The winds of change are blowing within the Bitcoin market, bringing with it a brand new wave of short-term merchants, whereas veteran holders stay steadfast of their beliefs.

A current report from Bitfinex Alpha revealed an interesting dichotomy in investor conduct, with new gamers chasing fast earnings, whereas skilled holders (who cherish life) accumulate over the long run.

Associated Studying

ETF mania drives short-term surge

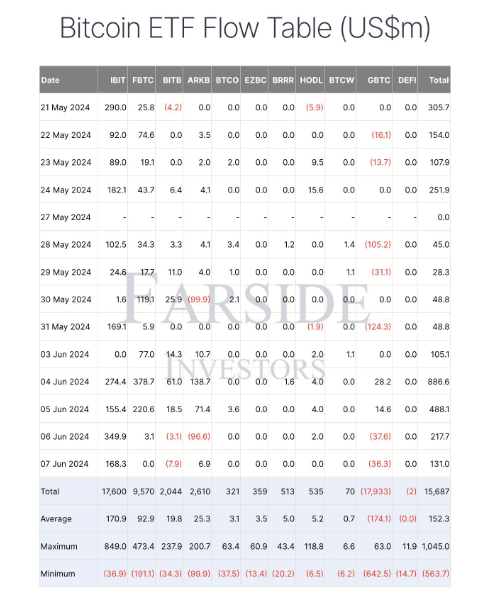

Spot Bitcoin ETFs are monetary devices that mirror the value of Bitcoin, they usually have develop into a recreation changer. These simply accessible choices are attracting a brand new era of traders with a eager eye for short-term positive aspects.

This inflow is clear within the important improve in short-term holders (those that have held Bitcoin for lower than 155 days). Their holdings have surged almost 55% since January, pointing to a surge in speculative exercise.

It seems like we nonetheless have cliffhangers from the earlier cycle.

Quick-term holders notice that the value is steadily rising as new gamers enter the market and purchase #bitcoin. Hedge funds, pension funds, banks, and so on.

However costs will not be rising as a result of previous cash are in circulation.

us… pic.twitter.com/VxaXozgANT

—Thomas heyapollo.com (@thomas_fahrer) June 12, 2024

Nevertheless, this newfound enthusiasm comes with a caveat. Quick-term traders, by their very nature, are typically extra delicate to cost fluctuations. Sudden market corrections can set off sell-offs, inflicting value fluctuations. The report highlights this vulnerability, emphasizing the necessity for warning amid the present market “greed” sentiment (as measured by the Worry and Greed Index).

Lengthy-Time period Holders: Diamonds within the Tough

Regardless of the brisk short-term exercise, long-term holders proceed to precise unwavering confidence in Bitcoin’s potential. A number of of those veterans of earlier market cycles confirmed a shocking shopping for spree after initially promoting off some property when Bitcoin hit all-time highs in March.

The report additional underscores this bullish sentiment, noting that long-term traders are holding extra Bitcoin than on the present value level. This suggests a “maintain” mentality, the place traders imagine the present value is an efficient entry level for future positive aspects.

Moreover, Bitcoin whales (giant traders who maintain giant quantities of Bitcoin) are mirroring their conduct previous to the 2020 bull run by actively accumulating Bitcoin, suggesting that the earlier market rally could also be repeated.

journey the countercurrent

The present Bitcoin market presents a novel scenario. On the one hand, the inflow of short-term traders has injected new vitality and liquidity. Nevertheless, their presence additionally carries the chance of elevated volatility. However, long-term holders stay the cornerstone of the market, offering stability and confidence.

Associated Studying

Bitcoin Worth Prediction

The Bitfinex Alpha report coincides with predictions based mostly on technical evaluation, predicting that Bitcoin value could improve by 29.51% to succeed in $87,897 by July 13, 2024.

Nevertheless, the report additionally acknowledged that market sentiment is advanced, with the concern and greed index hovering within the “greed” zone. This factors to the necessity for warning, as investor optimism can typically precede value corrections.

Featured pictures are from VOI, charts are from TradingView