Knowledge reveals that Bitcoin whales on cryptocurrency exchanges Bybit and HTX have opened giant lengthy positions at present worth ranges.

Bybit and HTX’s Bitcoin taker shopping for and promoting ratio has surged just lately

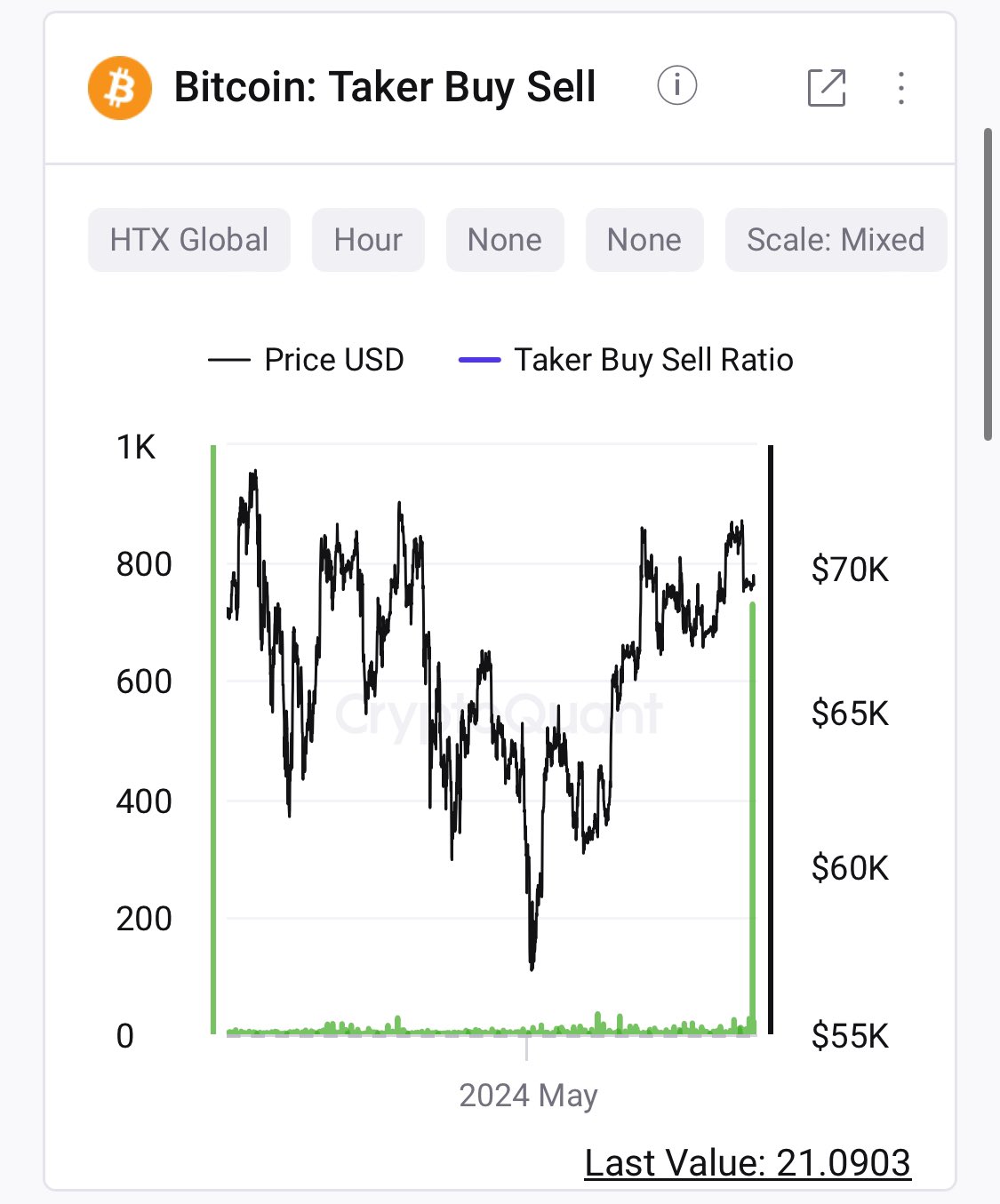

Ki Younger Ju, founder and CEO of CryptoQuant, revealed in a brand new article on X that whales on the HTX platform have just lately opened a lot of lengthy positions. The related metric right here is the Taker Purchase to Promote Ratio, which tracks the ratio between Bitcoin taker shopping for quantity and taker promoting quantity.

When the worth of this indicator is bigger than 1, it signifies that the present shopping for or lengthy buying and selling quantity of the recipient is bigger than the promoting or brief buying and selling quantity of the recipient. This development signifies that most individuals within the derivatives market are presently bullish.

Alternatively, the indicator being under this threshold might imply {that a} bearish mentality dominates the sector, as brief quantity outweighs lengthy quantity.

Now, the chart under reveals the newest developments within the Bitcoin taker buy-sell ratio on the HTX change:

The worth of the metric seems to have been fairly excessive in latest days | Supply: @ki_young_ju on X

As proven within the chart above, HTX’s Bitcoin taker buy-to-sell ratio has surged extraordinarily excessive just lately. Which means customers of the platform have simply opened a lot of lengthy positions.

The indicator’s sharp rise comes after BTC dropped to $69,000 ranges. Subsequently, whales on the change appear to suppose this dip is value inserting large bullish bets on.

Maartunn, one other member of the CryptoQuant employees, quoted and retweeted Ju’s publish on HTX’s growth, noting that the Bybit platform’s Taker buy-to-sell ratio additionally noticed a big spike from latest lows.

Seems to be just like the metric has additionally registered a big worth for this change | Supply: @JA_Maartun on X

It is clear from the chart that whereas the spike in Bybit’s Bitcoin taker buy-to-sell ratio itself is certainly fairly giant, its scale continues to be not as alarming as that noticed on HTX.

Nonetheless, indicators reaching these highs imply that orders on the whale platform are additionally closely tilted in direction of the longs. In consequence, it seems that a minimum of two giant entities on the change have determined to put giant bullish bets on latest worth ranges.

It stays to be seen whether or not these lengthy positions will repay for these large Bitcoin buyers.

bitcoin worth

Bitcoin has been buying and selling sideways since its plunge just a few days in the past, with its worth nonetheless round $69,420.

The worth of the coin hasn't made any notable restoration from the plummet but | Supply: BTCUSD on TradingView

Featured photos from Dall-E, CryptoQuant.com, charts from TradingView.com