Bitcoin has had a poor week, with its market worth down 4.65% over the previous seven days, in keeping with CoinMarketCap. Nonetheless, outstanding cryptocurrency analyst Ali Martinez has issued a worth alert, indicating that the market chief may undergo extra losses if it fails to achieve entry to particular help areas.

Associated Studying

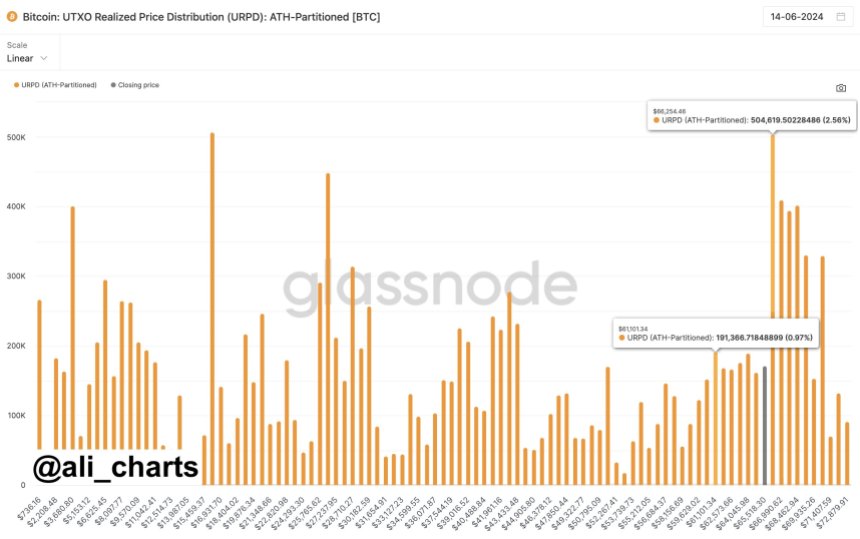

Bitcoin URPD Chart Reveals Potential Correction – Analyst

Martinez stated in a June 15 X put up that Bitcoin must rise above $66,254 shortly or it may fall to round $61,100. Martinez’s concept relies on the UTXO Realized Value Distribution (URPD) chart produced by the info evaluation platform Glassnode.

#bitcoin A fast transfer again above $66,254 is required to keep away from a possible pullback to $61,100! pic.twitter.com/WMr7jcAVJU

— Ali (@ali_charts) June 14, 2024

For context, unspent transaction outputs (UTXOs) confer with items of Bitcoin that haven’t been spent after a transaction. Every UTXO has a realized worth, which is the market worth on the time the UTXO is traded. The availability of Bitcoin is damaged down primarily based on the realized worth of UXTO within the UTXO Realized Value Distribution chart, displaying how a lot BTC was bought at totally different ranges.

This information can be utilized to check market sentiment, distribution evaluation, and help and resistance ranges. What’s extra, investor conduct may also be studied, because the excessive focus of UTXOs signifies that almost all of traders are buying Bitcoin at ranges that may translate into potential resistance or help ranges.

Based on a URPD chart shared by Martinez, 504,619 BTC have been bought at a worth of $66,254, indicating that Bitcoin has sturdy help potential in the course of the present downtrend. Moreover, the following realized worth for probably the most bought Bitcoin (191,366 cash) is $61,101, which represents the following help stage if the key cryptocurrency fails to reclaim the $66,254 worth mark.

Associated Studying

Bitcoin Value Overview

On the time of writing, Bitcoin is buying and selling at $66,151, with costs down 1.15% on the final day. On the identical time, BTC’s day by day buying and selling quantity additionally dropped by 5.54%, price $25.4 billion. Nonetheless, Bitcoin stays within the inexperienced on the month-to-month chart with a acquire of 5.80%, which is a major optimistic, particularly for long-term merchants.

Based on information from Coincodex, the general sentiment stays bearish, with the Concern and Greed Index at 74, indicating the present optimism and risk-taking conduct of traders, highlighting the potential for excessive market volatility.

Featured picture from BBC, chart from Tradingview