Knowledge reveals that the latest web acceptance of Bitcoin has largely been detrimental. What this might imply for asset costs.

Bitcoin web acceptance has been largely detrimental over the previous month

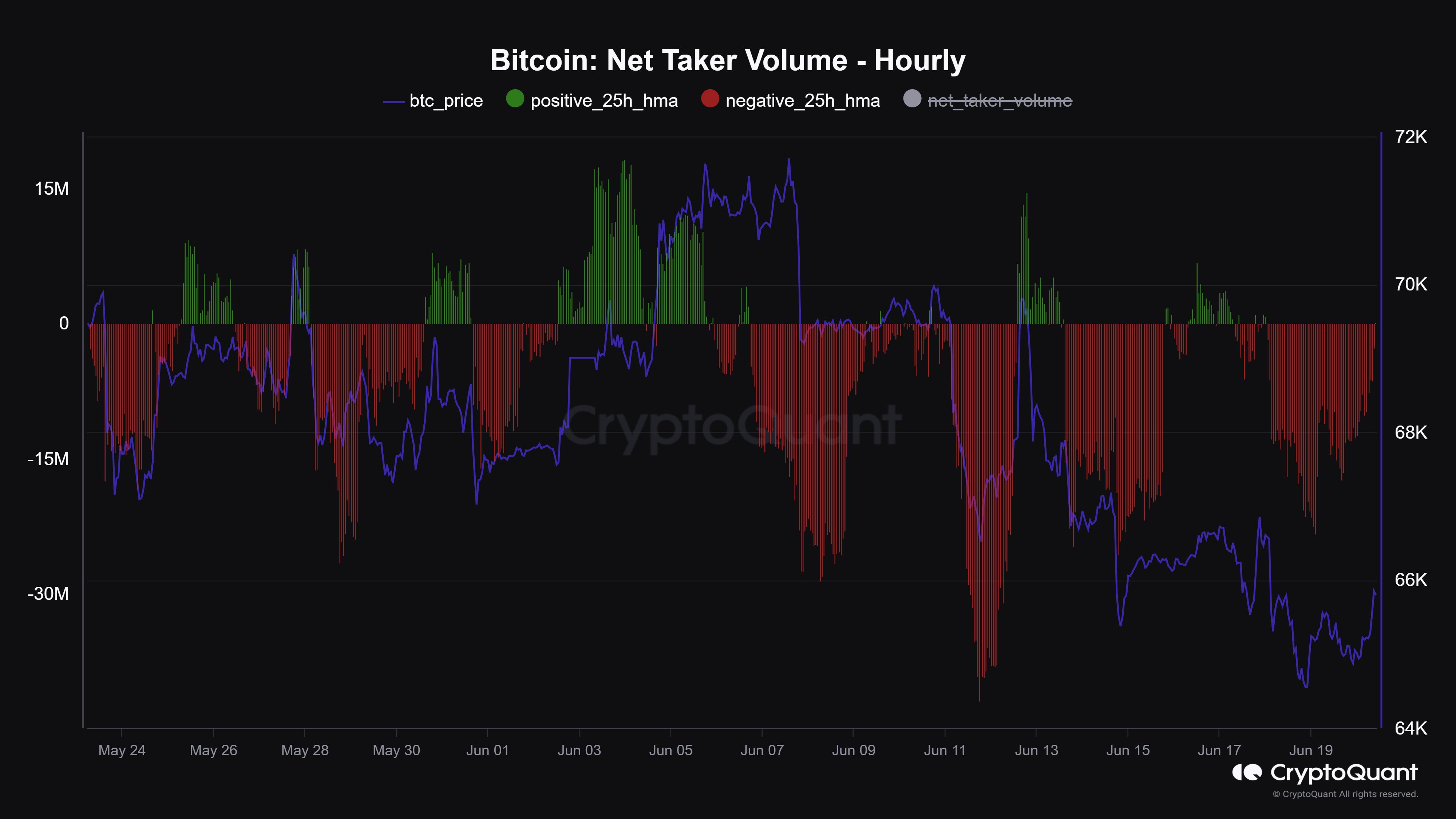

As CryptoQuant group supervisor Maartunn identified in a submit on X, the online taker numbers point out an absence of sturdy taker shopping for over the previous month.

Internet Taker Quantity is a metric that tracks the distinction between Bitcoin taker shopping for quantity and taker promoting quantity. After all, these two volumes measure the purchase and promote orders stuffed by the takers within the perpetual swap.

When the worth of this indicator is constructive, it signifies that the present bearer shopping for quantity is larger than the bearer promoting quantity. This development signifies that many of the market is holding a bullish sentiment.

Then again, the indicator is buying and selling beneath the zero line, indicating the dominance of bearish sentiment within the sector as brief quantity outweighs lengthy quantity.

Now, the chart beneath reveals the development in Bitcoin web acceptance over the previous month:

The worth of the metric seems to have been detrimental in latest days | Supply: @JA_Maartun on X

As proven within the chart above, there have been only some spikes in Bitcoin web taker quantity into constructive territory throughout this window, and the magnitude of those spikes was not too massive.

The indicator remained within the purple zone the remainder of the time, with vital detrimental values continuously noticed. Because of this, bullish promoting seems to have dominated the market final month.

