CRV, the native token of stablecoin decentralized alternate Curve Finance, has been promoting off over the previous yr or so. After final week’s plunge, the coin is down 75% from its March 2024 highs, which is a big concern for token holders.

CRV recovers, will increase by 45% after plunge

Nevertheless, in response to one analyst who follows X, the underside may very well be: debate Favorable basic occasions in about two months might push the coin to $2. CRV is altering palms at round $0.32, up 42% from final week’s lows.

Most significantly, costs are stabilizing, and the follow-through on June thirteenth was spectacular.

Associated Studying

What’s encouraging, nonetheless, is the longer decrease shadow, indicating welcome demand on the finish of the buying and selling day. The push was evident when costs closed greater the following day, with bulls extending positive factors over the weekend.

It stays to be seen whether or not the June 13 plunge marks the top of CRV’s woes. At present, an enormous 45% rebound from final week’s lows and enlargement in Ethereum value could create demand, additional pushing CRV in the direction of the $0.40 mark.

As Erogov’s dangerous money owed are settled, the curve of token issuance modifications

The analyst believes that large issues are brewing with Curve Finance as a protocol and CRV as a significant token launch platform. In mid-August, the coin’s inflation fee will drop from 20.37% to six.34%. This lower is primarily because of the protocol’s shift to CRV distribution.

Beginning August twelfth, Curve will mechanically cease allocating CRV to the core crew for redemption. As an alternative, the meter will distribute tokens on to the neighborhood, slashing inflation.

The curve indicator determines how CRV is allotted to varied liquidity swimming pools. By indicators, Curve Finance stays decentralized. It is because token holders can now vote on how a lot CRV a given pool’s liquidity suppliers can obtain as inducements.

Associated Studying

Along with modifications in CRV distribution, liquidation of Michael Egorov’s place remove Unhealthy debt drawback. Due to this fact, Curve can not generate actual earnings and extract worth for CRV holders.

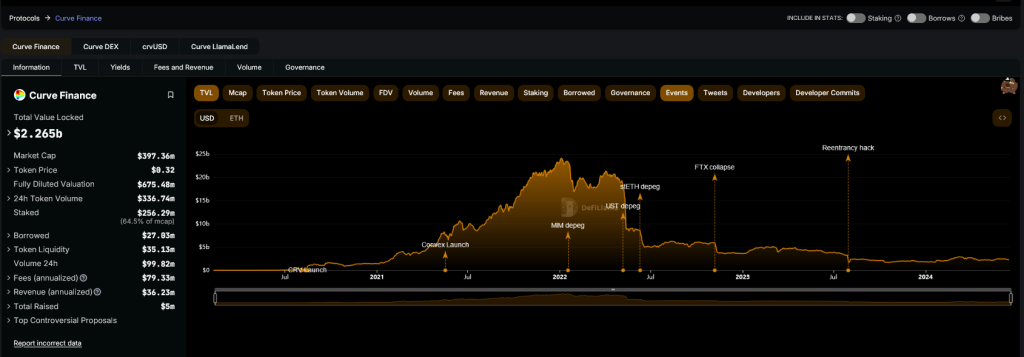

The analyst stated Curve might grow to be a number one decentralized international alternate market within the coming years. The protocol is among the largest decentralized finance (DeFi) platforms. In keeping with DeFiLlama, its complete worth locked exceeds $2.2 billion.

Function footage are from DALLE, charts are from TradingView