On-chain information exhibits that the buy-to-sell ratio of Bitcoin takers on choose cryptocurrency exchanges has spiked considerably. This is the way it impacts the costs of main cryptocurrencies.

Bitcoin traders purchase dips on this trade

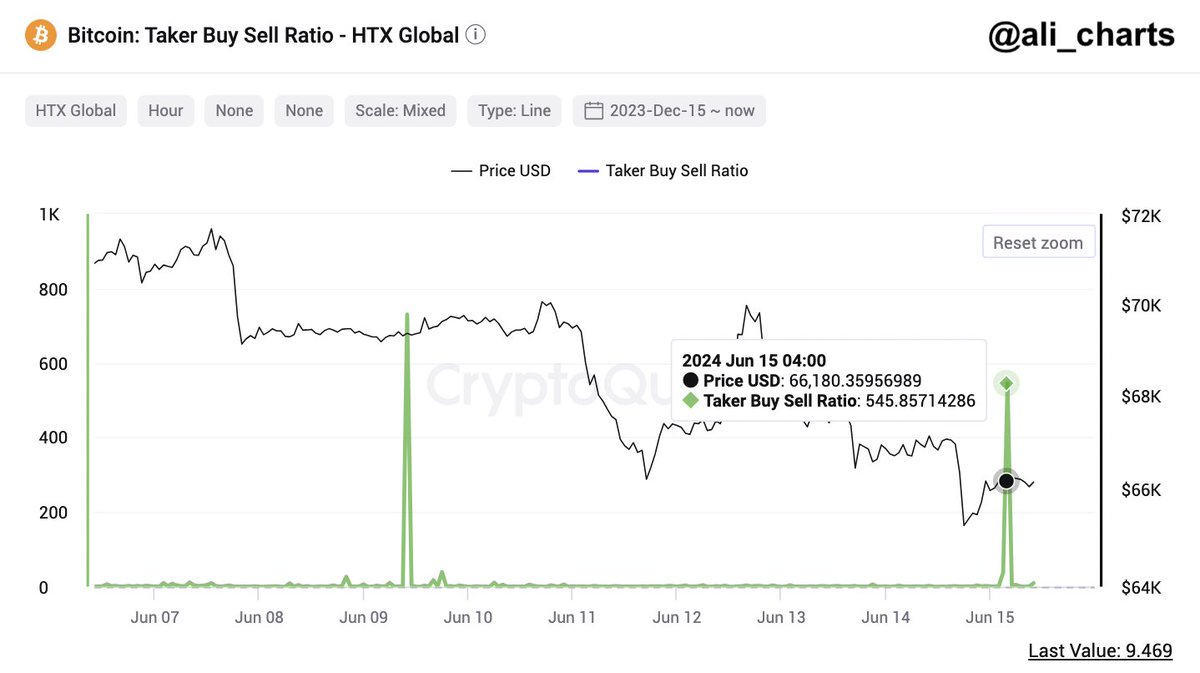

Famend cryptocurrency skilled Ali Martinez revealed on the X platform that traders on particular exchanges have been making the most of the latest decline in Bitcoin costs. The related metric right here is the taker purchase/promote ratio, which measures the ratio between the amount taken by takers and the amount taken by takers offered.

Usually, when the worth of this indicator is larger than 1, it signifies that the taker shopping for quantity on the related trade is larger than the taker promoting quantity. On this case, extra merchants are prepared to purchase the coin at a better worth on the buying and selling platform.

Quite the opposite, when the taker purchase/promote ratio is decrease than 1, it signifies that extra sellers are prepared to promote cash at a lower cost, indicating that the promoting quantity is larger than the shopping for quantity.

Bitcoin taker purchase/promote ratio | Supply: Ali_charts/X

In accordance with CryptoQuant information, the Bitcoin taker purchase/promote ratio on HTX trade (previously often called Huobi) not too long ago surged above 545 on Saturday. This exhibits a major enhance in shopping for strain and a shift in investor sentiment.

In a publish on X, Martinez famous {that a} spike in bullish strain could possibly be an indication that Bitcoin’s worth is about to rise. The excessive shopping for quantity on HTX trade comes towards the backdrop of BTC’s latest drop to $65,000.

Nevertheless, it’s value noting that the typical Bitcoin taker purchase/promote ratio throughout all exchanges stays under 1.

Common BTC mining price surges above $86,500

Newest information exhibits that the typical price of mining Bitcoin has surged to $86,668. This quantity displays the cumulative charges related to producing 1 BTC, together with electrical energy, {hardware}, and working prices.

As Ali Martinez highlighted in an article on In opposition to this historic backdrop, the newest enhance in common mining prices means that Bitcoin’s worth could also be about to rise.

#bitcoinThe present common mining price is $86,668.

guess what? Traditionally, Bitcoin USD At all times larger than its common mining price! pic.twitter.com/S3UkwgvS3N

— Ali (@ali_charts) June 15, 2024

As of this writing, Bitcoin worth continues to hover across the $66,000 mark, with no vital adjustments over the previous day. The foremost cryptocurrency has fallen practically 5% over the previous week, in keeping with CoinGecko.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Barron’s, chart from TradingView