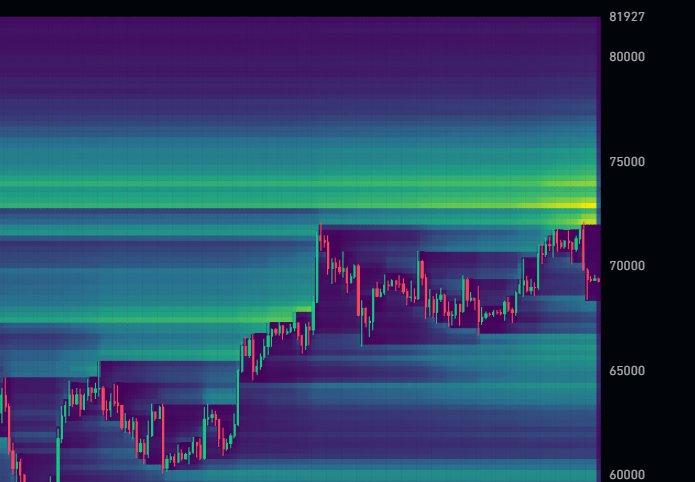

Judging from the sample on the day by day chart, Bitcoin’s spot charge has not eased. Following the flash crash on June 6, the worth reversed sharply from the $72,000 degree, additional highlighting the significance of liquidation ranges.

Bitcoin worth has pulled again from this degree prior to now, with analysts anticipating a brief squeeze to happen as soon as it breaks above.

Hedge funds are shorting Bitcoin futures: may this technique backfire?

On this blunder, certainly one of X’s analysts notes Hedge funds and Wall Road companies are more and more taking brief positions in Bitcoin futures contracts in anticipation of a plunge in Bitcoin costs.

Whereas they’ll reap the benefits of the price differential to take a web lengthy place within the spot market, the dealer famous that this technique is dangerous. If something, big losses may outcome if costs unexpectedly spike.

Change knowledge and dealer notes present that between the present worth level and simply above the all-time excessive of $74,000 $12 billion price of brief BTC futures positions.

The transfer means hedge funds are web bearish, and since everybody is aware of Wall Road’s huge weapons are shorting, the transfer may backfire.

Even so, hedge funds promoting Bitcoin futures is nothing new. Sometimes, hedge funds are likely to brief futures on a particular product whereas shopping for the spot market and revenue from arbitrage trades.

Associated Studying

The issue is, this hedging technique is fashionable in conventional finance and has been worthwhile earlier than. Bitcoin, then again, is a brand new asset class exterior of the standard monetary system.

Subsequently, the technique might not work out precisely as meant, leading to big losses.

BTC is fragile, however spot ETF issuers are shopping for closely

Whether or not Bitcoin will recuperate from spot charges stays to be seen. In reality, Bitcoin is going through vital promoting stress, falling from $72,000.

Whereas the uptrend stays, consumers have but to reverse the June 6 losses, that means the trail of least resistance within the brief time period is south. A fall beneath $66,000 would utterly erase the Could 20 features, signaling a development shift.

Associated Studying

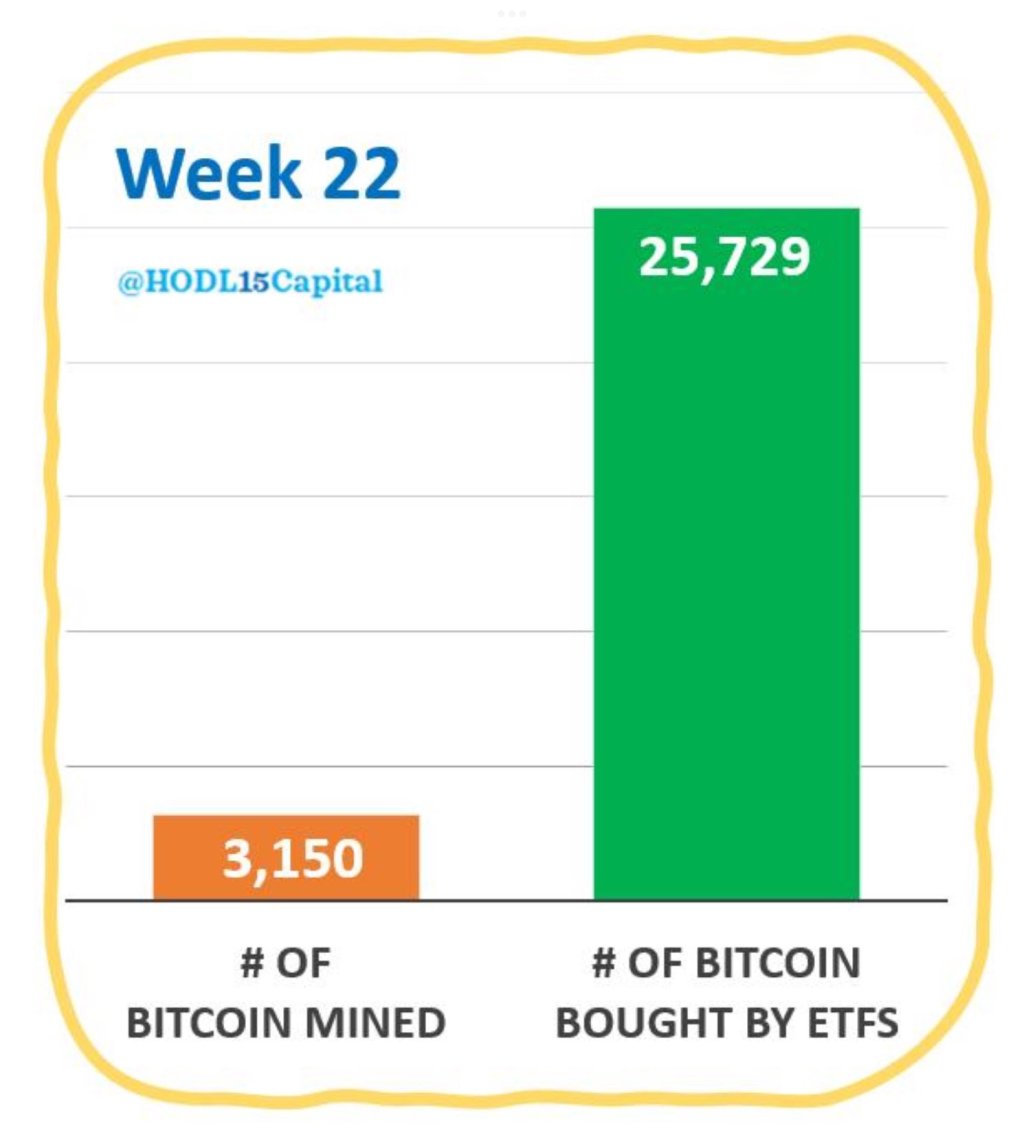

Nonetheless, consumers stay optimistic in regards to the future. Final week, all U.S. spot Bitcoin exchange-traded fund (ETF) issuers had been on a shopping for spree regardless of shrinking.

Based on HODL15 Capital, they added 25,729 Bitcoins within the first week of June. These reserves are equal to roughly two months of mined cash and characterize the very best weekly shopping for exercise since mid-March. BTC subsequently rose to all-time highs round $73,800.

Characteristic footage are from DALLE, charts are from TradingView