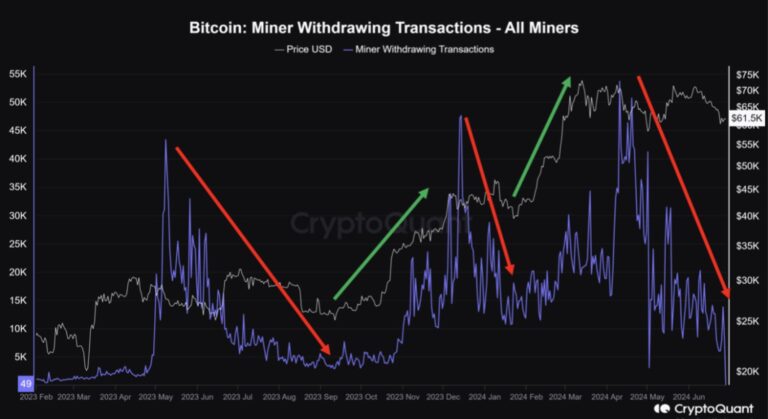

Evaluation supplied by CryptoQuant reveals important modifications in Bitcoin miner habits that might sign a turning level. CryptoQuant analyst Crypto Dan outlined the discount in miner promoting strain, which has traditionally been a key think about Bitcoin’s value trajectory.

Bitcoin mining promoting strain drops

Crypto Dan stated, “The promoting strain on miners has decreased. One of many whales chargeable for the latest decline within the cryptocurrency market has been miners. He defined that the Bitcoin halving resulted within the halving of mining rewards, leading to outdated, much less environment friendly mining. This alteration has diminished the usage of gear, thereby lowering general mining exercise, forcing miners to promote Bitcoin by means of over-the-counter transactions (OTC) to keep up operations.

Evaluation exhibits that the market is at present absorbing the sell-off, with a major lower within the quantity and frequency of Bitcoin being transferred out of miner wallets. Crypto Dan stated: “The present market could be seen as pricing on this sell-off, and thankfully the amount and quantity of Bitcoin despatched by miners from wallets has been lowering quickly of late.”

Associated Studying

The affect of this shift is important. Crypto Dan added, “In different phrases, the promoting strain from miners is weakening, and if all their promoting quantity is absorbed, there could also be a state of affairs the place it continues to rise once more.” He’s optimistic concerning the market and predicts that within the third quarter of 2024 There will probably be a optimistic development.

CryptoQuant’s historic knowledge corroborates this evaluation. BTC has beforehand proven the same sample, with miner promoting exercise having a powerful affect on market costs, notably between Might and September 2023 and between December 2023 and January 2024. BTC costs have been buying and selling sideways for a very long time, coinciding with peaks in miner gross sales. Notably, when these promoting actions subsided, Bitcoin value resumed its upward development.

This sample means that the latest lower in miner promoting may very well be a precursor to a different important bullish section for Bitcoin, as market situations seem ripe for the same reversal of fortune.

