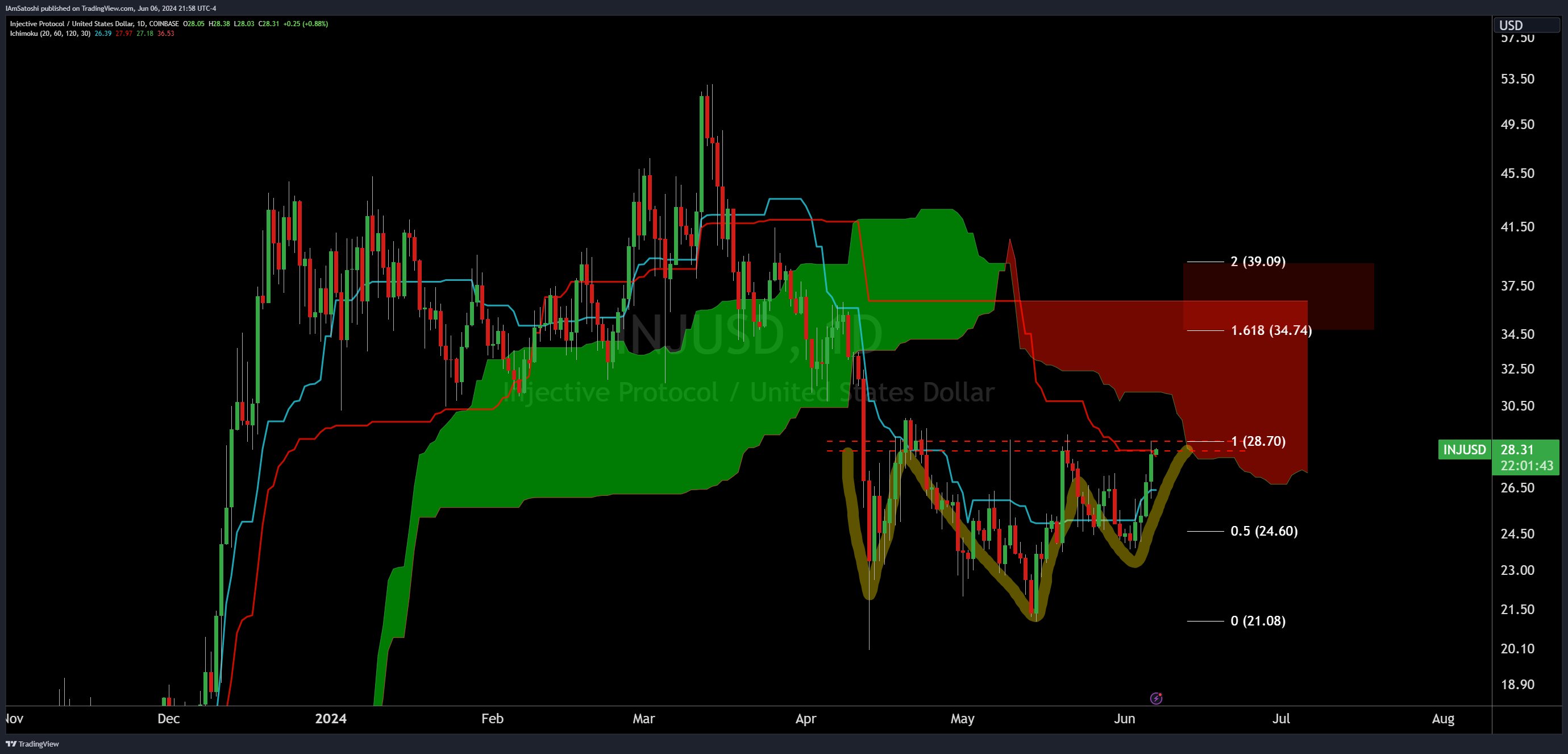

In an evaluation shared on This chart reveals a robust risk of a reversal within the current bearish pattern, which might push the cryptocurrency’s worth to new native highs.

Injection costs able to take off

The iH&S sample highlighted in Olszewicz’s chart is a extremely revered sample amongst technical analysts for predicting bullish reversals following a downtrend. This sample is acknowledged by three troughs: the center trough (head) is the deepest, flanked by two shallower troughs (shoulders) which can be of roughly comparable depth.

Associated Studying

Trying on the chart, the left shoulder shaped round mid-April, beneath $23.50. A Might prime emerged, with a drop to lows close to $21.08. The sample ended with a proper shoulder in early June that dropped to round $23.90, just like the left shoulder.

The neckline is a key part of the shape, drawn on the height that connects the shoulders to the top. On Olszewicz’s chart, this line is situated at roughly $28.70. A breakout of the neckline is commonly interpreted as affirmation of the completion of the sample and an impending bullish pattern. In accordance with the chart, INJ’s worth is about to interrupt by way of this key threshold.

Analyst charts additionally incorporate the Ichimoku Cloud, which gives a dynamic view of potential help and resistance areas. At present, INJ’s worth is hovering close to the decrease fringe of the crimson cloud, indicating an impending resistance zone that merchants might hold a detailed eye on.

Associated Studying

Fibonacci extension ranges drawn from the iH&S sample’s head low to the neckline additional enrich the evaluation. These ranges point out potential worth targets if a bullish breakout is confirmed. The 1.618 Fibonacci extension is priced at $34.74, whereas the extra formidable 2.0 extension reaches $39.09. These targets signify potential resistance ranges the place merchants might revenue, so they’re essential for understanding potential future worth actions.

Josh Olszewicz’s reliance on the iH&S sample is mixed with different technical indicators such because the Ichimoku Cloud and Fibonacci Extensions to current a complete view. This evaluation means that INJ’s worth might rise to $34.74, and even $39.09, which might signify a 33% enhance from present costs.

Traders and merchants might want to hold a detailed eye on INJ’s worth motion, paying shut consideration to buying and selling quantity and market sentiment, which might speed up or hinder the anticipated bullish momentum.

At press time, INJ was buying and selling at $29.51.

Featured picture created with DALL·E, chart from TradingView.com