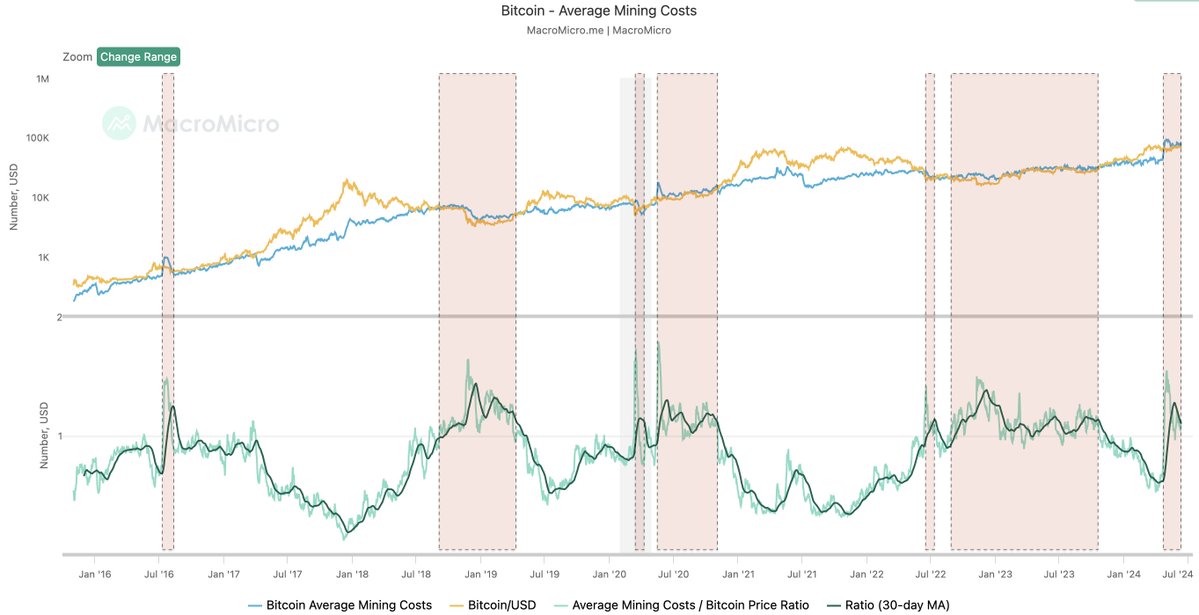

Information exhibits that the present common value of Bitcoin mining is roughly $86,700. Historical past suggests right here’s what’s prone to occur subsequent for Bitcoin.

Common Bitcoin mining prices are at present considerably increased than worth

In a brand new article on X, analyst Ali Martinez talked concerning the present common value of mining BTC. The Bitcoin community runs on a consensus mechanism primarily based on “proof of labor”, during which validators known as miners compete with one another utilizing computing energy to hash the subsequent block on the chain.

This computing energy naturally has its working prices, with electrical energy being probably the most vital expense that miners should pay as a result of it’s a everlasting value. The motivation to spend cash on a mining operation is the block reward these validators obtain after efficiently including the subsequent block.

Clearly, mining charges differ by location as a result of electrical energy costs will not be the identical all over the place. Subsequently, the MacroMicro chart cited by Ali makes use of BTC energy consumption knowledge supplied by the College of Cambridge to seek out the typical.

Associated Studying

Under is a associated chart displaying how the typical value of mining on the Bitcoin community has modified over the previous few years.

As you may see from the chart above, earlier this 12 months, the typical Bitcoin mining value (blue) had been decrease than the worth of the cryptocurrency, however lately, the previous has surged in worth and surpassed the latter.

The rationale behind this sudden improve is that there’s one other variable at play when calculating the typical value of Bitcoin mining: issuance, which is the variety of cash minted by miners per day.

Typically talking, the worth and frequency of block rewards stay fastened, and subsequently the community’s issuance (i.e., the sum of block rewards mined in a day) additionally stays kind of fastened.

Nevertheless, sure occasions don’t adjust to this rule. They’re halvers. These periodic occasions, which happen roughly each 4 years, completely reduce block rewards in half.

The newest such incident occurred in April, the fourth within the historical past of cryptocurrencies. In fact, the halving implies that the price of mining 1 BTC rises dramatically, as miners will solely obtain half the earlier reward for finishing the identical quantity of labor.

Subsequently, it’s no shock that the coin’s manufacturing prices elevated dramatically in the course of the latest halving. At the moment, this indicator stands at $86,700, which implies that the typical miner will likely be underwater in keeping with MacroMicro’s mannequin.

Associated Studying

Based mostly on previous developments on this indicator, Alibaba recognized a sample that Bitcoin has been following. “Traditionally, BTC has at all times surged above its common mining value!” the analyst famous.

Subsequently, if this sample continues within the present cycle as nicely, it could solely be a matter of time earlier than Bitcoin surges in direction of the $86,700 mark.

bitcoin worth

Bitcoin has lately fallen by greater than 5%, taking its worth beneath the $66,000 stage.

Featured photographs from Dall-E, MacroMicro.me, charts from TradingView.com