As Bitcoin falls under the $65,000 mark (presently buying and selling at $64,886), there’s a rising sense of urgency amongst merchants within the cryptocurrency market.

The newest downturn displays a broader pattern noticed over the previous week, with Bitcoin shedding round 2.4% in worth. It fell an extra 1% prior to now 24 hours alone, pointing to rising market jitters.

Associated Studying

Must you panic?

Analysts at blockchain analytics platform Santiment highlighted that the present part of decline is the biggest three-day drop in energetic Bitcoin wallets since their peak in early March, indicating a big shift in investor conduct and market sentiment.

Nevertheless, that is in stark distinction to ETH, as Ethereum wallets proceed to develop, indicating a cut up in investor confidence within the main cryptocurrency.

Regardless of the bearish stress on Bitcoin, the rise in Ethereum wallets factors to a bullish outlook for Ethereum. In the meantime, based on Bitfinex analysts, the continuing sell-off is considerably influenced by long-term Bitcoin holders and whales adjusting their holdings in the course of the market consolidation part.

This conduct is typical of long-term holders who select to scale back positions during times of market uncertainty to take benefit or mitigate losses.

Bitfinex analysts revealed that the Hodler Internet Place Change indicator has been exhibiting unfavourable values, indicating that these vital gamers are shifting their holdings to exchanges and probably promoting them, thereby exerting downward stress on Bitcoin costs.

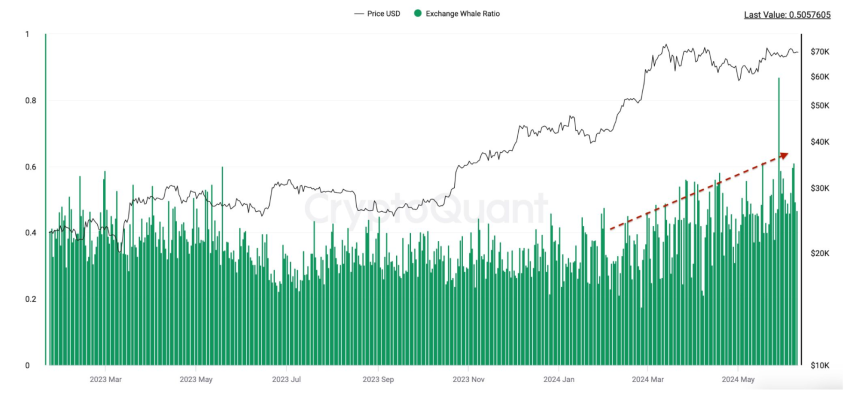

This pattern echoes the rising Bitcoin change whale ratio, which tracks the massive variety of deposits coming into exchanges relative to general market exercise.

As extra whales transfer Bitcoin onto the platform for buying and selling, the rise in potential provide in the marketplace may trigger the worth to fall.

Must you purchase it?

Regardless of these pressures, some analysts stay cautiously optimistic a few potential rebound. CrediBULL Crypto is a widely known analyst, suggestion On the

There’s a probability for us Bitcoin USD The underside is on this SFP.

Here is what I am watching proper now.

Sure, we technically nonetheless have entry to the “Dream Bulls” space under, however as I stated earlier than, it would not shock me to see a lead on this space.

That being stated, what you’re promoting is… pic.twitter.com/cI6moqbadJ

— CrediBULL Crypto (@CredibleCrypto) June 18, 2024

Funding charges within the cryptocurrency derivatives market are a key indicator of dealer sentiment. The newest knowledge from Coinglass exhibits that funding charges are barely constructive, which generally alerts a bullish outlook for merchants.

Associated Studying

It’s price noting that constructive funding charges imply extra merchants are betting on rising Bitcoin costs and are keen to pay a premium to carry lengthy positions in futures contracts.

Funding charges are barely constructive, indicating bullishness.

Purchase the dip.

👉https://t.co/iyLrhuoty0 pic.twitter.com/YFfCsGMTni

— CoinGlass (@coinglass_com) June 18, 2024

This indicator usually counteracts present market sentiment, suggesting that regardless of the sell-off, components of the market are bracing for potential worth features.

Featured picture created utilizing DALL-E, chart from TradingView