On-chain knowledge reveals that the provision of long-term Bitcoin holders has continued to say no lately. What this might imply for the asset.

The 30-day change in Bitcoin provide for long-term holders has lately been detrimental

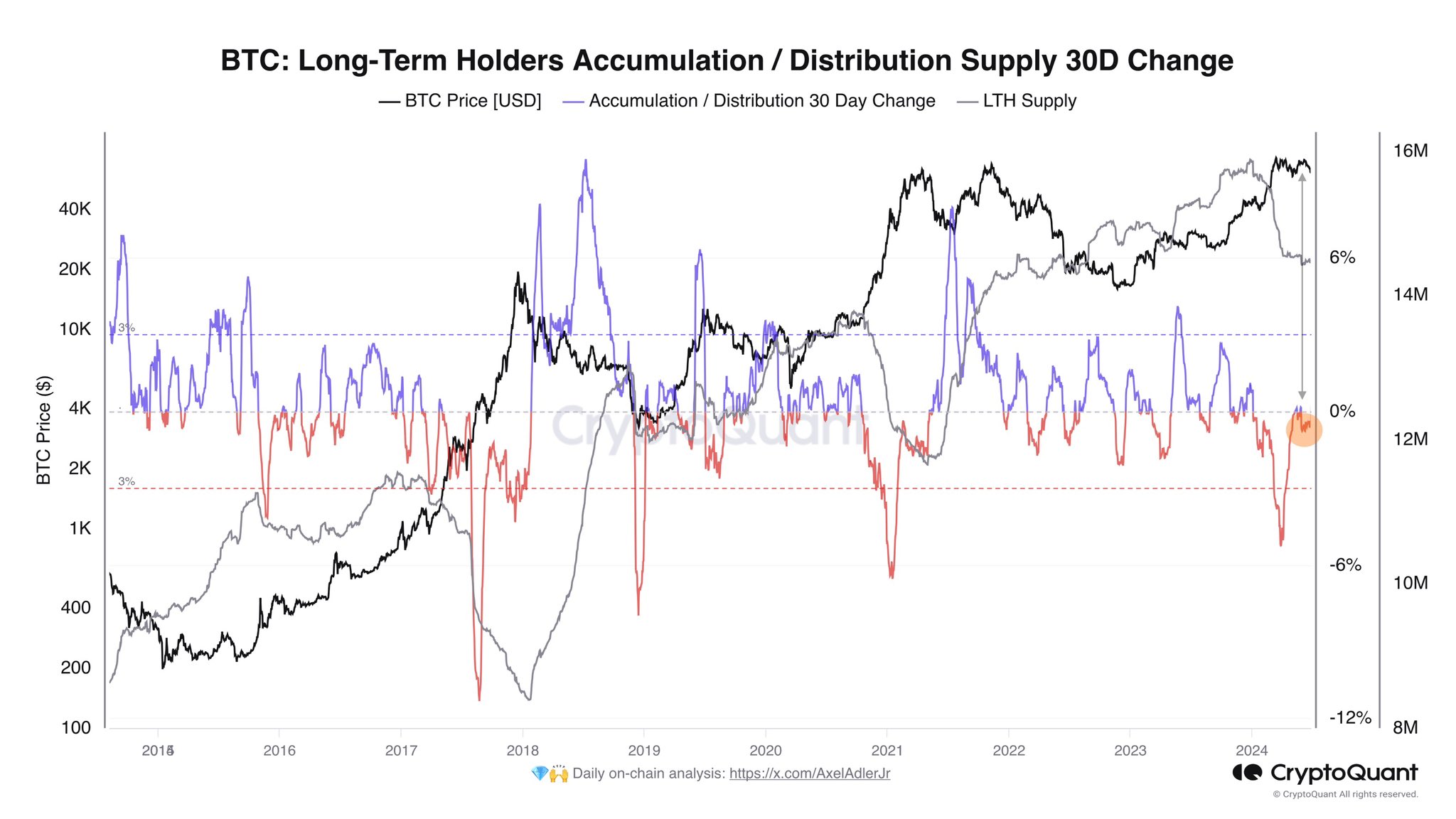

As CryptoQuant writer Axel Adler Jr defined in an article on X, the provision of BTC to long-term holders has not proven any indicators of rising lately. “Lengthy-term holders” (LTH) check with Bitcoin traders who maintain Bitcoin for greater than 155 days.

LTH is among the two principal segments of the BTC market primarily based on holding time, the opposite group is known as “short-term holders” (STH).

Statistically, the longer an investor holds a token, the much less probably they’re to promote it at any level. Due to this fact, LTH is taken into account a cussed phase of the business, whereas STH contains traders with fickle concepts.

Regardless of its resilience, Bitcoin LTH has been concerned in a sell-off lately. The chart under reveals the development within the complete provide held by these HODLers and its 30-day change over the previous decade.

The worth of the metric appears to have been detrimental in current weeks | Supply: @AxelAdlerJr on X

The chart above reveals that Bitcoin LTH provide has been declining for the reason that spot exchange-traded fund (ETF) was authorised by the U.S. Securities and Alternate Fee (SEC) in January.

As is obvious from the 30-day change chart, the indicator’s steepest declines happen when costs rally to new all-time highs (ATH).

These diamond merchants maintain their currencies for the long run and have a tendency to build up giant positive factors. The timing of the sell-off suggests these income had been so inflated in the course of the rally that even these diamond arms fell into the temptation of taking income.

Regardless of the bearish worth motion the cryptocurrency has skilled lately, the indicator continues to fall, albeit at a a lot smaller fee.

The continued retracement is much more fascinating because the authorised launch of the spot ETF is now over 155 days previous. It seems that no matter shopping for habits occurred by holders at the moment is presently being offset by contemporary promoting by members of the older cohort.

Axel famous that the shortage of development in LTH provide may point out pessimism throughout the market. Because the chart reveals, that is nothing new on this cycle.

It seems that Bitcoin LTH has additionally participated within the sell-off over the last two bull runs. Due to this fact, the current distribution of LTH could not essentially be a nasty sign up the long run.

bitcoin worth

As of this writing, Bitcoin is buying and selling round $61,200, down greater than 4% over the previous week.

Seems like the value of the coin has been taking place over the previous few days | Supply: BTCUSD on TradingView

Featured photos from Dall-E, CryptoQuant.com, charts from TradingView.com