Bitcoin is trending increased at spot charges, rebounding after breaking above $63,000 on June 30. Though momentum is constructing, the coin’s value motion stays controversial. Nonetheless, some stay skeptical and are justified in considering the valuation could also be overvalued.

Analyst: Bitcoin is overvalued, and right here’s why

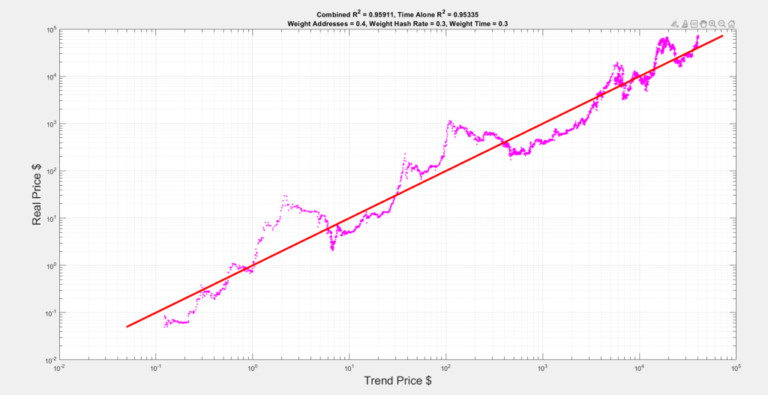

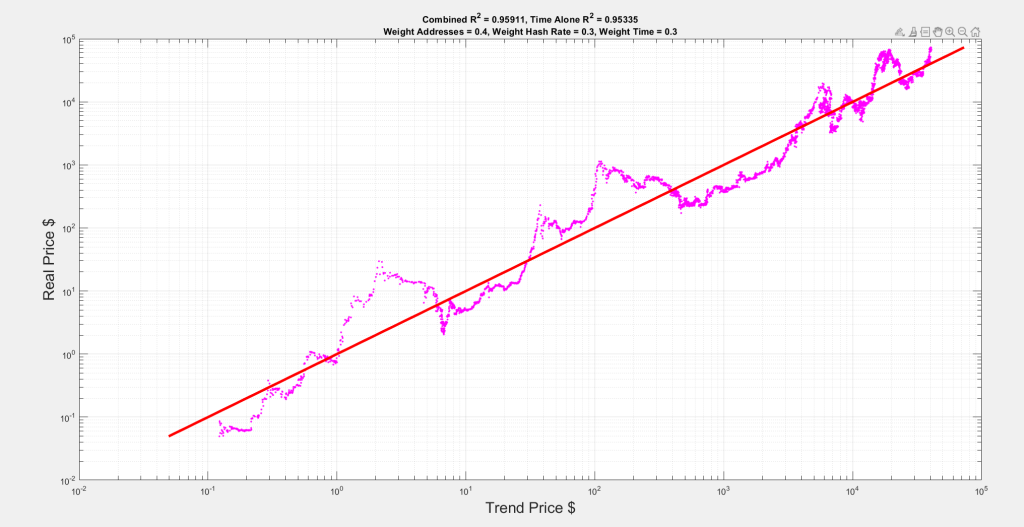

In an article on All in all, the analyst mentioned, the preview takes under consideration a number of parameters, together with time, the variety of energetic Bitcoin addresses and hash price.

The analyst mentioned that by way of this mannequin, there are causes to doubt the upward pattern, thus dampening the sentiment of optimistic holders who anticipated the bulls to proceed to rise. As of this writing, Bitcoin is again in its multi-week vary, capped at all-time highs with help at $56,800 in Could.

Associated Studying

Trying on the value motion, it is clear that patrons are within the driver’s seat, at the very least from the top-down preview. Regardless of the decrease lows, particularly when the worth broke $60,000 in Could, bulls nonetheless had the chance to preview the top-down.

Notably, after rising within the first quarter of 2024, the worth is inside a bull flag sample.

Trying on the day by day chart, patrons failed to interrupt above $74,000, whereas $72,000 is a powerful liquidation line. Within the brief time period, the pattern might flip if the worth decisively breaks $66,000, particularly if buying and selling quantity picks up.

Germany sells off as BTC rises relative to US M1 cash provide

The current sell-off by the German authorities has additional fueled issues. On July 1, they transferred 1,500 Bitcoins price greater than $94 million. Lookonchain information reveals that 400 BTC was despatched to a few exchanges together with Bitstamp.

Whereas it is unclear whether or not they bought them, sending them to exchanges means they had been eager to dump them – which is a internet bearish transfer. Addresses related to the German authorities presently maintain greater than 44,000 BTC, price greater than $2.5 billion at spot charges.

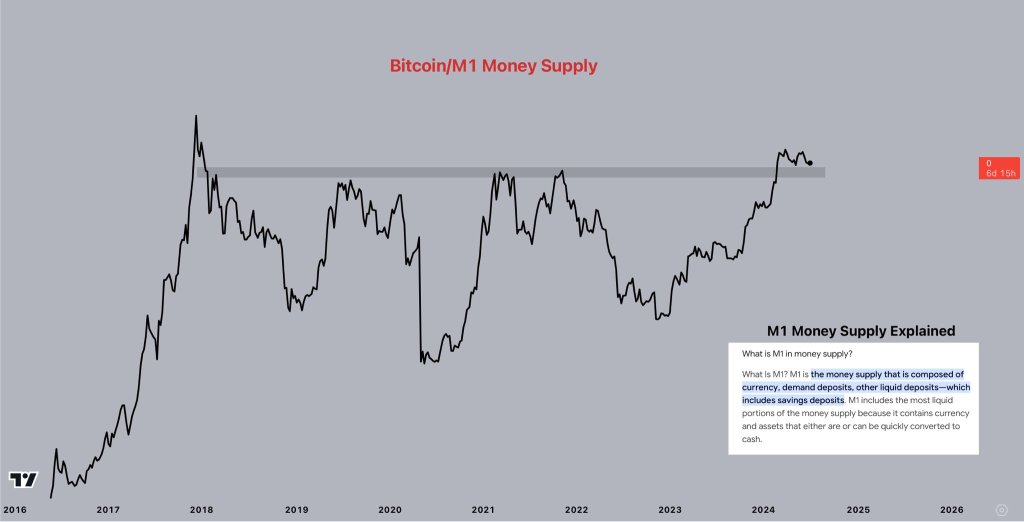

Even with these issues, others stay bullish on Bitcoin. Citing the connection between the U.S. M1 cash provide and BTC value, one analyst mentioned the coin is gearing up for a significant rise.

Trying on the chart, analysts consider that Bitcoin has but to achieve a brand new all-time excessive relative to the U.S. M1 cash provide in additional than six years.

Associated Studying

Nevertheless, given the regular surge in BTC costs since mid-2023, it’s possible that bulls will take over and push Bitcoin to new all-time highs.

Characteristic photos are from DALLE, charts are from TradingView