In hindsight, all Bitcoin wanted for actual institutional adoption was the introduction of risk-minimized, easy-to-use merchandise within the type of exchange-traded funds (ETFs). In January this 12 months, the SEC accredited 9 new ETFs to supply Bitcoin publicity by way of the spot market, which is a strict enchancment over the futures-based ETFs that may start buying and selling in 2021. and numbers have declined. BlackRock’s ETF alone set a document for the shortest time for ETF belongings to succeed in $10 billion.

Along with the eye-popping AUM numbers from these ETFs, final Wednesday additionally marked the deadline for establishments with greater than $100 million in belongings to report their holdings to the SEC by way of a 13F submitting. The paperwork reveal the whole image of who owns Bitcoin ETFs — and the outcomes are decidedly optimistic.

Institutional adoption is broad-based

In years previous, a single institutional investor reporting possession of Bitcoin can be a newsworthy, even market-moving occasion. Simply three years in the past, Tesla determined so as to add Bitcoin to its stability sheet, inflicting Bitcoin to rise by greater than 13% in a single day.

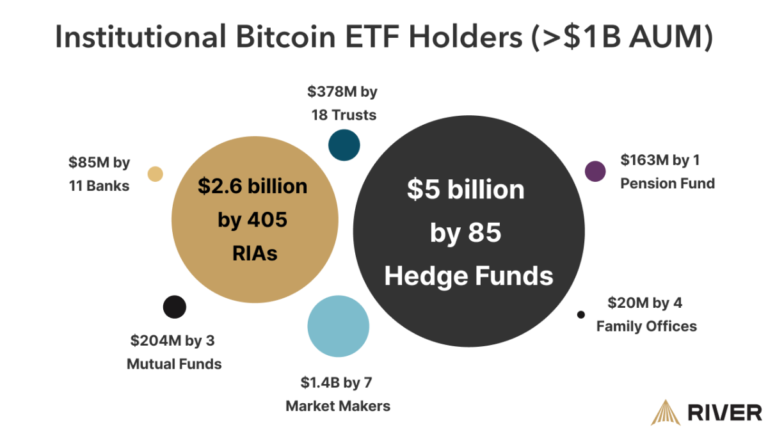

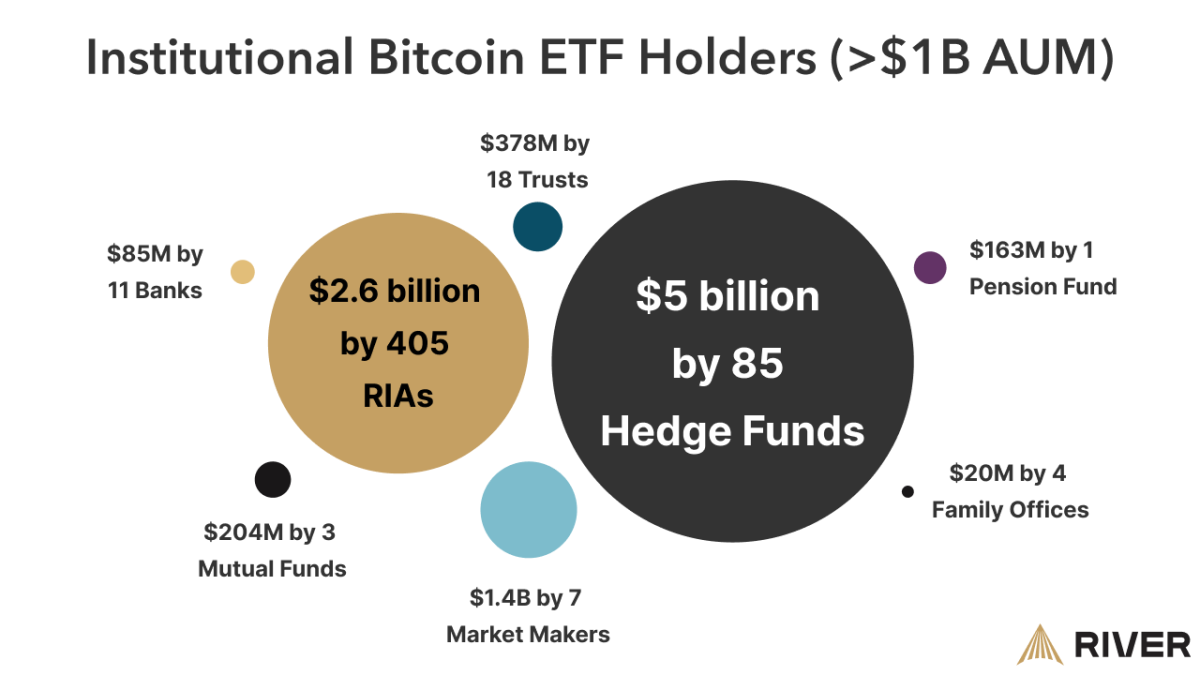

2024 is clearly completely different. As of Wednesday, we’re conscious of 534 distinctive establishments with over $1 billion in belongings which have chosen to start allocating Bitcoin within the first quarter of this 12 months. From hedge funds to pensions and insurance coverage corporations, the scope of adoption is staggering.

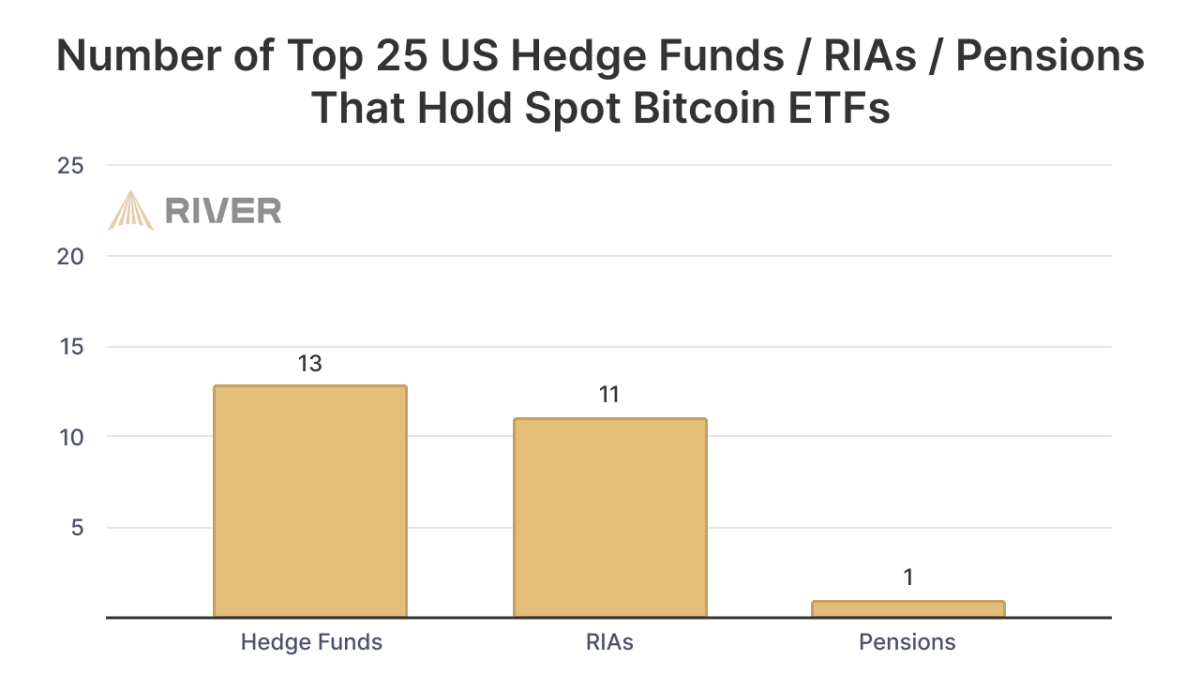

Greater than half of the 25 largest hedge funds in the USA at present maintain Bitcoin, probably the most notable of which is Millennium Administration’s $2 billion place. Moreover, 11 of the biggest 25 registered funding advisors (RIAs) are actually allotted.

