Bitcoin has lengthy been an icon of the cryptocurrency market, thriving on its 24/7 accessibility. Weekend buying and selling, as soon as a infamous breeding floor for volatility, is particularly vital within the cryptocurrency house.

Nevertheless, a latest report from Kaiko reveals a much less optimistic image – Bitcoin’s weekend buying and selling volumes have fallen to all-time lows, probably signaling a brand new period dominated by institutional weekday warriors.

Associated Studying

Bitcoin buying and selling exercise suspended

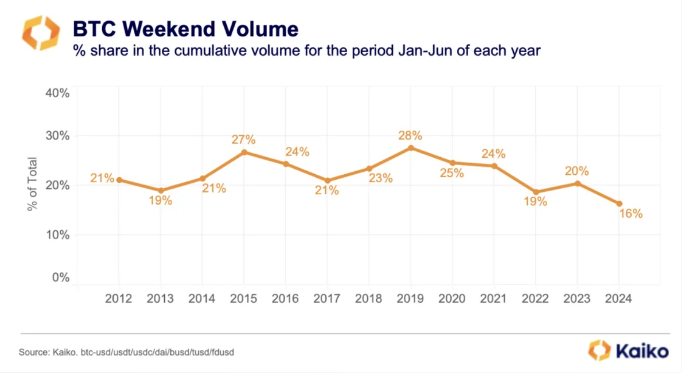

Kaiko’s information is easy: Bitcoin’s weekend buying and selling exercise has shrunk considerably, from a excessive of 28% in 2019 to simply 16% in 2024. These exchange-traded funds mirror the conduct of shares and might solely be traded throughout conventional market hours.

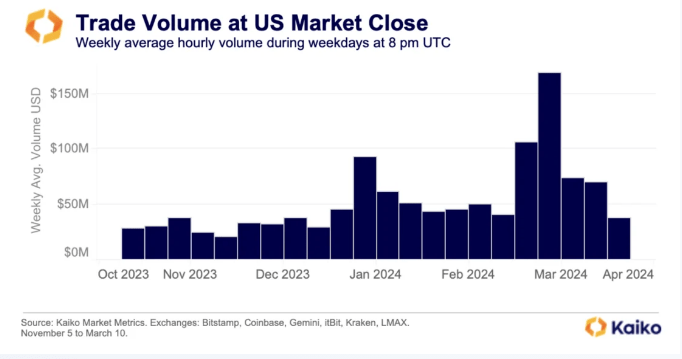

The impression of institutional traders who are likely to favor these regulated merchandise is obvious. The report highlighted a surge in Bitcoin buying and selling exercise through the “base mounted window” – the final hour of U.S. inventory market buying and selling. This implies establishments are shaping new buying and selling patterns, prioritizing weekdays over the as soon as lively weekends.

Past the Weekend: Multifaceted Market Transformation

The decline in weekend exercise is not simply attributable to ETFs. The closure of crypto-friendly banks similar to Signature and Silicon Valley Financial institution in March 2023 is one other contributing issue. These establishments present 24/7 infrastructure that allows market makers to repeatedly place purchase and promote orders. Their absence created a liquidity void over the weekend, additional dampening buying and selling exercise.

The altering panorama is not all doom and gloom, nevertheless. The report presents a glimmer of hope for traders in search of stability. The discount in volatility over the weekend might make Bitcoin a extra predictable asset, probably attracting a brand new wave of institutional curiosity. Moreover, historic tendencies recommend July might be a constructive month for Bitcoin, with costs rising in seven of the previous 11 Julys.

The approaching unrest?

Whereas the buying and selling scene might have calmed down over the weekend, the cryptocurrency market seems to be set to be a bit unstable within the coming weeks. The potential approval of an Ethereum ETF might additional drive institutional participation and will impression Bitcoin’s dominance.

Associated Studying

the highway forward

The drop in weekend buying and selling exercise alerts a possible paradigm shift within the Bitcoin market. Whereas the as soon as tumultuous weekend could also be a factor of the previous, the approaching months promise to be eventful.

Institutional traders at the moment are within the highlight, shaping new buying and selling patterns and probably ushering in an period of better stability. Nevertheless, this month might nonetheless deliver important volatility, retaining traders nervous.

Featured picture from Inc. journal, chart from TradingView