Afternoon photos

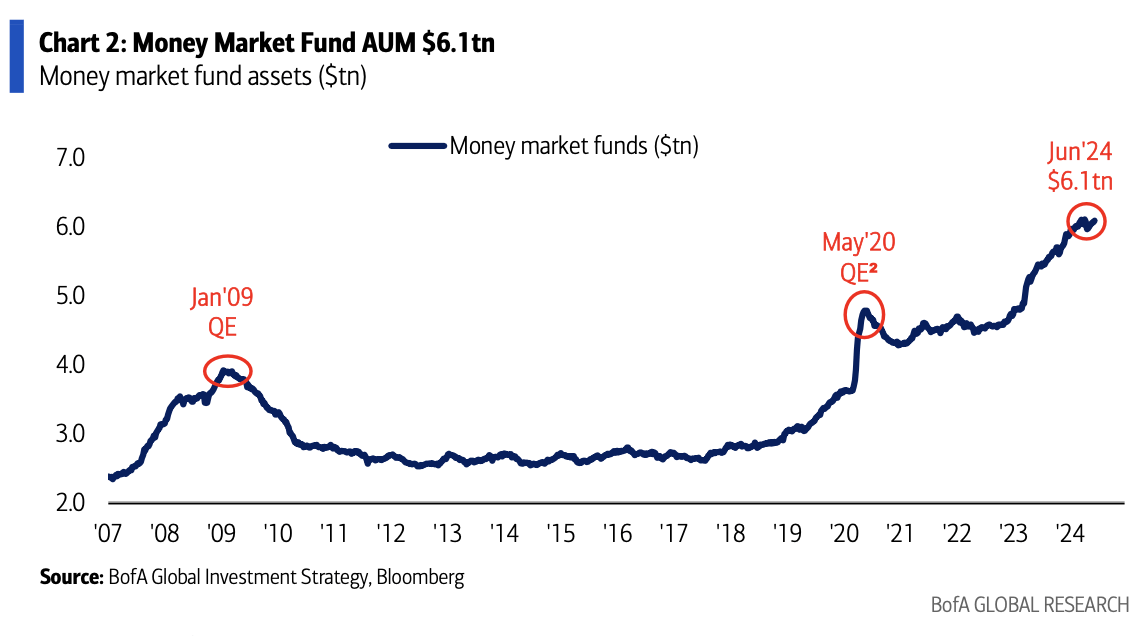

Cash market funds dominated weekly inflows throughout the asset class, pushing their complete holdings above $6T to a file excessive, in response to Financial institution of America (BofA) knowledge.

In line with statistics, $40.4 billion of money flowed into cash market funds, exceeding the stream into U.S. shares, Treasuries and investment-grade bonds Movement Present directions launched by Financial institution of America on Thursday. Money influx annualized $680B.

Weekly money inflows pushed complete cash market fund property to a file 6.1t. Retail and institutional buyers proceed to hunt to learn from the best rate of interest atmosphere in additional than 20 years. The Federal Reserve this week saved the federal funds price at 5.25%-5.5% and mentioned it might minimize rates of interest solely as soon as in 2024 in an effort to scale back inflation to its 2% goal.

Jurrien Timmer, international macro director at Constancy, wrote in an article on The Corporations Affiliation mentioned that day that the overall property of cash market funds reached 6.12 tons.

In different weekly statistics, Financial institution of America mentioned:

- Fairness funds attracted $6.3B and BUS progress funds attracted $1.8B, the biggest inflows since March.

- Worth funds recorded their largest outflows since March at $2.6B.

- Know-how shares recorded $2.1B in inflows.

- Treasury inflows of $1.8B characterize the sixth consecutive week of inflows. Funding grade bonds noticed their largest inflows in 9 weeks, reaching $7.7B.

In markets, the S&P (SP500) (SPY) (IVV) and Nasdaq Composite Index (COMP:IND) hit all-time highs this week, however retreated on Friday. U.S. Treasury yields (US10Y) (US2Y) fell as buyers centered on the prospect of the Federal Reserve reducing rates of interest this 12 months, albeit lower than the three beforehand forecast.

Go to the Looking for Alpha Bonds web page to see how Treasury yields are performing throughout the curve. Listed below are some cash market, progress, and worth inventory ETFs: (GSY), (PULS), (VUG), (IVW), (SPYV), (FVAL).