However why are Bitcoin ETFs so engaging to establishments new to purchasing Bitcoin?

Giant institutional buyers are sluggish creatures from a monetary system steeped in custom, danger administration and regulation. For retirement funds, updating a portfolio requires months and even years of committee conferences, due diligence and board approvals, which are sometimes repeated a number of instances.

Gaining publicity to Bitcoin by shopping for and holding actual Bitcoin requires, along with new accounting and danger administration processes, the necessity for a number of trade suppliers (equivalent to Galaxy Digital), custodians (equivalent to Coinbase) and forensic companies ( Chainaanalysis) for a complete evaluate, ETC.

Compared, it is simple to get Bitcoin publicity by shopping for ETFs from Blackrock. As Lynn Alden stated on the TFTC Podcast, “From a developer’s perspective, ETFs are mainly an API for the fiat system. It simply permits the fiat system to plug into Bitcoin higher than earlier than.”

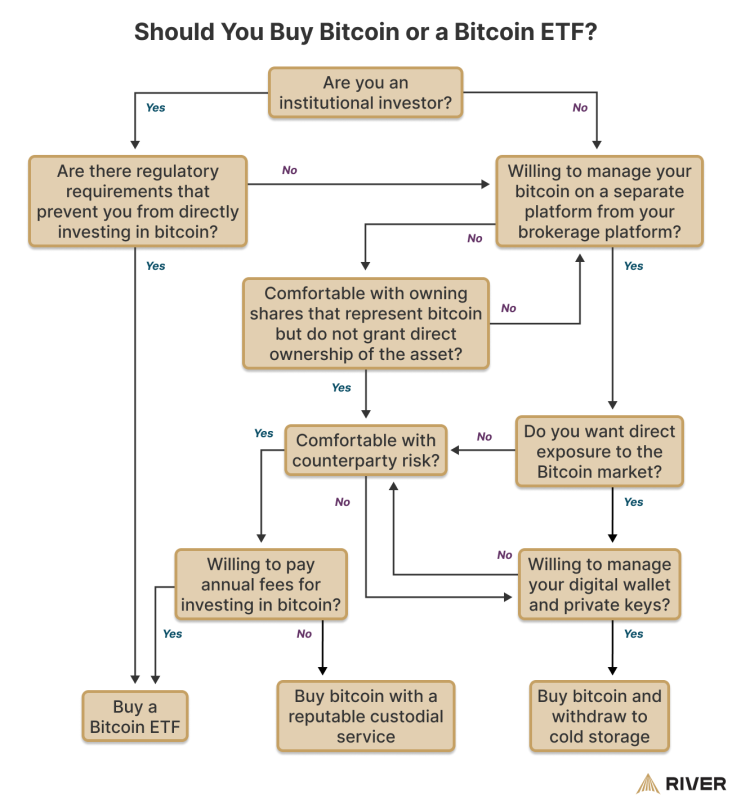

That is to not say that ETFs are the perfect approach for individuals to achieve publicity to Bitcoin. Along with the administration charges that include proudly owning an ETF, this product comes at a value that would undermine the core worth that Bitcoin supplies within the first place – an incorruptible forex. Whereas these trade-offs are past the scope of this text, the next flowchart describes some components to think about.

Why hasn’t Bitcoin seen extra rallies this season?

With ETF adoption so excessive, it is perhaps stunning that the worth of Bitcoin is barely up 50% year-to-date. The truth is, if 48% of the highest hedge funds are allotted now, how a lot upside is admittedly left?

Whereas ETFs have broad possession, the typical allocation by establishments that personal them is sort of restricted. Among the many main (1b+) hedge funds, RIAs, and pension funds which have made allocations, the weighted common allocation is lower than 0.20% of AUM. Even Millennium’s $2 billion distribution represents lower than 1% of its reported 13F holdings.

Due to this fact, the primary quarter of 2024 might be seen because the interval when establishments “get away from zero.” As for when they are going to cease dipping their toes within the water? Solely time will inform.

This can be a visitor publish from River’s Sam Baker. The views expressed are completely their very own and don’t essentially replicate the views of BTC Inc or Bitcoin Journal.