One analyst defined that Bitcoin has traditionally recovered from bearish phases, very like the cryptocurrency is experiencing now.

Bitcoin hash ribbon reveals miner capitulation continues

In a brand new article on X, analyst Willy Woo discusses the correlation between Bitcoin hashrate and asset value restoration. “Hashrate” is a measure of the entire computing energy of miners at the moment related to the community.

The development of this indicator might be seen as consultant of the scenario amongst validators of those chains. When this indicator rises, it signifies that miners discover the chain engaging for mining now.

However, the decline on this indicator signifies that some miners have determined to disconnect from the community, presumably as a result of they at the moment discover mining BTC unprofitable.

One method to gauge whether or not these behaviors are a unbroken development is thru “hash bands.” This indicator compares the short-term shifting common (MA) of hash price to the long-term shifting common.

When the previous fell beneath the latter, the miners surrendered en masse. Likewise, the alternative sort of crossover signifies that the capitulation of the group is over.

Now, what does hash striping should do with asset costs? As Woo factors out, Bitcoin reveals a restoration when “weak miners die and hashrate recovers.” This corresponds to the part the place market capitulation ends.

Under is a hashband chart shared by analysts exhibiting the present scenario for miners.

The info for the BTC hash ribbons over the previous a number of years | Supply: @woonomic on X

As proven within the picture, Bitcoin hash bands point out that miners are experiencing capitulation. The explanation why miners are in a nasty scenario is because of the halving occasion in April.

Halving is a cyclical occasion that happens each 4 years and completely cuts the community’s block reward in half. The block reward right here naturally refers back to the reward obtained by mining employees for fixing the compensation of blocks on the chain.

These rewards make up a significant portion of this group’s earnings, so reducing them in half might considerably influence their monetary well-being. Subsequently, it’s no shock that hashrate has been on a downward development just lately.

An fascinating factor in regards to the newest capitulation is that the hash belt has been signaling this for 61 days. “This has gone down in historical past as a result of it took a very long time for miners to give up after the halving,” Woo stated.

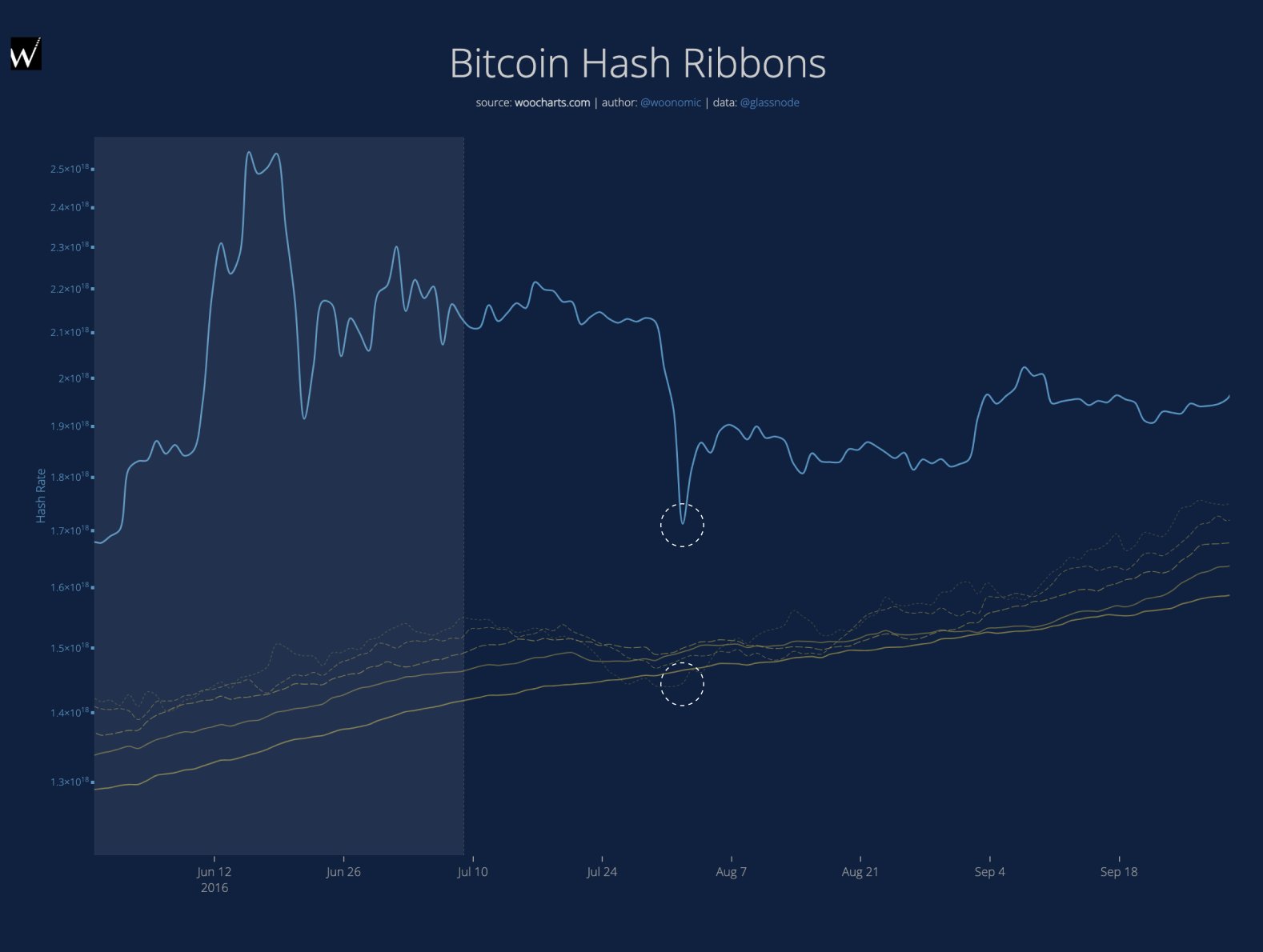

For comparability, this is a close-up of a worrying mining interval in 2016:

The miner capitulation occasion main as much as the 2017 bull run | Supply: @woonomic on X

It took miners 24 days to see a restoration on the time, which is considerably shorter than the length of capitulation occasions up to now within the present cycle. The shorter one in 2020, the hash band had a reverse crossover in 8 days.

The 2020 miner capitulation | Supply: @woonomic on X

It now stays to be seen when the hash bands will cross once more this time and whether or not the resurgence of miners will even result in a resurgence of Bitcoin costs.

bitcoin value

As of this writing, Bitcoin is buying and selling round $63,900, down greater than 4% over the previous week.

Appears to be like like the worth of the coin has been on the decline just lately | Supply: BTCUSD on TradingView

Featured photos from Dall-E, woocharts.com, charts from TradingView.com