Key value ranges for bullish breakout

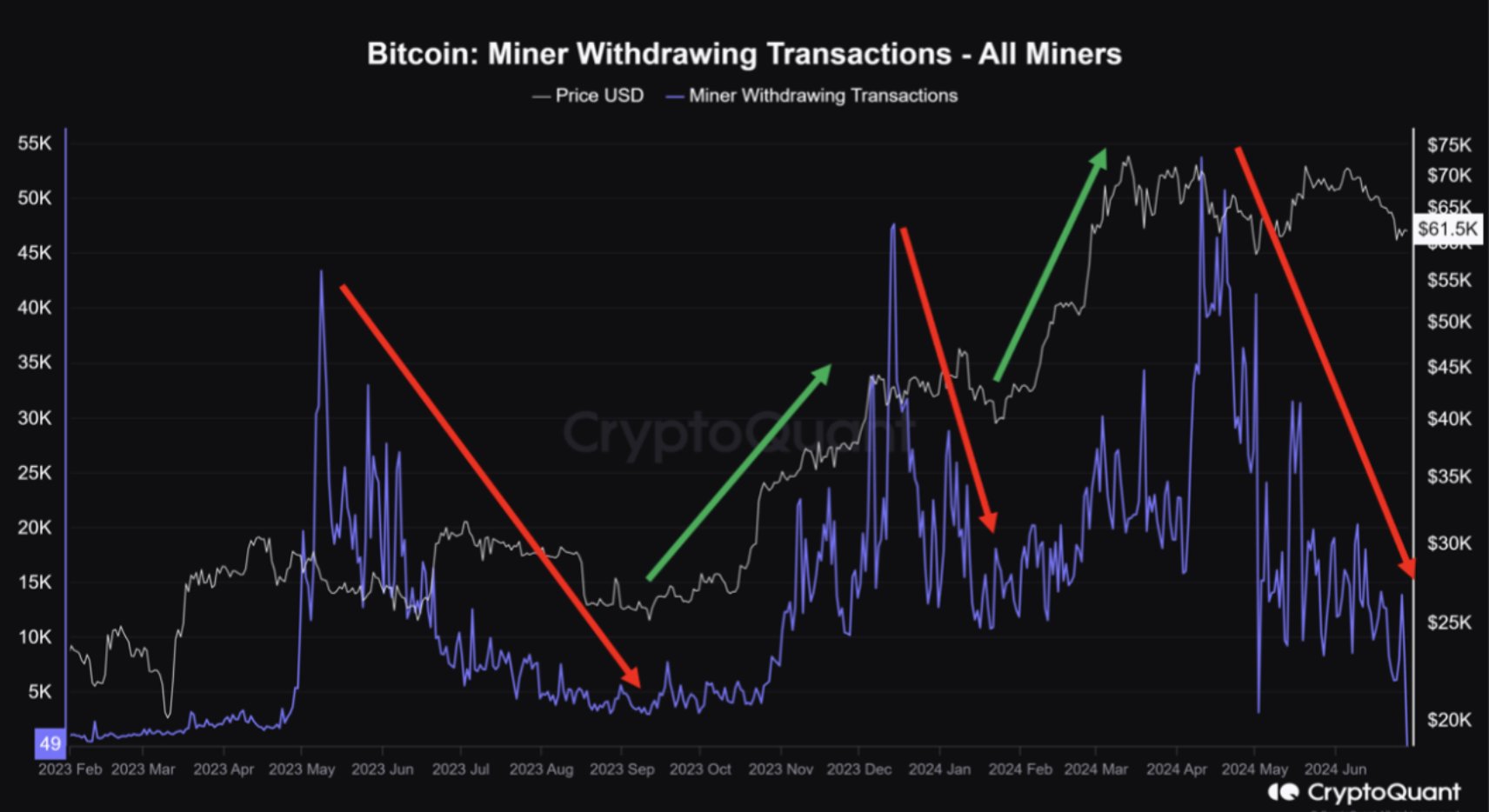

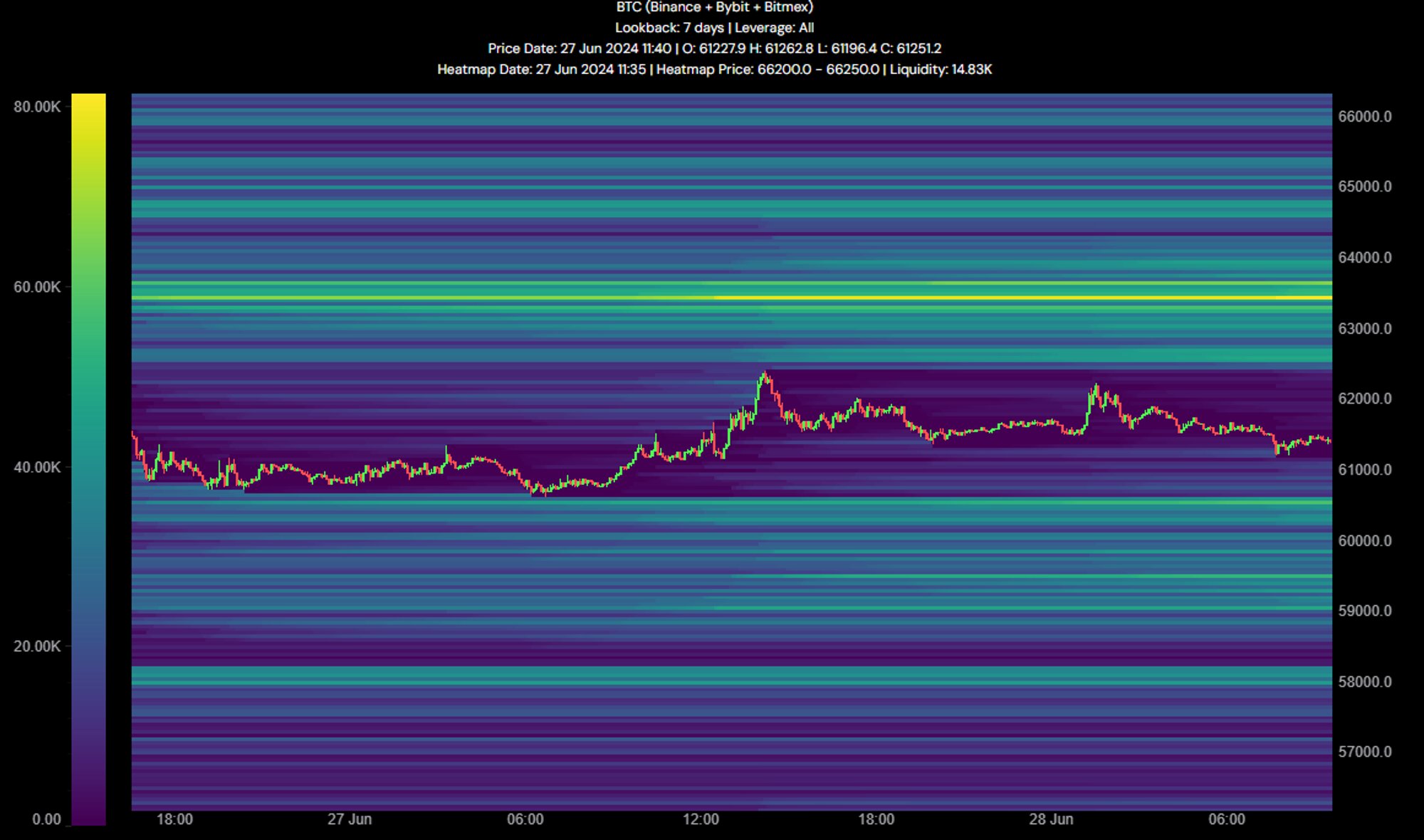

Additional insights from alpha dōjō technical analysts present an in depth understanding of market situations. Their every day replace on Bitcoin by way of Nonetheless, analysts have recognized key value ranges that might sign future market actions: “If BTC regains the $63,500 space, it is going to be bullish; if it falls beneath the $60,000 degree, it is going to be bearish.

Associated Studying

Technical evaluation additionally exhibits that the present Bitcoin market liquidity is comparatively scattered and lacks substantial cluster orders. Essentially the most notable orders had been clustered across the $63,500 degree, indicating that this value level is crucial for market sentiment and underlying bullish momentum.

Order e book knowledge supplied by alpha dōjō highlights the present dominance of promote orders, indicating bearish sentiment amongst merchants. Conversely, patrons are described as weak, with fewer purchase orders supporting value will increase. This imbalance exhibits that the market is at present cautious and should await clearer alerts earlier than establishing extra substantial positions.

At press time, BTC was buying and selling at $61,704.

Featured picture created with DALL·E, chart from TradingView.com