The chart reveals that this era coincided with a section of great scale that was accompanied by will increase in cryptocurrency costs. Subsequently, if BTC has to get well, this indicator may have to show inexperienced once more.

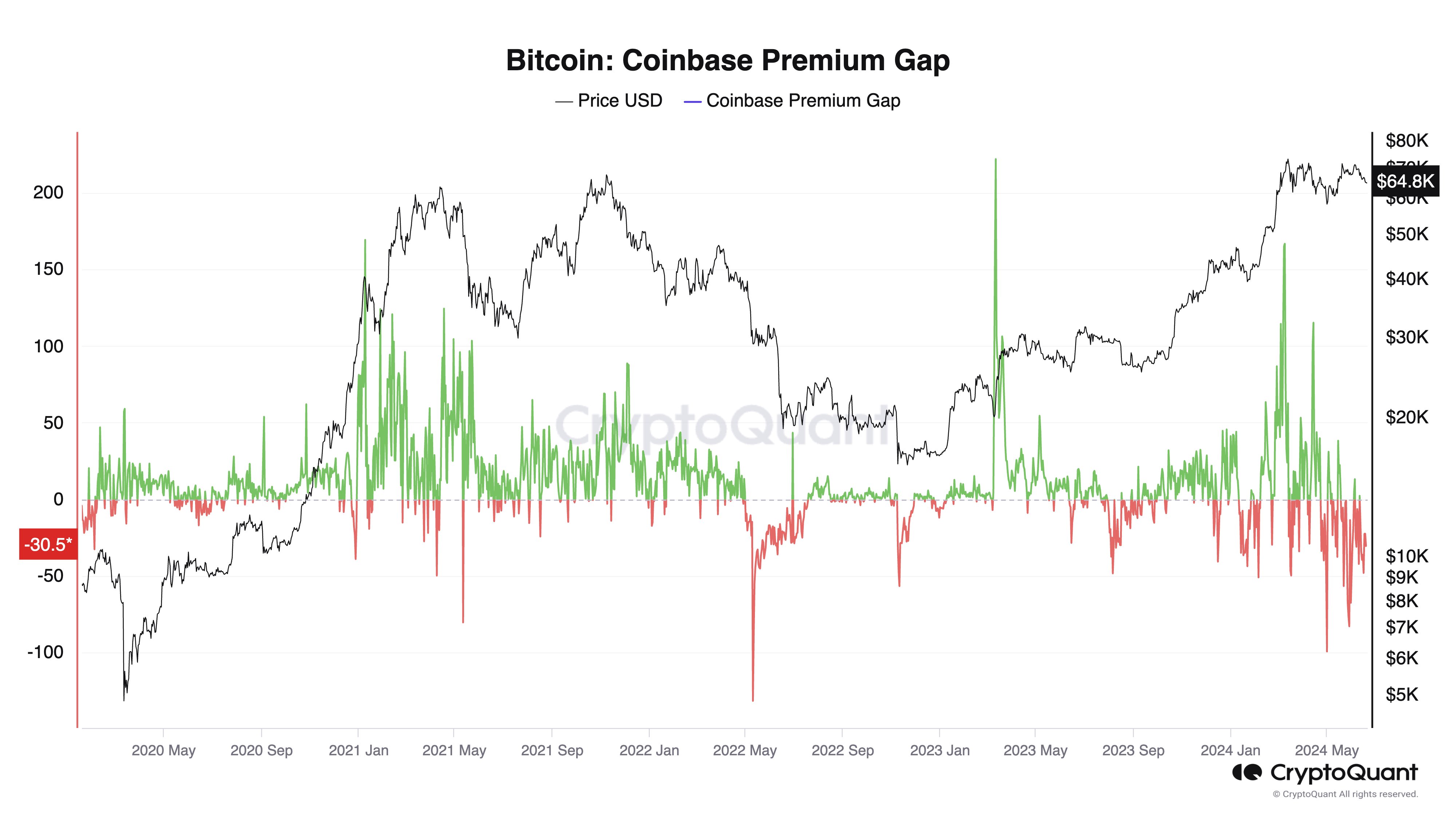

Internet acceptance isn’t the one indicator that has been bearish on Bitcoin not too long ago; as CryptoQuant founder and CEO Ki Younger Ju shared in an X submit, the Coinbase premium hole additionally seems to be detrimental.

Seems to be like the worth of the metric has been fairly purple in latest weeks | Supply: @ki_young_ju on X

Coinbase Premium Hole tracks the distinction between Bitcoin costs listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair). The worth of this metric displays how investor conduct on Coinbase differs from investor conduct on Binance.

As proven within the chart, the Bitcoin Coinbase premium hole has been in underwater territory not too long ago, suggesting that Coinbase is going through better promoting strain than Binance. This sell-off could also be one of many the explanation why the asset has been caught in consolidation these days.

bitcoin worth

Bitcoin is buying and selling round $64,800, a spread inside which the asset has been buying and selling sideways for a while.

The worth of the asset appears to have been taking place not too long ago | Supply: BTCUSD on TradingView

Featured photographs from Dall-E, CryptoQuant.com, charts from TradingView.com