The Bitcoin market has undergone important modifications just lately, influenced by macroeconomic components and modifications in investor sentiment. Digital asset funding merchandise noticed important outflows final week, which CoinShares attributed to a number of key financial updates.

These embrace the discharge of US Shopper Worth Index (CPI) knowledge, Federal Open Market Committee (FOMC) assembly and Producer Worth Index (PPI) knowledge. These occasions appeared to set off a speedy surge in Bitcoin’s value, pushing it to the $70,000 mark at one level earlier than shortly sliding again to regulate valuations again to round $65,000.

Associated Studying

Market Shift: Bitcoin faces large outflows whereas some altcoins appeal to funding

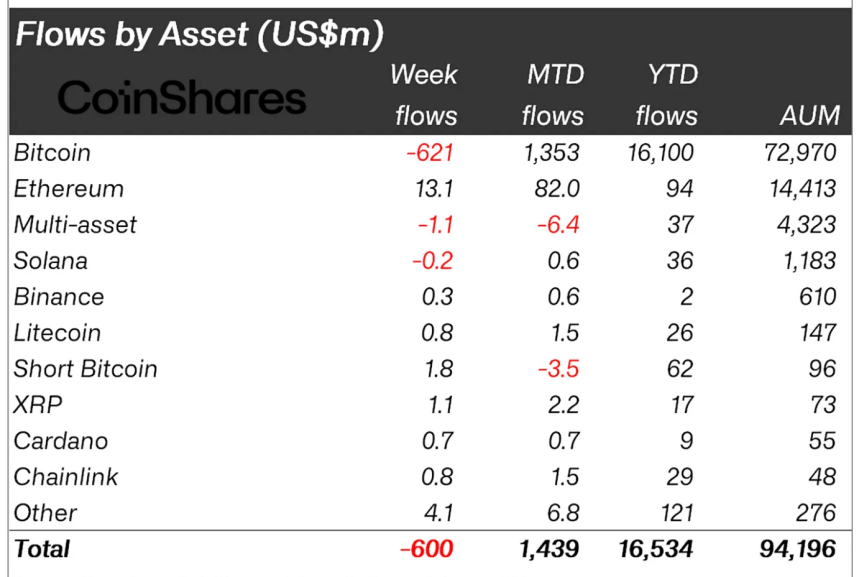

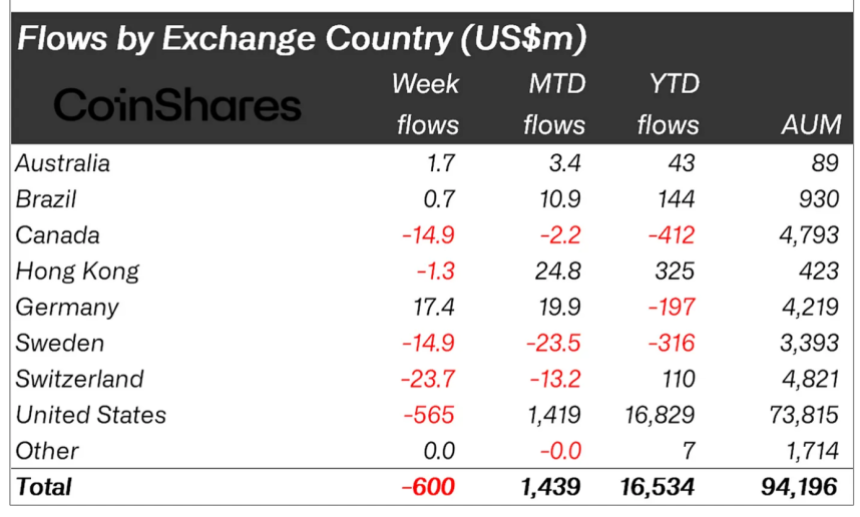

To date, the fluctuations in Bitcoin’s value have been a part of a broader sample of volatility within the digital foreign money market. Final week alone, establishments and retail buyers withdrew roughly $600 million from crypto funds, marking a big retreat.

CoinShares mentioned this may increasingly sign an more and more cautious development, amplified by the “hawkish stance” on the latest FOMC assembly, which can encourage buyers to scale back publicity to risky property akin to cryptocurrencies.

