Bitcoin (BTC) has struggled to regain bullish momentum currentlyNonetheless in a consolidation section, it’s simply above the important thing $60,000 help stage. Regardless of reaching an all-time excessive three months in the past, the biggest cryptocurrency fell to $59,500 on Wednesday as promoting strain mounted on miners.

Bitcoin sell-off craze

Ongoing miners give upIt’s the longest noticed for the reason that FTX implosion in the summertime of 2022, displaying the supply-squeezing impact of Bitcoin’s halving.

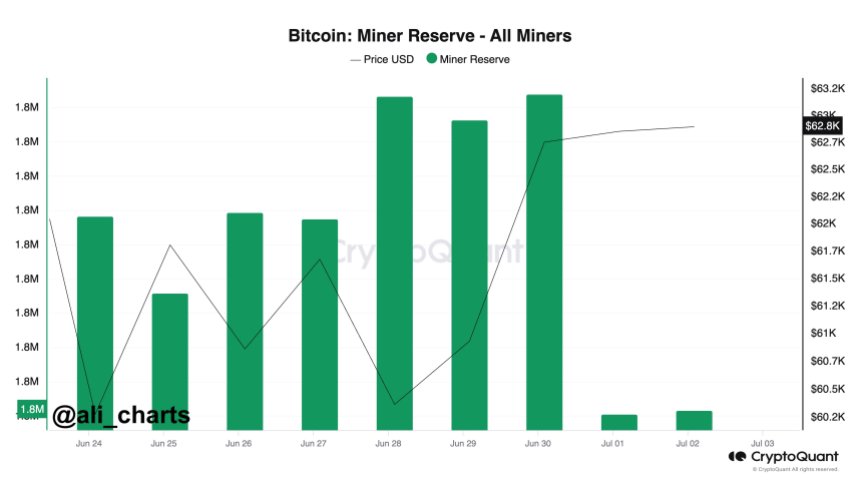

Cryptocurrency analyst Ali Martinez famous that Bitcoin miners Offered Over 2,300 BTC prior to now 3 days, totaling roughly $145 million.

Associated Studying

Promoting strain from miners has intensified current Bitcoin offered by US and German governmentsincluding to the downward strain in the marketplace and conserving the worth inside the decrease vary of the broader consolidation zone between $60,000 and $70,000 that has emerged in current months.

Notably, addresses related to the German and US governments have despatched $737 million value of BTC in numerous transactions to exchanges comparable to Coinbase, Bitstamp, and Kraken.

as promoting strain Because the strain from governments and miners subsides over time, market observers count on that Bitcoin’s worth could rebound, following the standard sample noticed within the post-halving interval, which generally results in new all-time highs.

Bitcoin Worth Outlook

Market skilled Scott Melk level out The market could also be approaching a key sign that would result in a bullish divergence if the every day candle closes beneath the $60,300 stage.

This may contain the every day RSI (relative power index) shifting out of oversold territory, just like final August when costs have been round $26,000.

Melk emphasised that the closing worth have to be beneath the above-mentioned ranges earlier than the RSI will transfer considerably upward with none changes. low low. The RSI would want to fall considerably beneath its June 24 ranges.

Associated Studying

Nevertheless, cryptocurrency analyst Andrew Kang highlighted the significance of potential losses in Bitcoin’s four-month swing vary, which is analogous to the vary noticed following BTC and altcoin’s parabolic rally in Might 2021.

kang notes Cryptocurrency leverage of greater than $50 billion is presently close to all-time highs, coupled with the truth that the market has been in a chronic consolidation section for 18 weeks with out experiencing the acute whipsaw throughout the 2020-2021 bull market.

Moreover, Kang mentioned the preliminary estimate of a low of $50,000 could also be too conservative and could possibly be reset extra considerably to $40,000.

This pullback can have a major impression in the marketplace and will require a number of months of unstable or declining worth motion earlier than a reversal and uptrend could be established.

As of writing, BTC has recovered to $60,350 ranges after briefly falling beneath this key help stage for additional beneficial properties.

The biggest cryptocurrency in the marketplace has erased all beneficial properties on the broader timeframe and is presently down 12% on the month-to-month timeframe.

Featured photographs from DALL-E, charts from TradingView.com