Bitcoin was the worst affected, dealing with outflows totaling $621 million. Nonetheless, there’s a glimmer of hope as altcoins akin to Ethereum, Litecoin and others have seen small inflows. Ethereum leads the way in which with positive aspects of $13 million, exhibiting that investor confidence in altcoins is split in comparison with Bitcoin.

The scenario presents a combined view, with Bitcoin struggling underneath promoting stress whereas sure altcoins are gaining marginal traction. In the meantime, the general impression in the marketplace is obvious, with complete property underneath administration falling from greater than $100 billion to $94 billion in every week.

Buying and selling quantity additionally fell sharply from the annual common, indicating a cautious method by merchants throughout the board. From a regional perspective, whereas the USA has been hit by capital outflows, international locations akin to Germany have seen capital inflows, demonstrating the various international responses to the present financial local weather.

Bitcoin ETFs have combined fortunes

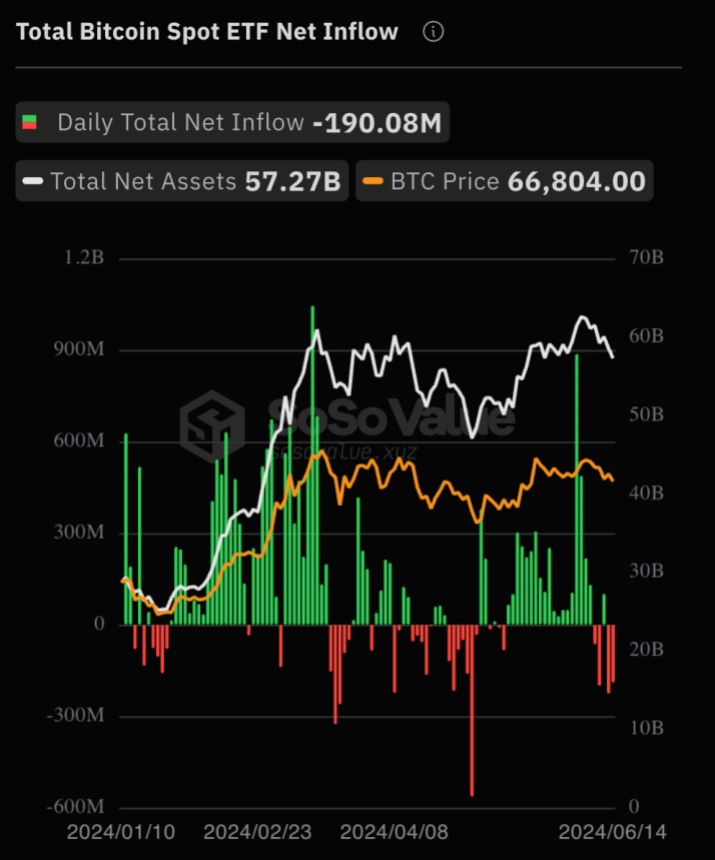

Whereas general web inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) have grown steadily in latest weeks, reaching $15.11 billion, the trade skilled a downturn final week, with knowledge exhibiting day by day web outflows of $190 million. A lot worth.

Taking a look at market efficiency, the worth of Bitcoin has fallen sharply, hitting a low of $65,398 final Friday. Nevertheless, as of at present, Bitcoin value has recovered barely to $65,552, however continues to be down 1.1% prior to now day and 5.5% within the week.

Talking about Bitcoin spot ETFs, BlackRock Chief Funding Officer Samara Cohen noticed gradual however regular curiosity in Bitcoin spot ETFs, though their uptake has been slower than anticipated.

Cohen mentioned that at present the vast majority of Bitcoin ETF transactions (about 80%) are performed by “autonomous buyers” utilizing on-line brokerage platforms.

Cohen added that the iShares Bitcoin Belief (IBIT) is without doubt one of the ETFs launched this 12 months that has attracted consideration from particular person buyers, hedge funds and brokerage companies, as proven in its latest 13-F submitting.

Associated Studying

Nevertheless, participation from registered funding advisors stays comparatively low, Cohen mentioned on the latest Crypto Summit.

Featured picture created utilizing DALL-E, chart from TradingView